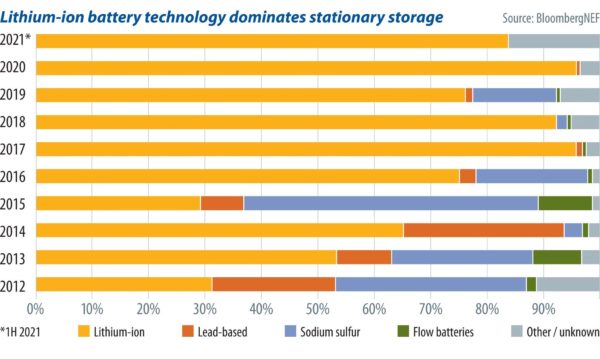

From the outset, as many industry insiders say, the question of alternatives to lithium-ion batteries is not an either-or situation, as different technologies suit different applications. Energy storage will be enormous, and whatever storage alternative technologies can shoulder will free up more Li-ion resources for the sectors in which it is particularly useful, especially electric vehicles (EVs).

Sodium-ion

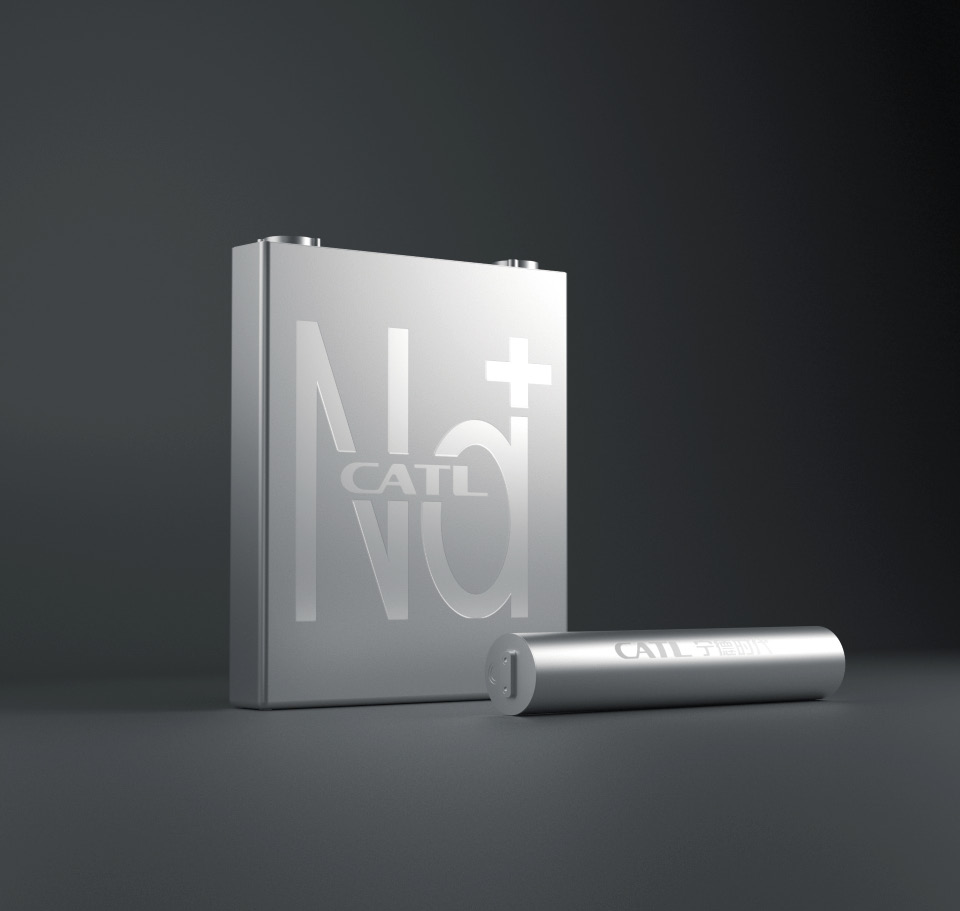

Excitement about sodium-ion (Na-ion) systems was renewed and redoubled earlier this year after CATL, the world’s largest lithium-ion battery manufacturer, backed its sodium-ion technology for commercialisation by 2023. James Quinn, CEO of U.K.-based Na-ion tech startup Faradion, which has licensed its technology to AMTE Power, said CATL’s announcement “shows that sodium-ion technology is going mainstream … Given [CATL] is China’s top car battery maker with a market value of almost $200 billion, it is big news for the cell chemistry.”

Unlike some of the elements in a lithium-ion battery – particularly lithium carbonate, cobalt and nickel – sodium is low-cost, abundant, and as Deakin University’s Mega Kar said at pv magazine’s recent Insight Australia event, “much safer.” And this is not just because a Na-ion cell can be fully discharged to 0 volts (makes for ease of transportation), but all the way down to the “cathode and anode materials.”

The CATL announcement showed that this technology isn’t just in the lab, but within touching distance of economies of scale. “We have already developed cooperation/corporation with OEMs and energy storage customers to commercialise the first-generation sodium-ion batteries,” a CATL spokesperson told pv magazine. “And already started the process of industrial deployment, and plan to form a basic industrial chain in 2023.”

And as far as costs may weigh on development, CATL isn’t worried. Based on its experience in lithium-ion batteries and existing industrial deployment, the company said that “the resource investment and time required to develop sodium-ion batteries will be greatly reduced.”

The space for innovation within sodium-ion is vast. “Micro-improvements in Li-ion cell chemistry are being made each year,” said Quinn, but “Na-ion has the runway to make meaningful improvements in density and cycle rate year-on-year for several years still. This rapid scale of innovation is what makes the chemistry so exciting.” This touches upon one of the oft-mentioned shortcomings of Na-ion technology, its relatively low lifecycle compared to lithium-ion. Though Quinn believes the Na-ion technology will shortly reach a typical Li-ion mark of around 3,500 cycles, though CATL itself claims to have a lithium BESS which can manage 12,000 cycles, equivalent to a 20- to 25-year lifespan, mirroring that of solar.

Again, energy storage is not a zero-sum game. Wood Mackenzie’s most recent estimates show annual global storage deployments tripling year-on-year, reaching 12 GW/28 GWh this year alone. Hence why CATL’s spokesperson explained that “the new energy industry has entered a multi-level, multi-type and diversified development stage, and the increasingly segmented market has put forward differentiated needs for batteries. Sodium-ion batteries have their unique advantages and different application scenarios and will coexist and complement lithium-ion.”

CATL claims its first-generation sodium-ion battery has reached 160 Wh/kg, which it says is “currently the highest level in the world.” However, Quinn says Faradion’s sodium-ion technology has already hit that mark and is aiming for 200 Wh/kg.

Nickel hydride

Swedish battery storage manufacturer Nilar’s nickel metal hydride (NiMH) is a bipolar design, with strong performance in stability and sustainability. Unlike lithium-ion, hydride batteries are not flammable, thanks to their water-based electrolyte. Nilar Application Engineer Alexander Klasson told pv magazine the Research Institutes of Sweden (RISE) tested the system by putting the batterypacks inside a chamber and setting them on fire.

The battery’s nickel plates are “laid horizontally on top of each other, like the layers of a lasagne,” said Klasson. “So instead of cables, the current goes through the entire pack.” In effect, the whole stack is the cable. What is more, Klasson spoke of a new technological feature: gas chamber holes which run through the layered cell plates. “The electrolyte dries as it ages and degrades,” he explained, “leaving excess hydrogen behind.” The gas chamber holes allow an oxygen hose to be attached which “restores the battery by creating a whole new water electrolyte,” refreshing 120 cells at once. This renewal process, which Nilar estimates to be a once-in-a-decade requirement, does, however, need to be undertaken by a qualified individual.

Nevertheless, the battery, set for release next year, is slightly too heavy for EV application but seems a promising alternative to Li-ion in many other sectors, and this explains why the jurors awarded Nilar the “Megawatt Winner” in pv magazine’s Energy Storage Highlights 2020 edition.

Nickel-hydrogen

Technology doesn’t just fall from the sky, except in the case of EnerVenue, as the company’s nickel-hydrogen battery technology has long been in use by NASA on the International Space Station (ISS), meaning that it has been falling from the sky for decades. Back in the 1980s, NASA needed a battery to use in satellites, the ISS, Mars Odyssey and the Hubble Telescope. Supported by solar arrays, the ISS’s nickel-hydrogen batteries charged during insolation and discharged during eclipse.

However, the ISS’s nickel-hydrogen batteries were swapped for lithium-ion replacements in 2017 because Li-ion is smaller, more power-efficient and easier to manipulate in terms of design, hence better suited for the weight-restrictions of space exploration. On Earth, weight advantages are less critical in permanent installations.

But it wasn’t until Professor Yu Cui of Stanford University developed what is EnerVenue’s technology that nickel-hydrogen batteries have started to be viewed as anything but an extremely expensive solution for extreme situations, like space exploration.

As demonstrated by its NASA history, the technology is particularly good in remote and harsh conditions (operational temperature range between -40 C to 60 C) and requires very little maintenance. EnerVenue insists that maintenance costs for its nickel-hydrogen battery aren’t just low, but that there are no maintenance costs – once you install it you can forget about it, and that goes for fire suppression, too.

One shortcoming, and this goes for all batteries containing nickel, is that Rystad Energy predicts nickel demand will outstrip supply by 2024, thanks to rising EV battery demand.

Hydrogen solutions

The Lavo battery made headlines earlier this year for its novel approach. It’s a hydrogen-based battery specifically designed for incorporation with a solar system which contains both a water purifier and electrolyzer, so that solar energy can separate the hydrogen from the water, let the oxygen go, and store said hydrogen safely as a solid material by combining it with an absorptive sponge-like metal. Lavo is not divulging the composition of said metal, but the result is a stable metal hydride. The hydrogen can then be leaked out through a reduction in pressure and diverted into a fuel cell.

Lavo Chief Marketing Officer Matthew Muller said the battery is both “a complementary and alternative technology to Li-ion, depending on the sector and user’s needs.” But the Lavo system also “includes a Li-ion battery for immediate response time … so Lavo combined lithium technology with hydrogen storage to deliver scalable solutions.” But where “Lavo does become a true alternative is in the power-to-fuel market … the batteries provide the demand response and act similar to a starter motor in a vehicle, helping to get the system up and going while providing any additional peak energy demands,” continued Muller.

Of course, the round-trip efficiency is still the approximate 50% barrier which most hydrogen storage systems come up against. However, Lavo says it has far exceeded it given the battery’s longevity.

Vanadium redox flow batteries

Like other alternative battery storage options, VRFBs are better suited to long duration and overnight applications. Moreover, the electrolyte is highly reusable. “VRFBs are already competitive when viewed on LCOE basis over its lifetime,” says Australian Vanadium Manager Director Vincent Algar. He explained that the “long-term risk mitigation with VRFB is a value add that also needs to be considered” as VRFBs are not constrained by “number of cycles or depth or discharge … (or) constraints with permanent battery damage and difficulties in recycling.”

Because of that long lifespan and no hassle temperament, VRFBs are a great BESS alternative to remote systems, off-grid projects, and microgrid solutions, particularly in the mining, agricultural and data sectors.

“Vanadium is much more abundant than lithium. [The company views them] as complementary to each other and with the strong demand for lithium-ion batteries from the electric vehicle market, it makes sense to use VRFBs where they fit particularly well,” explained Algar.

“We are starting to see the evolution in storage demand shifting from shorter duration, shorter life products, to those that supply a safe, sustainable, reliable and flexible, long-term source of clean energy.”

Australian Vanadium is in the early stages of building its own electrolyte manufacturing facility, with an initial annual capacity of 33 MWh in Western Australia. Algar says this is not only “expandable,” but part of plans “for electrolyte manufacturing hubs throughout the country.”

Iron-air batteries

Another interesting electrochemical storage technology is iron-air batteries. U.S.-based Form Energy, which is backed by Bill Gates’ Breakthrough Energy Ventures (BEV) and steelmaking giant Arcelor Mittal, utilises the principle of reversible rusting. As CEO Mateo Jaramillo, formerly of Tesla, said, the battery breathes in oxygen from the air while discharging and converts iron metal to rust. “While charging, the application of an electrical current converts the rust back to iron and the battery breathes out oxygen.”

The key characteristic of iron-air batteries is the potential for multi-day storage, and Jaramillo believes Form’s washing-machine-sized iron-air battery system will cost “less than one-tenth the cost, per kWh,” of Li-ion, “when we achieve high volume scale.” But like other technologies, Jaramillo pointed out that its “technology is not a replacement for lithium-ion. Quite the opposite, in fact. Our rechargeable iron-air battery and lithium-ion batteries are complementary for low-cost, highly reliable renewable power plants and complete systems.” Again, different technologies for different applications.

“The way we tend to think about it,” Jaramillo continued, “combined with cheap renewable energy, our multi-day technology can replace the function of coal plants or high-capacity factor natural gas plants … while lithium-ion batteries are an optimal replacement for peaker plants that run during short periods of high energy demand.”

Jaramillo, who imagines warehouses full of tens of thousands of these washing machine sized batteries, says the material costs of iron-air are significantly cheaper. He expects to have a 1 MW pilot battery installed by 2023 that will be capable of continuously discharging for more than six days.

Iron-flow batteries

Another Gates-backed company is U.S.-based Energy Storage Systems (ESS), which took its iron, salt and water composed batteries public in October through a SPAC with Acon S2 Investment Corporation and is now trading on the New York Stock Exchange.

Eric Toone, Gates’s BEV science lead, told Bloomberg that “this is a big, big deal. We’ve been talking about flow batteries forever and ever, and now it’s actually happening.”

Of course, with the chemistry mentioned, the ESS system is much cheaper than Li-ion on the materials front, much safer, and longer lasting too. ESS told pv magazine USA that its new warranty is 10 years for all components, but the battery has the potential to last decades longer, with ESS prescribing a design life of 25 years and zero degradation over 20,000 cycles.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Very interesting, we need article like this, very useful, thank you

Why no mention of zinc bromide flow batteries, already in production, by the Australian company RedFlow?

https://redflow.com/