From pv magazine Global

At an industry seminar hosted by the China Photovoltaic Industry Association (CPIA) on 5 February, 2026, honorary adviser Wang Bohua delivered a keynote reviewing the sector’s “14th Five-Year Plan” cycle (2021-25) and outlining expectations for 2026-30.

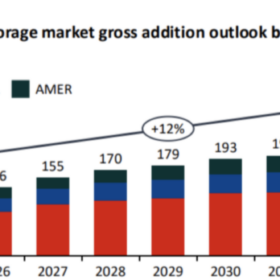

Looking to 2026–2030, Wang projected average annual global PV additions of 725 GW to 870 GW, and China additions of 238 GW to 287 GW.

He argued the next cycle will hinge on curbing “malign” price competition, accelerating low- or no-silver pathways and perovskite-tandem industrialisation, and pushing manufacturing towards smarter, greener, and more integrated models.

He also noted China will end export tax rebates for PV products from 1 April, 2026, a move he framed as intensifying the push from volume growth to quality and value.

Wang said China’s PV manufacturing chain expanded rapidly during 2021/25, with annual manufacturing output value exceeding $203.3 billion (USD 144.1 billion).

He also cited cumulative PV capacity topping 1.2 TW, annual additions surpassing 300 GW, and exports reaching more than $253.9 billion over the five-year period, with modules shipped to over 200 countries and regions.

The presentation described a five-stage arc across the past five years. It pointed to a policy push and rapid growth in distributed PV in 2021, followed by a capacity rush in 2022 and record exports alongside emerging supply imbalances in 2023.

In 2024, the focus shifted to n-type technology adoption and overseas manufacturing expansion. By 2025, the sector entered a broad loss-making phase, with slower capacity and output growth and prices falling below cost across major segments.

On the supply side, Wang said nameplate capacities by the end of 2025 were around 3–6 times higher than at the end of the previous five-year plan, reaching more than 3.5 million tons of polysilicon, 1,500 GW of wafers, 1,400 GW of cells, and 1,100 GW of modules.

Concentration shifted, with the top five producers holding about 60% of capacity in polysilicon and wafers, and roughly 45% in cells and 50% in modules.

Wang highlighted large price declines during 2021-25, including polysilicon falling from $55.21/kg to $8.92/kg, wafers from $1.52 per piece to $0.26, cells from $0.20/W to $0.06/W, and modules from $0.37/W to $0.14/W.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.