It was around the beginning of 2018 that the idea of making PV wafers larger as a cost optimisation began to gain ground. Up to this point, the “M2” wafer measuring 156.75 mm had been widely accepted as the industry standard, representing the vast majority of products on the market.

As is so often the case in solar, making wafers larger as a cost optimisation was not an entirely new idea. This time around though, it has quickly gained ground among all of the leading manufacturers, turning the market on its head. Figures from PV InfoLink forecast a complete reversal in demand for the M2 wafer, from a 97% market share in 2018, collapsing to just 3% by the end of 2021.

The size, or sizes, that will fill this gap have been the subject of much debate over the past year. The change began incrementally, with manufacturers initially moving up to 158.75 mm or taking another look at the 161.7 mm M4 wafer that had previously been used in some niche products for the rooftop market.

In June 2019, monocrystalline manufacturer Longi Solar looked to answer the question with its 166 mm M6 wafer, promising to boost energy yields and bring down wafer costs by around 4%. Then in August 2019, Zhonghuan Semiconductor introduced its 210 mm ‘G12’ wafer, with which it promised module power ratings up to 600 W from a 60-cell PERC module. For Zhonghuan, it may have been a logical progression to bring PV wafer dimensions in line with those it produces for the semiconductor industry. For the solar industry though, such a fundamental change at the top end of the supply chain created new uncertainty over the ideal dimension – and this uncertainty looks set to remain with the market for at least the next couple of years.

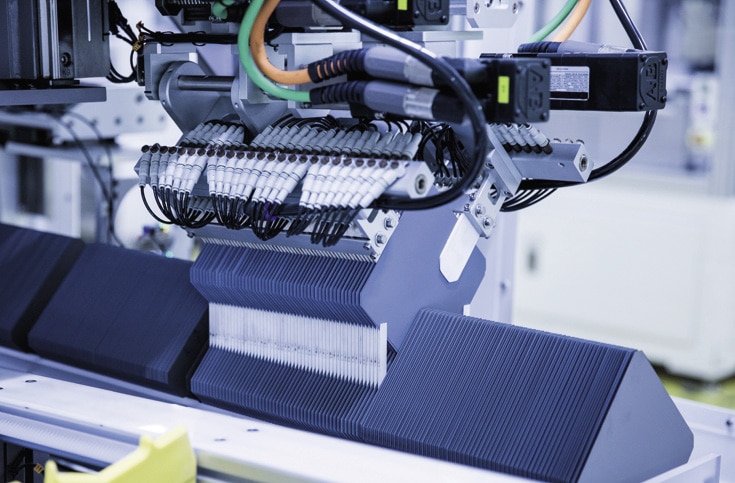

It quickly became apparent that while Zhonghuan’s 210 mm wafer could offer advantages in terms of power output, jumping straight from M2 to G12 dimensions came with its own set of challenges, in some cases requiring costly upgrades or outright replacement of factory equipment. And further downstream, the larger formats and quite different electrical characteristics of modules made from these wafers require redesigns to balance-of-system components and system layouts, and for investors represents essentially a new and unproven technology.

This led Longi, in June of this year, to launch the 182 mm M10 wafer. The company’s calculations show that this is the optimal size to bring down levelised cost of electricity, taking into account shipping, handling, and all other costs. “With M10 wafer size standardisation, all players through the value chain now have a common platform to develop and optimise their individual equipment and process to realise optimum performance and lower cost,” said Hongbin Fang, director of product marketing at Longi, earlier this year. “This standardisation will help to deliver better value for our customers.” Longi has estimated that its latest module based on the 182 mm wafer will save one or two cents per watt at the system level.

Camps forming

And with the launch of the M10 wafer, the industry quickly divided itself into two broad camps, each backing one size over the other. And this story continues to play out – in mid-November, at a conference event held in Shanghai, Longi, JinkoSolar and JA Solar jointly stated their expectation that they expect to see 54 GW of module production capacity based on the M10 wafer online by the end of 2021. In the same week, Trina Solar announced a joint venture with cell manufacturer Tongwei that will focus on the 210 mm products. “Trina Solar and Tongwei both have outstanding advantages in their roles for the industrial chain. They have reached a consensus on 210 series modules, and this cooperation will further strengthen our strategic partnership,” stated Wu Qun, secretary of Trina Solar’s board of directors, announcing the joint venture. “Through the joint efforts of all industry partners, the 210-product industry chain has matured, and is now more conducive for deeper integration.” Trina also said it expects to have “no less than 50 GW” of production capacity at the end of next year, the bulk of which will be devoted to 210mm modules.

Elsewhere among the Tier-1 module manufacturers, Risen launched its Titan module series based on the G12 wafer a year ago, and Canadian Solar is ramping up production of its Series 7 modules, also incorporating the 210 mm wafer, and sees this as the industry’s future. “Considering all the constraints including shipping, weight, availability of materials and reliability, 210 mm is the upper boundary of modules for utility-scale projects, with great savings on the mounting structure and cable at the system level,” Canadian Solar CEO Shawn Qu told pv magazine. “210 mm is a stable platform for developing modules which achieves the best LCOE.” Hanwha Q Cells, meanwhile, is planning to launch a 590 W product based on 182 mm cells in the near future, and says that it has concerns surrounding the G12 in terms of mechanical load stability and high currents. “M10 wafers are the best choice to harvest the cost savings in manufacturing and deployment whilst avoiding the challenges of even larger substrates,” said Jürgen Steinberger, global product manager for Q Cells. “The module width is more practical, half-cut cells are still a good choice with only tiny disadvantages in cell-to-module compared to half-cut cells based on smaller wafers.”

With major investments already committed from both camps, it looks as though both of these new wafer sizes will gain market share. Over the next few years analysts are forecasting a wafer market split between the two, with M10 initially seeing a slight advantage and G12 beginning to catch up after 2023. This has led some to theorise that the M10 wafer could be seen as a transition product, smoothing over the changeover to the larger G12 format. Longi, however, is convinced that its product offers better electrical performance, as well as simpler handling and installation, and will be adopted as a new industry standard. “The 182 mm modules effectively support the existing industrial specifications and electrical systems,” stated Longi Solar Senior Product Manager Li Shaotang at a conference promoting the 182 mm wafer in Shanghai in November. “Additionally, in terms of LCOE, 182 mm modules are superior to 210 mm due to lower system cost, better generation capacity, and reliability.”

As projects begin to be built with both module types, it should become clearer whether one has an overall advantage, or whether the two are each better suited to certain installation scenarios. In the meantime, however, other industry players are busy preparing for a market with significant variation in terms of module size, and plenty of confusion over the best path to take. “Within the two cell sizes, we see about five new module designs, and the industry has never really dealt with that much choice,” said Greg Beardsworth, director of product management at Nextracker. “There’s definitely the risk of overwhelming and confusing the market.”

Part of Nextracker’s response has been to try to work closely with module suppliers to ensure compatibility with its trackers, and setting appropriate load testing requirements and other parameters. Working together in this way, said Beardsworth, is the most economic approach, ensuring, for example, that cost savings in module manufacturing don’t just translate into additional spending elsewhere.

And the company has so far found little to suggest that there are any major, fundamental design changes needed to build mounting systems and other components for use with these larger modules. “We have expanded our wind and structural analysis to cover this full range of panel sizes,” explained Beardsworth. “But we didn’t find anything like ‘once you go to this size, everything changes.’ So we can scale without having to start afresh.”

With several different formats available, module size could become just another input for project calculations. And understanding how specific site conditions could affect this decision will be key to preventing confusion among project developers. “If you have five different scenarios for the design of a 100 MW project, everybody’s head is going to explode,” said Beardsworth. “Selecting the optimal module format before detailed site design begins will help developers and EPC’s minimise churn and realise the potential benefits of higher power modules.”

Next year will see large formats begin to be installed in projects, first in China, then rolling out to other tariff-free locations. And the picture painted by performance data from these projects over their first few years in operation will help to make the advantages and disadvantages of either approach clearer. Until then, at least, it seems project developers will be spoilt for choice in terms of module size – a situation that’s sure to bring its own set of ups and downs.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.