From pv magazine 05/2021

The strong outlook for solar PV installations in China is a reflection of the development of the industry over the last decade, and it’s forecast to continue after the publication of the new carbon target.

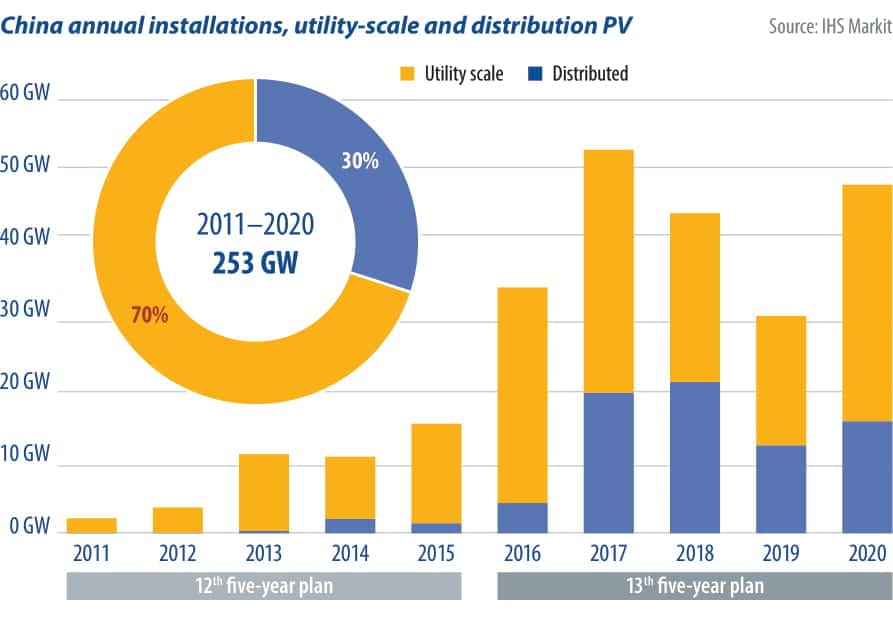

China dominated global solar PV installations in the period between 2011 and 2020. With 48.2 GW of additional solar capacity added in 2020, the country’s National Energy Administration (NEA) announced 253 GW of cumulative solar connections during the period, with roughly 70% of those connections deriving from utility-scale projects, driven by feed-in-tariffs.

Demand grew significantly during the 13th five-year plan period (2016-20), with 210 GW (AC) of solar connections – a five-time increase from the 12th five-year plan period (2011-15). Over the next five years, IHS Markit expects mainland China to continue to be the largest solar market globally in installation terms.

Fuelled by FITs

Policy support has played a significant role in the industry’s size, business model, time frame, speed of installations, and supply chain movements of solar PV in China. Chinese solar policy schemes followed a few key stages. First, at the beginning of the 12th five-year plan, the key national solar policy was the “Gold Sun Program 2009-13” and “Building-integrated PV (BIPV) projects 2009-13,” which provided a solar system subsidy (CNY/W).

Secondly, a feed-in tariff scheme was put into place. After July 2013, the State Council of China released “The notice to promote the healthy development of the solar industry,” which provided guidelines on the solar power generation subsidy (CNY/kWh), a feed-in tariff for solar power generation.

However, with financial incentives and technology advancements in the solar industry successfully lowering the cost of solar, the policy scheme shifted to unsubsidised projects by the end of the 13th five-year plan. Since 2019, NEA and the National Development and Reform Commission have already released two rounds of unsubsidised project tenders.

Installations in 2021

IHS Markit expects 2021 to be another record-breaking year, with 61 GW of solar additions, equating to an annual installation growth rate of 26% year on year. The main demand drivers are (i) the unsubsidised program, (ii) the residential segment, (iii) special pilot projects in high-voltage transmission and distribution lines, (iv) renewable parks in some provinces and (V), some additional policy schemes like the special transmission and distribution pilot projects. Former policy drivers like the PV poverty alleviation program and the Top Runner program have now been phased out.

There is a strong pipeline of projects from the unsubsidised PV program announced in 2019-20 and a further 8 GW of subsidised projects that are being transferred into the pool of unsubsidised projects. Yet, IHS Markit remains cautious that additional policy developments in China, or additional supply chain price increases could put our installation forecast at risk, especially since it is strongly skewed to the second half of the year.

Climate commitment

Chinese President Xi Jinping first announced the 2030 carbon targets at the Climate Ambition Summit in September 2020. By the end of 2020, Xi updated the 2030 carbon targets at the Climate Ambition Summit, representing a part of China’s new Intended Nationally Determined Commitment (NDC).

Energy-related goals included in the 14th five-year plan strengthen both the updated 2030 NDCs and the carbon emissions peaking target. The development of low-carbon-emissions energies, such as renewables and nuclear, will accelerate, while coal consumption growth will be under tight control. The main points include plans to do the following:

- Reduce carbon emissions per unit of GDP by over 65% from the 2005 level;

- Increase non-fossil fuels in primary energy consumption to around 25%;

- Increase the forest stock volume by 6 billion cubic meters from the 2005 level;

- Increase wind and solar power generation capacity to at least 1,200 GW.

As part of this announcement, the Chinese government for the first time stated specific renewable installed capacity targets as part of the new national climate goals. IHS Markit has revised upwards the five-year solar PV installation outlook in China to reflect the clear commitment to continue supporting renewables development as a pillar of the decarbonisation strategy in the country, as part of its search for carbon neutrality.

Author: Holly Hu

Holly Hu, senior analyst at IHS Markit, is responsible for tracking and analysing solar policies and markets in Asia, particularly China and Japan. She also provides in-depth coverage of the polysilicon-to-photovoltaic-module supply chain, with a focus on Chinese manufacturers. Before joining IHS Markit, Hu was the manager of the business development department at Trina Solar, where she provided market intelligence and analysis of industry rivals.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

3 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.