The biggest news for homeowners and small businesses is the new Cheaper Home Batteries Program which will expand the Small-scale Renewable Energy Scheme (SRES) from 1 July to include small-scale battery systems.

This is expected to lower the cost of a typical battery by around 30%, providing direct bill savings.

When batteries are installed at scale, this will provide energy savings for everyone, not just those who install a battery, because it will reduce peak prices and broader system costs.

Additional storage will also support the overall transition to a low carbon electricity grid.

The SRES has strong safety and compliance processes including the obligation to comply with relevant state and territory electrical safety requirements.

This gives battery consumers confidence as they lower their energy bills and reduce their carbon footprint.

Under the Cheaper Home Batteries Program, eligible battery installations will create small-scale technology certificates (STCs) as the SRES does with solar photovoltaic (PV) systems and heat pumps.

Because STCs equivalent to those created by batteries will be regularly purchased by the government, the costs will not be passed on to electricity consumers.

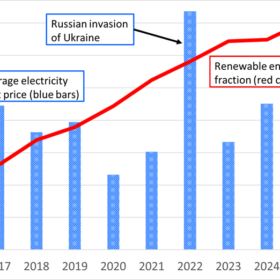

CER Chair David Parker said the share of renewables in the electricity mix will continue to grow as new large-scale renewable developments come online and more rooftop solar is installed. Q1 2025 has already set a record first quarter at 43% renewables in the National Electricity Market.

“The CER has so far approved a total capacity of 1.7 GW of new wind and solar power stations that have reached first generation. With a further 1.2 GW of applications received the 2025 pipeline is healthy,” Parker said.

In the newly reformed Safeguard Mechanism, as published by the CER on 15 April, 142 facilities surrendered 1.4 million Safeguard Mechanism credit units (SMCs) and 7.1 Australian carbon credit units (ACCUs) to manage their excess emissions.

The Safeguard Mechanism is designed to work over time to incentivise emissions reduction by large emitters to help meet our 2030 and 2050 emissions reduction targets.

The CER expects tightening baselines to reduce SMC issuances and increase total ACCU and SMC surrenders. This will also strengthen the incentive for facilities to identify, invest in, and deliver on-site emissions reductions.

Mr Parker said these market schemes working in tandem represented a robust and healthy carbon market.

For more detail, refer to the Q1 2025 QCMR.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.