It wasn’t long ago that MLPE was considered too costly and complicated for applications beyond those in which shading or challenging roof profiles. Gavin Merchant, the Country Manager, Australia and New Zealand, for SolarEdge Technologies says that time has well and truly passed and the company and its market share continue to grow.

pv magazine: 2017 was a record year for Australian rooftop PV. What did SolarEdge Australia achieve?

Gavin Merchant: With the growth in the Australian PV market, SolarEdge was also able to grow its market share and increase awareness and acceptance in 2017 – both in the residential and commercial segments. This is owed to both internal and external circumstances. We have increased our local headcount by 300% in Australia, and introduced new solutions that enable us to better serve the local market.

The new products include StorEdge compatibility with LG Batteries, our 3-phase residential solution, 2:1 commercial power optimiser solution, and various accessories. The Australian PV market also experienced a tipping point in terms of MLPE acceptance and awareness in both the residential and commercial PV segments.

The combination of the market maturity and us being better positioned to serve the local market, resulted in heightened brand awareness and led to significant growth in new installers selecting SolarEdge to optimise their PV systems.

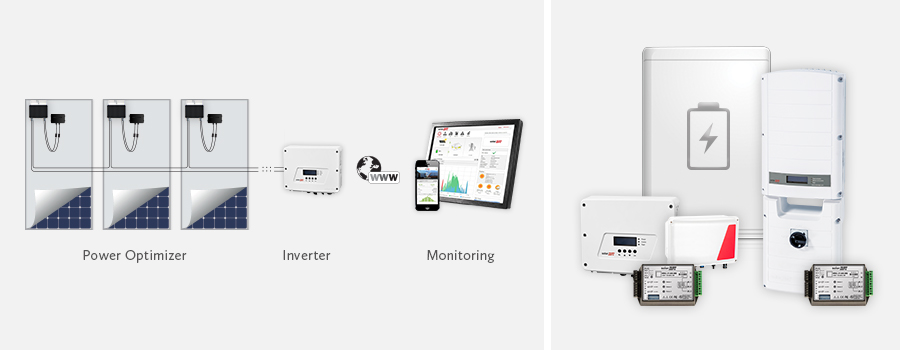

Image: SolarEdge

In the U.S. market, SolarEdge has had considerable success through partnerships with solar lease providers. What is the business model to serve the Australian market?

SolarEdge adapts its business strategy to each different region. In Australia, we have found that selling through distributors and training installers is a successful practice, especially for the residential PV market.

We focus on the added value that SolarEdge offers, such as increased energy, design flexibility, enhanced safety, and improved O&M, and how these benefits can help make installation businesses more successful.

For the commercial segment, SolarEdge provides installers and EPCs with tools and services to support the entire PV project lifecycle, from project design and pre-sale, to project execution, up to operations and maintenance throughout system lifetime.

There are reports for strong demand for battery storage in Australia, in fact it’s emerging as the fastest growing residential storage market globally. How is that translating to demand for StorEdge?

The demand by Australians for increased self-consumption and energy independence has helped to drive the adoption of PV plus storage solutions in general and specifically increased demand for SolarEdge’s StorEdge solution. Following on the successes of StorEdge in 2016, this past year was another good year for the solution.

We believe that this continued growth is largely due to the value-added benefits that the StorEdge solution offers, such as the DC-coupling of the solution which enables superior efficiency, simple design and installation, full system visibility, and enhanced safety.

We believe that this growing demand for energy independence has also opened up additional opportunities for self-consumption, such as our home energy management suite or EV charging, which we plan to launch in Australia.

The C&I market segment has long been thought to be a tricky one of optimiser providers. How significant is this segment for SolarEdge in Australia? What development is taking place?

Less than ten years ago, people thought that power optimisers were a niche solution for shaded residential roofs and never believed MLPE would be used in commercial systems. Today, SolarEdge is considered a market leader in commercial PV and we are already an active market player in small-scale utility PV.

The C&I PV segment continues to be an important sector for SolarEdge in general and specifically in Australia. We already have a number of sites in Australia that are over 1 MW.

Our success in this segment is due to two equally important factors. The first, is that our solutions provide added value for C&I PV installations. Besides yielding increased energy, SolarEdge’s commercial solution offers longer strings for decreased BOS costs, enhanced safety, and decreased O&M costs.

As part of our commitment to delivering innovative solutions, SolarEdge continues to introduce new products to serve this market and ensure that our solutions are more scalable and cost effective, such as our larger-capacity, three-phase inverters or dual-module power optimisers. In addition, we have a strong team of commercially-focused experts who provide EPCs with presales and tender assistance, design recommendations, and ongoing support.

The second factor is market maturity. Players in the C&I PV market are now equipped with an additional 10-20 years of experience. The sector is learning from its past mistakes as the systems age. For instance, back in 2010, business planning was mainly focused on CAPEX because the market was not mature enough to properly asses OPEX and the long-term impact on PV system performance. Today the industry is better positioned to understand how SolarEdge’s commercial solution, which can decrease both CAPEX and OPEX, can improve LCOE of large PV systems.

There were reports of tight inverter supply during some parts of 2017 – on the back of certain component shortages. Has this impacted SolarEdge in Australia in 2017? Will it have an impact in 2018?

Component shortages impacted suppliers throughout the industry, including SolarEdge. The significant increase in demand for SolarEdge inverters also added pressure to our supply. However, careful planning and strategy allowed extra supply to be sourced and produced. SolarEdge Australia is now seeing the positive results of these actions.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.