Australia’s biggest super fund, AustralianSuper, dumped its shares in Whitehaven Coal last week and yesterday announced its commitment to net-zero carbon emissions investment portfolio by 2050. AustralianSuper is jumping on the bandwagon with other major investors, and indeed fellow superannuation funds such as Hesta, in setting 2050 targets. But of course, there is no shame in jumping on the bandwagon in this regard. After all, a bandwagon is the most efficient way of getting the whole band to the next gig.

AustralianSuper, which invests $188 billion in assets in the global economy, says that its plan to transition to net zero 2050 is already in full swing. Indeed, the fund has already reduced the carbon intensity of its portfolio by 44% between 2013 and 2019.

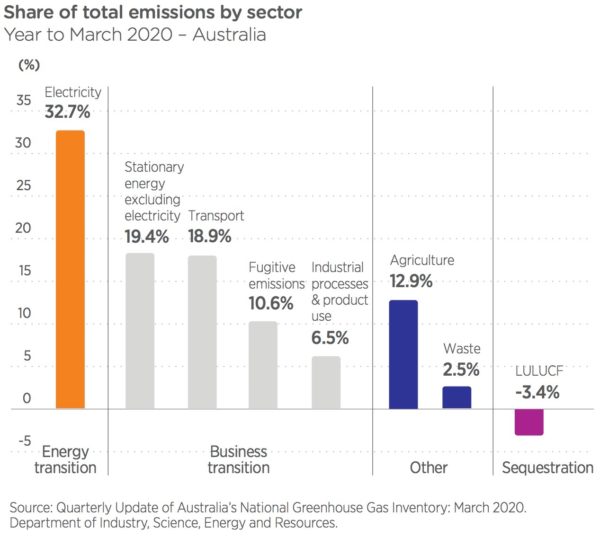

As emphasised in the above graph, electricity generation accounts for approximately 33% of Australia’s current greenhouse gas emissions. AustralianSuper admits that its portfolio must divest from coal and other fossil fuel-related generation to renewable alternatives. Therefore the fund also plans to have investments in renewable energy projects of over $1 billion by the end of 2022, and only to increase from there.

Already in AustralianSuper’s portfolio is Generate Capital, a San Francisco based investment platform for distributed energy and sustainable infrastructure. Quinbrook Investment Partners, an infrastructure management firm focusing on solar, wind and battery investments in the US, UK and Australia. And the National Infrastructure Investment Fund (NIIF), which is currently investing equity capital into India’s growing renewable sector.

Of course, clearly an investment fund of the size of Australian Super, a billion dollars in the renewable sector is surprisingly small, something few people want to hear. In its media release the fund even boasted: “We also hold lower emission transition fuels, like gas.” Which, considering the fund is in the process of praising its environmental and climate credentials, is like boasting that the company is going to recycle at its annual seal-clubbing retreat.

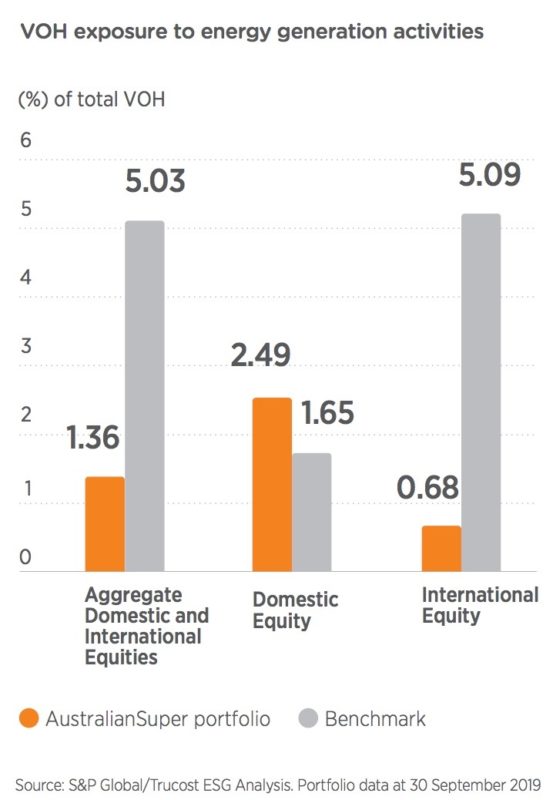

Nevertheless, as can be seen in the above graph provided by AustralianSuper portfolio carbon footprinting by Trucost last year, AustralianSuper still has a way to go to align its portfolio with the International Energy Agency (IEA) approved benchmark at which investment would mitigate climate change in accordance with Paris Climate Agreement standards.

The announcement follows also follows in the footsteps of ANZ which made a similar commitment late last month, and to which it received backlash from The Nationals section of the Coalition. Evidently, like everyone else, AustralianSuper doesn’t consider Deputy Prime Minister Michael McCormack, who accused ANZ of “virtue signalling”, to be much of a moral authority. Now, AustralianSuper can focus on significantly improving its green finance portfolio.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.