SunPower does a lot of things. As a manufacturer, for decades it has been making the most high-efficiency solar panels available on the market. The company has a systems business where it not only develops and builds solar projects but also provides custom balance of systems solutions for residential, commercial and utility-scale projects.

It also has a yieldco to hold solar projects. Or rather, it had one, but is in the process of selling it.

In some ways, SunPower has been similar to Silicon Valley technology companies like Twitter, in that growth and progress do not necessarily mean profitability. The company’s reports are eternally optimistic, with seemingly every quarterly call featuring some form of technology development and promising future profitability. However, SunPower has been losing money every quarter for years.

A year ago SunPower embarked on a major restructuring initiative, while introducing its new, lower-cost P-Series. However, this is not yet showing in reduced losses; for fiscal year 2017 the company reported an operating loss of over $1 billion, more than double SunPower’s 2016 loss levels, due largely to a massive write-down of its residential lease assets.

This was not fundamentally different in the first quarter of 2018. SunPower increased revenues 19% year-over-year to $392 million, but also reported an operating loss of $134 million, and a net loss of $148 million.

Divesting from utility-scale solar

On its Q1 results call, SunPower announced what may be the biggest change to date, that it is getting out of the utility-scale solar development business. Chief Financial Officer Chuck Boynton says that the company will stop developing new projects, as it sells off not only a number of plants but also the assets of its power plant business.

It is unclear what will become of SunPower’s modular Oasis Power Plant solution, and if this will still be available to third parties developing utility-scale solar with SunPower products.

SunPower framed the change as an opportunity, emphasizing the superior profitability of its commercial and industrial (C&I) and residential solar development through SunPower Solutions. “Globally residential, and distributed generation in general, is a terrific business,” noted Chief Financial Officer Chuck Boynton on the results call.

This includes the company’s custom solutions for residential and C&I installations: Equinox and Helix. During the quarter SunPower added a battery storage option to its Helix C&I solution, and reports 30% attach rates.

Both business segments appear to be showing progress, with SunPower’s residential business reporting 35% year-over-year growth and record Q1 deployments. The company’s C&I business grew 50% year-over-year, and SunPower claims the number one market share in the United States in this sector.

SunPower predicts that these segments will grow while utility-scale solar deployment remains relatively flat through 2023, and also notes that distributed generation is a better fit for its high-efficiency, higher-cost products.

“DG systems are more likely to be site-constrained and benefit from our high-efficiency technology,” noted CEO Tom Werner on the company’s call.

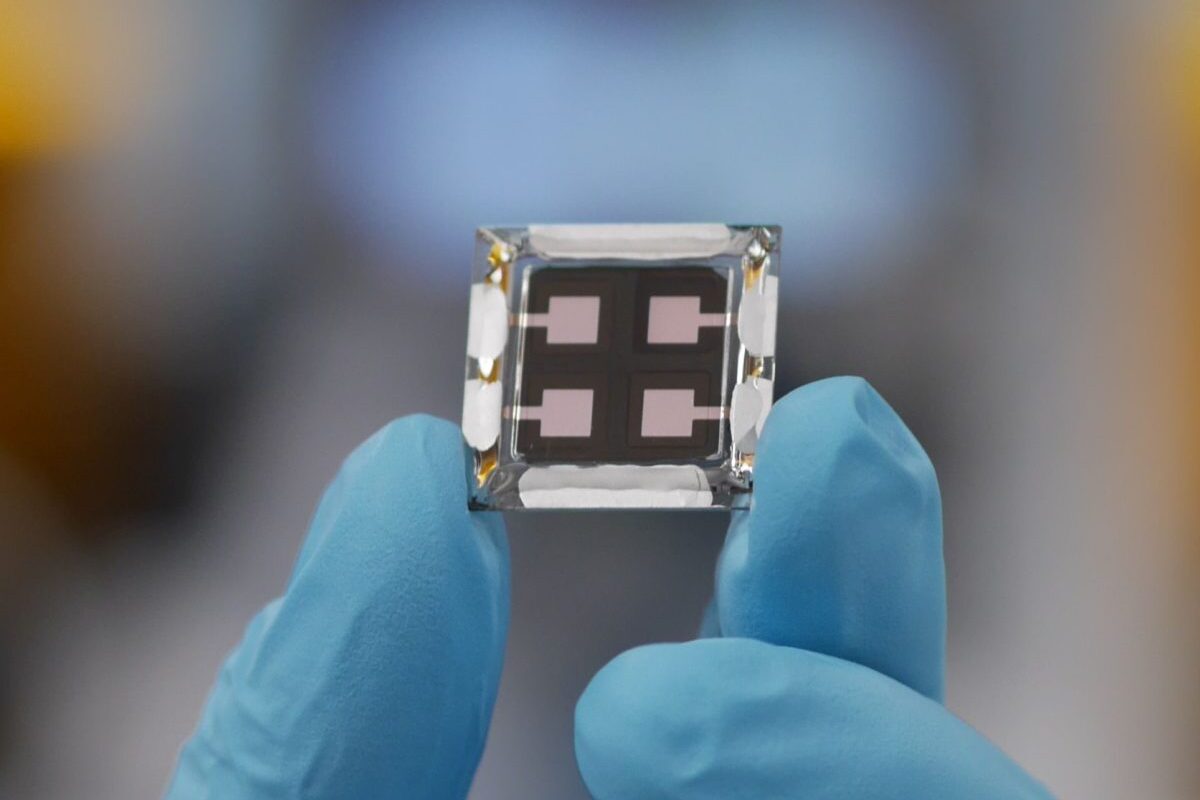

This is likely to be true even with SunPower’s new Integrated Back Contact (IBC) design under development in Silicon Valley, dubbed the New Generation Technology (NGT). SunPower projects that NGT will be 40% cheaper than its current IBC, while delivering similarly high efficiencies.

Selling off assets, buying a factory

Along with the pivot to DG, SunPower is busy selling off many of its assets. In February the company agreed to sell its share in yieldco 8point3 Energy Partners to Capital Dynamics at a per share price well below what the stock was trading at, and this will come to a shareholder vote on May 23.

Additionally, SunPower is selling off a 400 MW solar lease portfolio, as well as utility-scale solar assets. The sale of 8point3 is expected to provide $380 million in cash, the sale of the leases $200 million, and the asset sales should remove $400 million from SunPower’s balance sheet.

Although it is hard to come up with a total, SunPower plans to pay off a $300 million convertible loan in June, and in the event that the sale of 8point3 takes longer the company has a $300 million bridge loan lined up.

This will not yet deliver the elusive profitability. While SunPower CEO Werner says that the company “turned a corner” during Q1, the company still expects to lose another $100 to $125 million during Q2.

What may be more is that the company appears to be reducing its operating expenses, with selling, general and administrative expenses falling 3% year-over-year in Q1. Here the company is promising additional gains as it streamlines its operations.

At the same time, SunPower is buying SolarWorld America’s Oregon factory, but there is no public information at this time about how much this will cost. CEO Tom Werner noted the “significant synergies in the areas of operations and go-to-market structures” between the two companies, as well as the advantage of acquiring SolarWorld’s dealer network.

However, Werner also hinted that the company would not have bought the plant were it not for the Section 201 tariffs. So while it is clearly a major investment, it appears to be one that the company was compelled to make.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.