Whether named the Tesla Big Battery or Hornsdale Power Reserve, Australia’s biggest battery has been a sweet addition to the National Electricity Market (NEM). And it looks set to see a major expansion.

The Youtube channel HyperChange has reported that road-trains carrying Tesla Powerpacks have been spotted traveling out the Hornsdale site. U.S.-based HyperChange had been tipped off by a “citizen journalist” who had sent photos and a video of the Powerpacks on the way to the Hornsdale, with the truck driver reportedly telling the observer that some 37 truckloads of Powerpacks were being transported to the site. Given this, quick calculations reveal some 500-600 Powerpacks were likely on their way to the Hornsdale site.

The Youtube channel HyperChange has reported that road-trains carrying Tesla Powerpacks have been spotted traveling out the Hornsdale site. U.S.-based HyperChange had been tipped off by a “citizen journalist” who had sent photos and a video of the Powerpacks on the way to the Hornsdale, with the truck driver reportedly telling the observer that some 37 truckloads of Powerpacks were being transported to the site. Given this, quick calculations reveal some 500-600 Powerpacks were likely on their way to the Hornsdale site.

The HyperChange channels aims to cover, “the current economic era of perpetually accelerating disruption.”

pv magazine Australia has contacted both Neoen and Tesla for confirmation. Neoen indicates it has no comment on the reports.

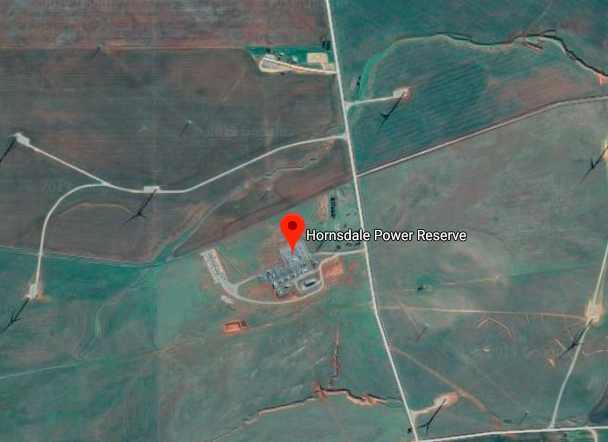

Image: Google

Google Earth images appear to confirm the reports of Hornsdale’s expansion. In the images it looks like preparatory earthworks have been completed at the site, adjacent to the existing battery array.

“This is going to lead to dramatic energy storage deployment growth… either in Q4 or Q1 2020,” HyperChange host Gali observed.

The original Hornsdale Power Reserve has a capacity of 100 MW/ 129 MWh – with around 70% of the system’s peak power output reserved for the South Australian government for the provision of system-security services. In this capacity alone, in particular in the provision Contingency Frequency Control Ancillary Service (FCAS) and Regulation FCAS, Hornsdale has been estimated to have resulted in savings of some $40 million in its first year of operation alone – according to a report from the consultancy Auercon.

The expansion of Hornsdale could see it participate to a greater extent in the wholesale market – primarily in arbitrage trading, buying at low wholesale prices and selling into the peaks. Very low or negative electricity prices during times of high solar and/or wind output, particularly when they coincide with periods of low electricity demand, could make an expansion of arbitrage trading attractive.

In the first nine months of 2019, Neoen reported energy storage revenues of €13.7 million (AU$22.25 million)– largely through the provision of FCAS and arbitrage. In 2018, the battery earned €18 million ($29 million) for Neoen. Of that, €15.2 million ($24.25 million) came in the form of “commercial revenues”, from the provision of grid services and arbitrage trading of power. €2.7 million ($4.3 million) came from fixed revenue from AEMO for the provision of contingency reserve.

The Hornsdale Power Reserve had a price tag of some €56 million ($AU87 million), according to Bloomberg. Given its earning of some €32 million ($52 million) in less than two years, an expansion of the initial array could indeed pencil out.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

“The Hornsdale Power Reserve had a price tag of some €56 million ($AU87 million), according to Bloomberg. Given its earning of some €32 million ($52 million) in less than two years, an expansion of the initial array could indeed pencil out.”

The (coalies) are shaking in their boots. Once an asset it amortized, it will become a money making asset with O&M handled by the additional revenue streams from the many ancillary grid functions this one asset can handle and deliver on. Somewhere in 2020 to early 2021 the TESLA energy storage facility should have paid for itself and the site will indeed be ready for expansion.

” Very low or negative electricity prices during times of high solar and/or wind output, particularly when they coincide with periods of low electricity demand, could make an expansion of arbitrage trading attractive.”

Interesting, in California right now the solar PV and wind generation overgeneration is being “curtailed” by CAISO, throwing away basically free solar and wind energy, then signing spot market purchase agreements to use basically fossil fueled generation to “ramp” around grid demands. Australia has to show bragging 5th largest economy in the World California how to run an alternative generation grid using energy storage. Moral of story, “mandating” is not DOING. Australia is DOING as California falls further and further behind. Of course mandate may not be the same in California as in other places. It could be in California it is a (Man Date), meaning something else entirely. LOL