Intellihub’s Green Loan is the first to meet Climate Bonds Initiative’s (CBI) strict criteria for Electrical Grids and Storage. The new facility has been arranged by ANZ, BNP, Crédit Agricole, MUFG, NAB, SMBC and Société Générale. Loan terms have been set at investment grade levels, reflecting the quality of Intellihub’s smart meter and data intelligence business and the internationally recognised green status of the loan.

In addition, part of the requirements of a CBS Certified green loan is the level of accountability required by the issuer. Intellihub has established its own Sustainable Finance Framework (Framework) setting out how it will manage the funds. This has been independently assured by EY (Ernst & Young). Reports are made annually throughout the term of the loan which show funds are being used to provide products and services that have climate integrity through both their contribution to climate mitigation and their adaptation and resilience to climate change.

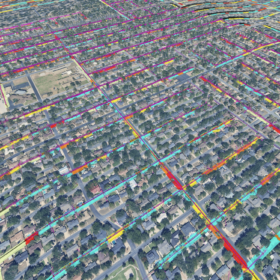

Since making its initial investment through its Secure Asset Fund in 2018, Pacific Equity Partners (PEP) has built Intellihub into a multi-billion-dollar business, delivering innovative metering and data solutions to consumers, retailers and network service providers. Smart meters are an essential part of energy systems in Australia and New Zealand. They measure the energy consumption from homes, business and commercial and industrial customers and provide real-time insights into how energy is being consumed and optimise the home for solar, batteries and electric vehicles. They are also key enablers for new services like demand response and virtual power plants.

Today, Intellihub is the only independent, dedicated multi-utility metering platform in Australia and New Zealand and is the provider of choice for more than 30 leading utility retailers. Importantly, smart meters are a critical enabling technology for the pivot to renewables and the future of distributed energy resources. The smart meter revolution is running in tandem to Australia’s rapid rollout of residential solar power, with 3 million homes in Australia with solar panel installations (as at 9 November 2021), equating to one in every three homes.

Evan Hattersley, Pacific Equity Partners Managing Director and a leader of its Secure Asset Fund, said, “Green Loans help to align business and environmental objectives. They are a win-win for companies and communities as we work together to protect our planet and ensure we build more sustainable businesses.”

“We are pleased with the support Intellihub has received from the banking market and the formal recognition of its green credentials, which will allow it to access additional sources of green-linked financial capital. It is an exciting first and a great example of our firm’s focus on combining business and climate,” said Mr Hattersley.

ANZ acted as sole Green Loan Coordinator for Intellihub. ANZ Managing Director, Corporate Finance Christina Tonkin said ANZ is delighted to have advised PEP and Intellihub on this significant transaction. “Intellihub’s Green Loan is a world-first, demonstrating PEP’s commitment to the decarbonisation of Australia’s electricity system and leadership in aligning its sustainability-driven investment strategy to its capital structure. This landmark transaction expands the application of green loans into a whole new industry globally.”

CBI CEO Sean Kidney added: “Intellihub’s landmark issuance represents a new frontier for green finance as we see the first Certification under the Climate Bonds Standard for Grids.

“Intellihub is Australia’s leading smart meter operator with significant market share. The smart meter industry is fast growing. Indeed, Australians are installing solar panels in their homes eight times faster than any another country. A Paris-aligned future requires electricity infrastructure that can manage far greater shares of variable renewable energy; this issuance can pioneer a flood of similar investments that scale up renewables and drive down costs globally.” he said.

ANZ, Crédit Agricole, MUFG, NAB and SMBC are working to syndicate the loan. BNP and Société Générale have already committed to significant positions.

Wes Ballantine, Intellihub’s CEO, said smart meters were an essential part of the energy systems in Australia and New Zealand as they measure the energy consumption from homes and businesses and securely transport that data to the market operators. They also enable consumers’ greater choice and control in how they consume energy.

“The energy sector across the world is evolving rapidly,” Mr Ballantine said. “We are seeing rapid increases in solar penetration and energy businesses are digitising, decarbonising and decentralising their operations.

“Smart meters are playing a crucial role in supporting this transition across Australia and New Zealand. They’re also providing vital data and services to energy networks which helps manage peak demand, the impact of increasing penetration of solar energy and keeps the electricity grid safe and secure.”

Regulators are looking at ways to facilitate the acceleration of decarbonisation. Recently, the Australian Energy Regulator (AER) joined international energy regulators to form the global regulatory energy transition ‘Accelerator’, an initiative to share capabilities and knowledge in regulation. In addition, the Australian Energy Market Commission is currently undertaking a review of metering regulation in Australia with the aim of accelerating deployments of smart meters so that more electricity customers can access the benefits of smart meter technology. Intellihub is ready to respond.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.