The new report, Data Centre Construction Outlook – Australia, provides detailed forecasts for data centre building activity in Australia, by state and region.

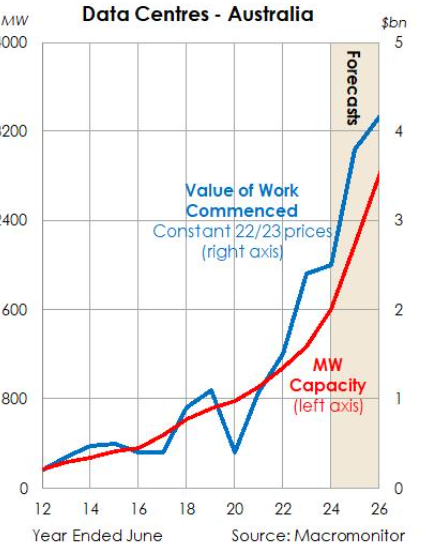

The report estimates the value of data centre commencements increased by 52% in the year to June 2025 and a further 10% increase is forecast for 2025/26.

“As the uptake of artificial intelligence has continued in Australia, we have seen a wave of announcements from data centre operators regarding new projects and earlier than expected expansions,” said the report’s author and Macromonitor Economist, Blake Willis.

“There are some big-ticket items, such as Amazon’s $20 billion investment in Sydney and Melbourne, and Microsoft spending $5 billion, but there is a broad base of projects on top of those which is driving an extremely optimistic outlook for data centre construction in Australia,” said Mr Willis.

Macromonitor estimates the capacity of the data centre sector to be 2180MW in 2024/25, a 250% increase from 2020 levels. As construction continues to ramp up, the report forecasts total capacity will be 2800MW by 2025/26 before crossing 5000MW in 2029/30.

“As the rollout of data centres continues ramping up across Australia, there are growing concerns over electricity requirements, especially in the context of the electricity grid’s transition to renewables,” explains Willis. “Given data centres require 100% uptime, any uncertainty regarding future grid stability could be a very real limitation for the data centre construction outlook.”

Macromonitor has observed a shift towards data centre campuses, as opposed to dispersed individual buildings. NextDC’s S7, CDC’s Marsden Park and Laverton projects and Amazon’s Glendenning project are all on large industrial plots which will see multiple data centres constructed on each plot.

“By buying large industrial estates it allows data centre operators to easily scale up capacity as demand grows without having to seek new land and restart the approval process. This will smooth out construction activity over the next decade as these sites are gradually expanded,“ explains Mr Willis.

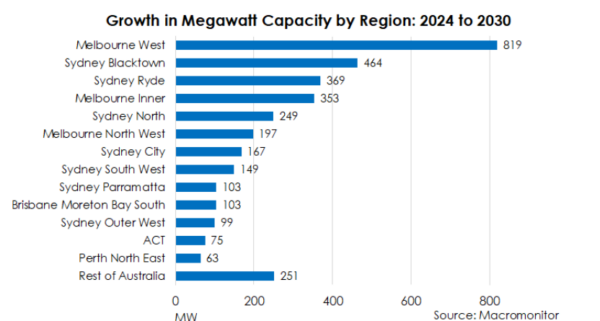

Macromonitor provides a breakdown of construction activity and capacity by region across Australia. They find that roughly 10 regions in Sydney and Melbourne will house a majority of the increases in data centre capacity over the next five years. Sydney’s Blacktown and Ryde regions, and Melbourne’s West, are poised to be the largest regions over the next decade, but many regions will see significant increases in capacity.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.