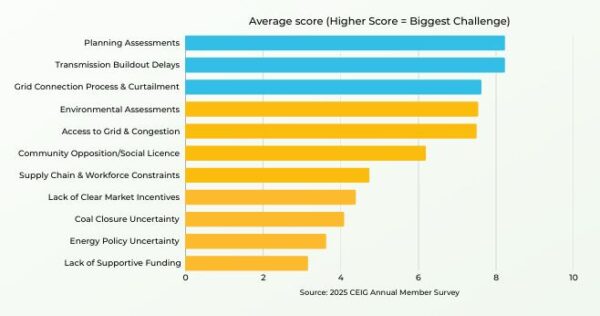

A new survey by the Clean Energy Investor Group (CEIG) has found that slow planning processes and delays in delivering transmission infrastructure are the biggest issues for renewable energy investors in Australia, while complex grid connections and lengthy environmental assessments also remain major pain points.

CEIG has released the findings from its second annual member survey, covering investors with more than 16 GW of installed renewable energy assets valued at about $38 billion (USD 24.75 billion) across Australia.

The 2025 Clean Energy Outlook shows that 46% of investors rate Australia as only ‘somewhat attractive’ for renewable energy investment compared to global competitors. Another 23% of respondents rated the market as ‘very attractive,” 23% identified it as ‘neutral,’ while 8% described it as ‘very unattractive.’

CEIG Chief Executive Officer Richie Merzian said renewable energy investor appetite is strong, but the results show Australia’s global competitiveness is at risk.

“Australia has enormous clean energy potential, but potential alone does not build wind or solar farms, batteries, or new transmission lines. Investment capital does,” he said.

“Australia remains highly reliant on foreign investment for renewables, with over 70% coming from overseas. If the nation continues to be just somewhat attractive for investors, we can expect that global capital to flow elsewhere, to other jurisdictions that are rolling out renewables and transmission with speed and scale.”

Image: CEIG

Delays to planning assessments, transmission buildouts, grid connections and environmental assessments ranked as the top challenges for investors.

“The next wave of clean energy investment is within reach, but only if we remove the barriers holding it back,” Merzian said.

The report includes several recommendations to unlock renewable energy investments in Australia, including improved coordination between state and federal governments, accelerated delivery of transmission infrastructure, a boost to the energy workforce and reforms to environmental laws to ensure consistent assessments.

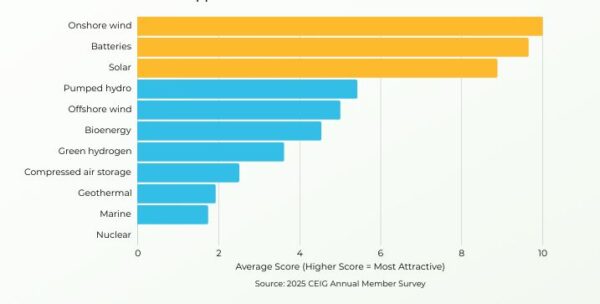

Image: CEIG

The study shows that onshore wind, batteries and solar projects are the most popular with investors, followed by pumped hydro. Green hydrogen, which previously captured investor interest, has seen a significant drop in the rankings.

New South Wales is ranked the most attractive jurisdiction for clean energy investment, overtaking Queensland.

“NSW has made progress with clearer policy direction and recent planning reforms,” Merzian said.

“The recent legislative changes and uncertainty in Queensland have weighed heavily on investor confidence, despite the Queensland government’s claims it remains open for business.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.