In 2018, DuPont added data from glass-glass installations to its Global Field Survey results for the first time. And in a way, the results undermine some long-held assumptions about glass-glass modules.

DuPont has inspected close to 20 MW of glass-glass installations, with an average age of between three and four years, finding that in 13% of the modules inspected defects were present.

While 20 MW is only a drop in the ocean of the over 1.04 GW of installations, totaling some 4.2 million modules DuPont engineers have inspected as a part of its survey since 2011, that defects are being reported at a relatively high rate is worrying. By comparison, the overall defect rate in the survey in 2018 stood at 22.3%.

“Most of us are aware that a lot of PV modules do not show up defects in the early years of deployment,” elaborates DuPont’s Kaushik Roy Choudhury, who leads the reliability field program. “Looking at installations that are three to four years old, glass-glass defects were at 13%. At more than four years old, we have seen that the backsheet defect rate goes up to 35% – if the same was to occur with glass-glass it should make folks concerned.”

Bifacial driver

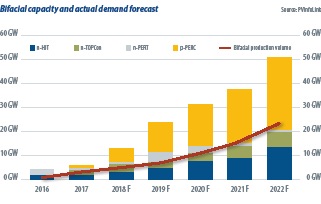

Bifacial technology was one of the most talked about technology trends within PV in 2018. With cell makers able to manufacture bifacial products at only a negligibly higher cost than monofacial, the incentive to add rear-side power output to a PV module becomes compelling.

Alongside technology, there have been market drivers of the bifacial ramp-up also. PV InfoLink calculates that bifacial modules were supplied to between 30% and 50% of successful projects under China’s Top Runner program, which incentivizes high efficiency solar technologies. Describing 2018 as “the first year for bifacial module development,” PV InfoLink analysts expect that bifacial module demand will “grow more significantly” as a result of Top Runner projects in 2019.

Given these drivers, the next question is: What is the best way to assemble bifacial cells into modules? The obvious answer is glass-glass. Highly transparent allowing power generation on both sides of the module, robust in some of the toughest elements, and able to remain in the field or on the roof for 30, 40, or even 50 years, dual-glass appears the ideal solution into which high efficiency bifacial cells can be incorporated. However, if the DuPont data are to be believed, it may not be quite so simple.

Defects present

“The defects we do see in glass a lot… are busbar and finger ribbon corrosion leading to power loss,” says DuPont’s Choudhury. “We have seen delamination of the glass, from both the front and back encapsulant. We have seen cracking on the rear glass – in localized places or in some cases extensive cracking as well. The other issue is encapsulant browning in the front, which is very prevalent.” Catastrophic module failures have also been observed by DuPont in the field, with modules bowing and eventually cracking and breaking into pieces under their own weight.

Image: DuPont

However, not all glass-glass modules are created equal. Proponents of the technology are quick to note that some of the failures observed by DuPont may have been in China, executed by developers and manufacturers unfamiliar with the technology. As with so much of the PV supply chain, there is high and low-quality glass-glass modules, and here attention to detail is important.

“At the moment, there is a lot of hype [about glass-glass modules], but the reality is that with some of those products, especially OEM [produced], you might find quality issues later on, which also hits onto us, as glass-glass will generally suffer,” says Bernhard Weilharter, the Managing Director of German module maker CS Wismar.

CS Wismar markets its modules under the brand Sonnenstromfabrik in Germany and has a production capacity of 300 MW. The CS Wismar facility is the former Centrosolar fab, which was something of a glass-glass pioneer, with its first product released onto the market in 2009. Weilharter says that in 2018 about 60% of its sales were glass-glass, with key markets being the Benelux countries and France.

Handle with care

Installers, also, are not yet fully comfortable with glass-glass, with fears that handling and installation faults could occur. “People are not experienced [with glass-glass] and there is a high risk of module breakage in the field,” says Lars Podlowski, VP of Technical Services at independent technical and quality assurance provider PI Berlin. “You need special clamps, positioned at proper positions from a static load perspective. Then of course they are very heavy – the installation troops don’t like them.”

Podlowski says that while PI Berlin does not have significant experience in working on PV projects deploying bifacial technology, he equally has not seen a large number of faults.

The clamps to which Podlowski refers, relate to frameless glass-glass modules. Frameless glass-glass modules do present a number of advantages including ease of cleaning in dusty regions, and an aesthetic advantage in BIPV applications. Additionally, the cost of the aluminum frame is spared – which can be up to 13% of total module cost. However, there are significant potential downsides. In frameless glass-glass applications, three rather than two clamps are required to affix the module, and the clamps themselves must have a special rubber coating in order not to cause cracking under wind loads.

“The cost advantage on the frameless is only on paper, but in the field there are extra costs on the downside,” says Weilharter – specifically referring to the additional number of clamps and their more-costly rubber lining.

The materials used for glass-glass modules themselves also play a role in ensuring quality. While some glass thicknesses used for dual-glass in its early days made them prohibitively heavy – “our first glass-glass from Centrosolar…was a failure,” says Weilharter – 2 × 2 mm glass sheets deliver a module weight only slightly heavier than the corresponding glass-foil. CS Wismar is currently moving towards a module with 2 × 0.8 mm in thickness, targeting applications such as roofs with weight limitations.

“With only 9 kg [in weight]…it can be bowed like a plastic,” says Weilharter. “And we did all kinds of mechanical stress, and the cells didn’t break.” The company currently deploys 2 × 2 mm as standard.

However, very thin glass is expensive to produce and manufacturers are likely to have lower yields in production due to the extreme thinness. As a result of the additional cost of very thin glass, most mass production bifacial modules being produced today are described as using

2 × 2.5 mm glass. More often, this means 3.2 mm on the front and 2 mm backsheet glass, states Weilharter – which brings down costs but in turn introduces its own issues.

Lamination matters

Problems with glass-glass module lamination can result in compromised quality. The module can bow either after lamination or in the field, particularly when frameless. This can be a result of using different front and rear glass thicknesses, but it can also be because of the lamination process and tooling itself.

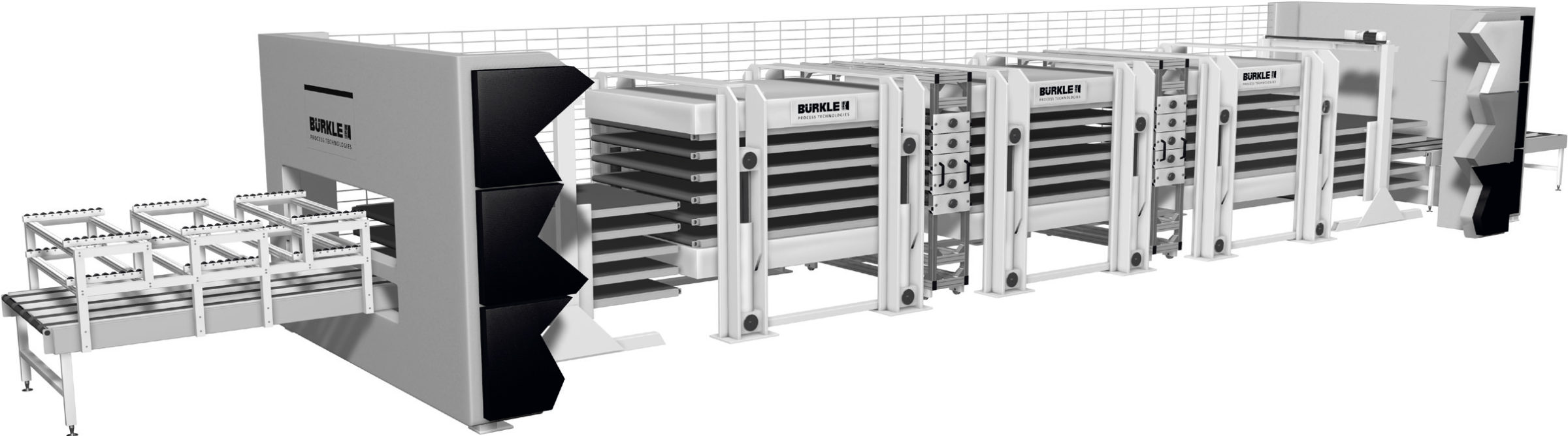

German lamination equipment supplier Bürkle supplies its Vacuum Flat Flat (VFF) laminator to glass-glass module producers. The laminator is available in both a single and multi-stack configuration, with a maximum number of stacks at six (or 12 modules) at present. Robert Gaiser is the Global Sales Manager PV for Bürkle and reports that some laminators use an upper membrane, and single heated plate at all stages for glass-glass lamination, which can lead to pinching at the edges, a less homogenous lamination, and bowing.

“With a membrane lamination and single side heating, the temperatures at the end will be at 120°C for the upper glass, and 150°C for the lower, which means the bottom glass will have expanded more. When cooling back to 25°C, the lower glass shrinks more and the EVA will be squeezed.” He reports that this will create tension within the EVA and potential bowing. “Especially with frameless you can see that the physical stability of the modules is reduced, because there is stress within the module,” says Gaiser.

Bürkle engineers are currently working on a prototype of its Inline Flat Lamination (IFL) tool for the PV industry. The tool employs a three-stage lamination process, in a membrane-less process: first vacuum evacuation phase with double sided heated flat press, second a double-sided heating lamination with a flat press, and finally a double-sided cold flat press for cooling. Gaiser says the tool could result in reduced replacement parts, a more homogeneous lamination.

Transparent backsheets

Last year DuPont introduced its transparent backsheet to the market at SNEC. A cynic might suggest that there is a certain coincidence in DuPont wanting to highlight the pitfalls of glass-glass products just as it introduces a product that competes with glass in bifacial applications.

“We had been seeing glass-glass module failure before we released the transparent backsheet,” responds Mark Ma, the Global Marketing Manager, DuPont Photovoltaic Solutions. “We launched the transparent backsheet because we believe it is a better solution for bifacial.”

Beyond reliability, DuPont says that its transparent backsheet also delivers better yield rates for producers and easier installation due to its light weight. Bürkle’s Gaiser confirms that in the lamination company’s testing, a transparent backsheet can be deployed using a more or less standard process, albeit at slightly different temperatures. “I see it as the cheaper solution for bifacial products,” he notes.

At present, DuPont says that its transparent backsheet is competitive with a glass backsheet on cost, and almost identical from a total cost of ownership (TCO) perspective. However, DuPont’s inspection program lead Choudhury reports that a transparent backsheet requires “a higher level of technical complexity [than a white backsheet]. We have tested different transparent backsheets in the market – a lot are not performing beyond a 25 year lifetime.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.