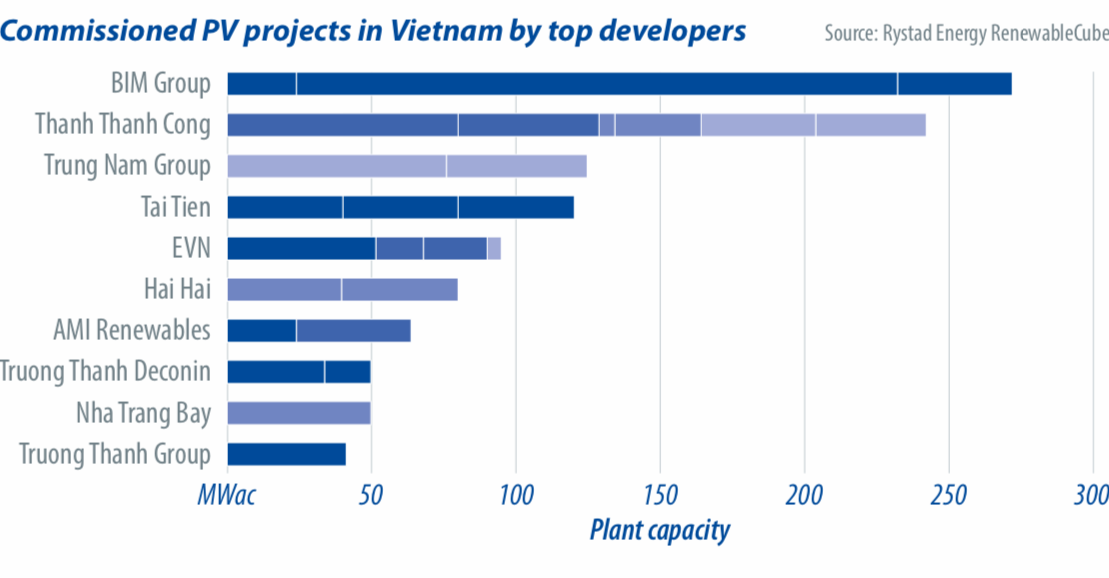

BIM Group leads the pack of local solar developers in Vietnam, with 272 MW in commissioned PV projects, boosted by Vietnam’s biggest utility-scale PV project, BIM Phase 2, which has an AC capacity of 208 MW. This project is also partly owned by Ayala Corp’s AC Energy, a major renewables developer in the region. The second biggest local PV developer with operational PV plants is Thanh Thanh Cong (TTC) Group, which has managed to complete six projects totaling 242 MW, with a few more lined up for June.

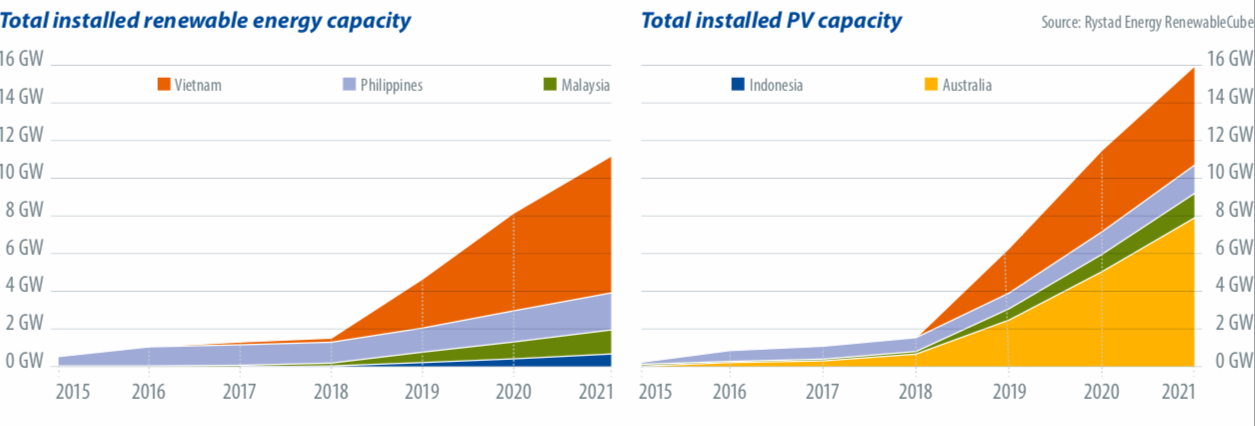

The nascent solar industry in Vietnam, which only launched in 2018 and is seeing sizable development this year, has an ambitious long-term plan to catch up with its peers in the Southeast Asian solar market. The growth in the country’s portfolio of solar projects has so far been meteoric, and according to Rystad Energy’s analysis, installed capacity will have grown to 2.4 GW in 2019, from about 100 MW in 2018.

International interest

Foreign investors and developers are also entering the market through equity acquisitions. BIM Group’s development is an example of this. The majority of the international partners are regional renewable energy companies coming from neighboring countries including the Philippines, Thailand and Singapore, such as Ayala Corp and Gulf Energy. The only European renewables player that has commissioned projects in Vietnam so far is Quadran International, with an investment in the 49.5 MW Cat Hiep project in Binh Dinh province.

It is easier for regional players to expand into neighboring countries compared to developers from other continents. The largest participation by foreign investors will be at B. Grimm’s Dau Tieng project, which officially reached its commercial operation date at the end of June.

Once a project receives financing, there is a lot more involvement by international players in the engineering, procurement, and construction phases. These post-financing steps draw in international EPC companies from Europe and China, as well as Japan and India.

By the end of June, however, we should see PowerChina taking the number one market share spot in Vietnam after a number of their projects reach their commercial operation dates.

There are also local companies developing EPC capabilities to satisfy the future growth of the solar market in Vietnam. We should expect these local EPCs to start handling projects as main contractors in the future. Vietnam is also developing the full range of utility-scale solar plants, with fixed tilt ground-mounted PV, single axis tracking ground-mounted PV, and floating PV.

Vietnam has scaled up its PV market in just one year to break into the gigawatt-scale bracket, and by the end of June, we expect renewables to account for up to 7% of the country’s total installed electricity capacity. Quickly becoming the PV powerhouse in Southeast Asia, Vietnam differs from other countries in the region with its many large-scale mega projects and a diverse landscape of market participants. To deal with the growth in energy demand, Vietnam will continue to be an important market for PV investment.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.