Powering Australia’s data centre boom: Navigating energy compliance and opportunity

Australia’s data centre sector is booming, driven by AI and digital growth – but so too are the energy and regulatory challenges.

$6.6 million neighbourhood batteries program kicks off final funding round

The Victorian government has launched its third and final round of grant funding through the 100 Neighbourhood Batteries Program, offering $400,000 per battery through multiple streams of eligibility to a pool of nine council regions.

Benefits sharing guide launched for communities in renewable energy zones

Community Power Agency has released a guide for regional communities hosting multiple renewable energy projects to promote benefit sharing strategies that ensure a stake over the next 25 years in an estimated $1.9 billion opportunity.

AGL aquires long-duration electro-thermal project from Photon Energy

AGL Energy has acquired the 150 MW solar, 90 MW thermal, and 720 MWh of storage Yadnarie Project from Dutch developer Photon Energy, and follows the project’s development approval received in June.

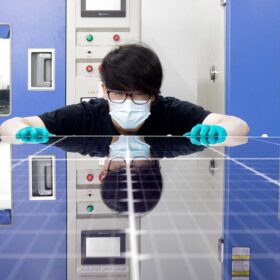

ARENA backs next-gen solar innovation with $60 million funding boost

The Australian government has announced $60 million in new funding for research and development projects that promise to accelerate cost reductions for PV technology and help meet the stretch target for “ultra low-cost” solar production.

Ampyr hits financial close on 600 MWh Wellington battery first stage

Ampyr Australia, the local arm of Singapore-based developer Ampyr Energy, has achieved financial close for its 300 MW / 600 MWh Wellington stage one battery energy storage system project being developed in central west New South Wales.

Banpu buys into EnergyAustralia battery project

Thai energy company Banpu has snapped up a 50% stake in the 350 MW / 1,400 MWh Wooreen battery energy storage system being built in Victoria’s Latrobe Valley as the Bangkok-based coal producer ramps up investments in renewable energy.

UK developer secures $718 million financing for 609 MW solar, battery portfolio

British Solar Renewables has reached financial close on a 12-project solar portfolio with three co-located battery assets. The $718 million financial package covers 536 MW of PV capacity and 146 MWh of energy storage in the United Kingdom and Australia.

$20 million greenhouse to reap solar innovation for agrivoltaic sector growth

ClearVue Technologies has joined a $20 million research project aimed at transforming agrivoltaics while generating clean energy using the company’s transparent solar glass technology.

Novel green hydrogen pilot plant wins $2.7 million grant

A Sparc Hydrogen photocatalytic water splitting reactor pilot plant under development in South Australia has been granted $2.75 million to accelerate development of the novel technology toward commercialisation.