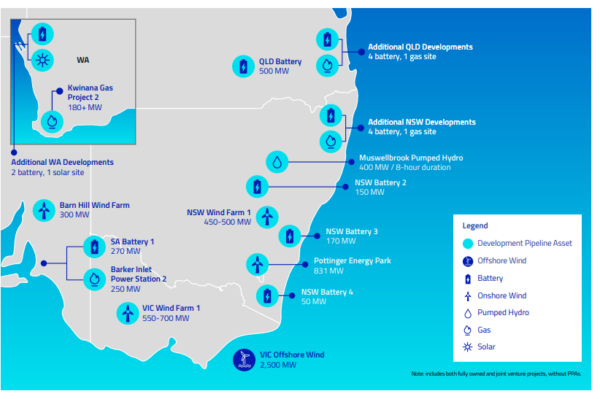

Sydney-headquartered gentailer AGL Energy’s end of financial year results see earnings growth from its battery portfolio and is banking on its future renewable energy development pipeline to herald more of the same as aging coal fired power phases out over the coming decade.

During the financial year, AGL reached financial investment decision on the 500 MW / 2,000 MWh Tomago battery energy storage system (BESS) and says the 500 MW Liddell BESS is on track to start operating in early 2026.

It started commercial operation of the 50 MW / 50 MWh Broken Hill BESS, and continued upgrades to the Clover Power Station to increase the output capacity of the Kiewa Hydro Scheme by 14 MW.

AGL aso announced in August 2024, the adquisition of Firm Power and Terrain Solar and received planning approval for the 500 MW / 2,000 MWh Queensland BESS, and the Barn Hill Wind Farm and BESS project.

Image: AGL Energy

AGL Managing Director and Chief Executive Officer Damien Nicks said the company is making progress in accelerating its grid-scale battery investments.

“With a final investment decision (FID) reached on the 500 MW Tomago Battery in July, we have a clear pathway to FID for an additional 900 MW of grid-scale battery projects, as announced at our February results.” Nicks said.

“The Liddell Battery remains on track for commencement of operations in early 2026, and we’ve strengthened our long duration firming optionality through the acquisition of two early stage pumped hydro projects in the Upper Hunter region next to our Muswellbrook Pumped Hydro project with Idemitsu.”

He added that the company has demonstrated significant investment in growth over the past 12 months.

“We press forward with the delivery of our strategy – with approximately $900 million (USD 589 million) deployed towards battery developments and strategic investments,” Nicks said.

“This included almost half a billion dollars towards growth capital expenditure, including the construction of the Liddell Battery, and another $400 million for the acquisitions of Firm Power, Terrain Solar and our strategic investment in Kaluza.”

Nicks added as part of the Community Power initiative, it acquired from Tesla the South Australia virtual power plant (SAVPP), one of Australia’s largest VPPs driving the company closer to its FY27 target of having 1.6 GW of decentralised assets under orchestration.

“This advanced our portfolio of decentralised assets under orchestration and demand side portfolio flexibility,” he said.

In addition, Nicks said the resilience and flexibility of its asset portfolio helped mitigate the earnings impact of outages in its thermal plants.

“We continued to see strong earnings from our growing battery portfolio. Importantly, in a period of ongoing inflationary pressures and investment in growth, through disciplined cost management and digitisation we kept operating costs broadly flat as planned,” he said.

The results highlight 33 TWh of total generation volumes were achieved but reflect a fall of 3% from the previous year, it launched its Community Power program providing energy transition benefits to consumers without access to solar or batteries, and increased its development portfolio by 9.6 GW and flexible fleet capacity by 8.3 GW.

Image: AGL Energy

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.