It could be forgiven of some Australian solar installers and PV power plant developers if they were hoping for a silver lining in the dark cloud of a new round of solar tariffs. However, the 30% tariff on solar imports to the U.S., announced this week, will likely have a negligible effect on global supply and demand dynamics – particular for modules destined for the rooftop market.

While the numbers are still being crunched, it appears that the Trump Administration’s solar tariffs will not result in a glut of modules, and fast-falling prices.

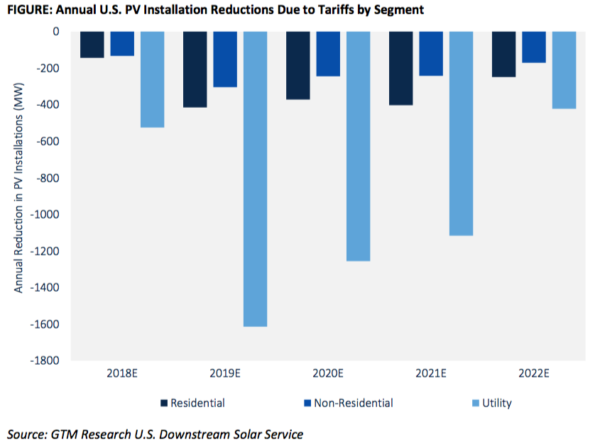

“My initial thought is that it is not going to be that big of an impact,” MJ Shiao, GTM Research’s Head of Americas told pv magazine Australia. “It’s an 11% reduction on a country that is a little over 10% of the global market, so a single digit GW impact to potential demand [over the five-year tariff period].”

In the months preceding the tariff decision, it was true that the stockpiling on modules by U.S. developers and distributors, combined with a 50 GW Chinese domestic market, was a cause for tight module supply in 2017. However, with the tariff decision being moderated by a 2.5 GW annual tariff-free cell quota and tariffs stepping down over five years, the U.S. market impact will likely be less pronounced than some had feared.

“It is hard to say what is going to be the actual impact on module prices, and there are broader events that will play a much bigger role,” said Shiao.

Some of those factors include the Chinese solar market itself, which is notoriously opaque to outsiders, and the manufacturing capacity additions of PV producers in China. In recent years, the rate at which new GW-scale production facilities have been brought online in China has been unprecedented, as has the growth of its end market.

For those considering module assembly operations in Australia protected by similar tariffs, GTM’s Shiao urges caution.

“There is some case for [U.S.] module assemblers to be the biggest winners out of all of this with the 2.5 GW [tariff free] cell quota,” said Shiao, “but it is also still a very competitive market for them. The tariff is only US$0.10/W in the first year, and by year four that is US$0.04/W.”

“Some module makers in the U.S. might hit their milestones in the short-term, but it is still not going to be easy for them.”

In 2015, the Australian Anti-Dumping Commission terminated an investigation in the dumping of solar modules in the Australian marketplace. The investigation was initiated at the behest of South Australian module maker Tindo Manufacturing.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.