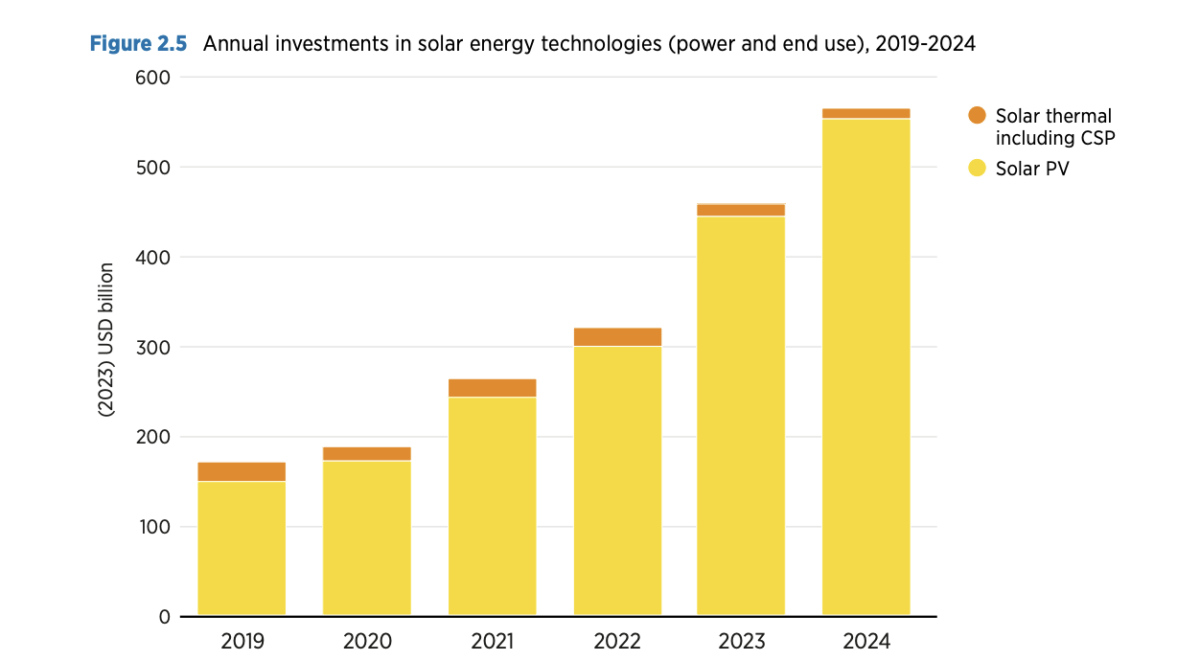

Investment in solar technologies reached a record $851 billion (USD 554 billion) in 2024, according to The International Renewable Energy Agency’s (IRENA) Global Landscape of Energy Transition Finance 2025.

The figure, which falls in line with IRENA’s projections from August last year, is a 49% increase on the average investment level seen across 2023 and 2023. It positions solar as the dominant renewable energy source in terms of investment, accounting for 69% of the $1.239 trillion (USD 807 billion) directed towards all renewable energy technologies in 2024.

The agency says policy support, combined with significant utility-scale and small-scale solar cost reductions, drove investments last year, which now sit at a level close to the average annual investment required under IRENA’s 1.5 C scenario, a pathway to limit global warming to 1.5°C by 2050.

China, Europe and the United States accounted for 70% of solar investments in 2024, but the report also highlights Brazil, India, Pakistan and South Africa as countries where solar investment is increasing notably.

IRENA is expecting the pace of investment in solar technologies will increase further, but highlights evolving trade dynamics, tariff uncertainties, macroeconomic headwinds and shifting geopolitical dynamics as potential barriers. “To sustain this growth amid higher levels of market penetration, it will be critical to develop new business models, expand storage solutions and implement supportive policies to sustain momentum,” the report says.

Total investment in the energy transition supply chain last year fell by 21% year-on-year to stand at $156 billion (USD 102 billion). This was largely down to a 72% drop in investment in solar factories, which reached $37.63 billion (USD 24.5 billion) last year. IRENA attributes this decline to an oversupply of worldwide manufacturing capacity and the proliferation of tariffs and non-tariff trade barriers on solar panel imports.

In contrast, investment in battery factories accelerated 112% last year, totaling $114.4 billion (74.5 billion), with China responsible for 84% of battery manufacturing investments in 2023 and 2024.

IRENA is forecasting investment in the manufacture of solar, wind, battery and hydrogen technologies will hit $189 billion (USD 123 billion) this year, nearing 2023’s record, before falling again in 2026.

IRENA’s report finds a total $3.69 billion (USD 2.4 billion) was spent on global investment in energy transition technologies in 2024, a 9% increase from 2023. Behind renewables, electric vehicles accounted for $1.172 trillion (USD 763 billion), while $551.4 billion (USD 359 billion) went towards power grids, $531.5 billion (USD 346 billion) on green hydrogen, $82.95 billion (USD 54 billion) to battery storage and $59.9 billion (USD 39 billion) to electric vehicle charging infrastructure.

Combined investment in renewable technologies, grids and battery storage reached $1.83 trillion (USD 1.19 trillion) last year, outpacing the $1.74 trillion (USD 1.13 trillion) spent on fossil fuels worldwide, although investment in the latter increased by 3% year-on-year.

Elsewhere in the report, an analysis of global renewable energy investments in 2022-2023 found 48.4% was provided as debt, most of it at market rates. Half of the total investment took the shape of equity, while low-cost debt and grants made up the remaining 1.6%.

IRENA says this finding highlights an urgent need to mobilize investments, particularly in impact-driven capital such as low-cost debt and grants, to maintain the momentum of the energy transition and avoid exacerbating debt burdens.

“IRENA has long called for smarter use of public funds to unlock private investment through risk-mitigation tools. Yet the heavy reliance on profit-driven capital is leaving developing countries behind,” commented Francesco La Camera, the agency’s Director-General. “Where private finance won’t flow, the public sector must lead, backed by stronger multilateral and bilateral cooperation and scaled-up climate finance.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.