The warning comes as leading energy advisory firm ERM Energetics releases new energy market analysis (Paying the price for volatility and illiquidity: How inaction is compounding power market risks) highlighting key risks for energy users and reinforcing the need for smarter and more proactive financial risk management, especially if uncontracted beyond 2026.

The analysis coincides with the welcome release of new morning and evening peak products by the ASX Energy exchange, which are expected to help fill key gaps in the approaches and financial instruments needed by large energy users to manage rising risk, particularly as the clean energy transition accelerates in the next few years to 2030.

Key risks outlined in the report include:

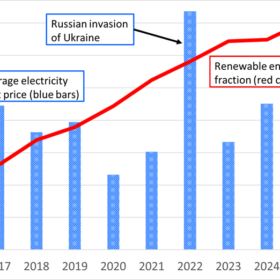

· Increasing volatility in both near and medium-term prices as weather driven events (such as wind droughts and heat waves) continue to impact supply and demand, compounded by the reduced reliability of Australia’s ageing coal fired power generation fleet.

· Skewed price distributions – not just more frequent price spikes, but prolonged periods of elevated pricing as futures market risk premiums surge, reflecting an increasing market perception of risk following disruptions in the physical and commodity markets.

· Reduced liquidity in financial markets, with ASX Energy trading volumes falling 20% between 2022 and 2024.

· Traditional hedging instruments no longer being fit for purpose.

· A growing mismatch between the pace of the physical energy transition and the supply of the financial tools and expertise needed to manage new risks.

ERM Energetics energy market experts Gilles Walgenwitz (Head of Energy Markets) and Anita Stadler (Head of Renewable Energy Investments), say while the risks in Australia’s electricity markets are significant and growing, they can be managed.

“We are in the midst of a structural change in the energy market and the market dynamics that people are used to are changing rapidly, and I don’t think many corporates have fully engaged with it,” said Gilles Walgenwitz, Head of Energy Markets at ERM Energetics.

“If you want to reduce your exposure to volatility in pricing and budget, if you want to reduce your overall electricity costs, you need to start taking control.”

“The introduction of new ASX Energy products is a welcome step, though long overdue. Unfortunately, financial risk management hasn’t kept up with the scale and pace of the transition. This is a major weakness for Australia’s energy transition and a risk for energy users. If you continue to assume that retailers will shoulder rising risk on your behalf, you’ll end up paying what is increasingly becoming a significant risk premium.”

“The good news is new financial instruments are emerging, and businesses that act now can reduce risk and take control of long-term energy costs,” Walgenwitz said.

Anita Stadler, Head of Renewable Energy Investments at ERM Energetics, said energy users must move beyond short-term thinking and take advantage of smarter approaches, and new financial tools to manage growing risks.

“Corporates maintaining a short-term orientation are doing so at significant risk to their businesses, especially those in energy-intensive sectors. These new ASX Energy exchange products represent a critical step forward in aligning financial instruments with the realities of a high-renewables electricity system and high-volatility energy markets, but only if corporates act to incorporate them into smarter, more staged procurement and hedging strategies.”

“If you’re uncontracted through to 2030, you must act now or risk a future where you will be forced to recontract for supply amid potentially heightened uncertainty and volatility.”

These recommendations are explored in detail in the ERM Energetics report, which urges energy users to assess their options against the growing cost of inaction during this transformational energy transition. For energy users consuming over 100GWh annually, the message is clear: now is the time to take direct control of your hedging strategy and shape your own path through the energy transition.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.