From pv magazine’s Issue 09 – 2022.

The “Make in India” policy has three main planks. First, there is a new tariff barrier on all PV cell and module imports in the form of a basic customs duty (BCD) of 25% and 40% respectively from April 2022 onwards. Second, the government is offering a production-linked incentive (PLI) worth INR 240 billion (AU$4.6 billion) to domestic manufacturers. Finally, the government has created a non-tariff barrier in the form of Approved List of Models and Manufacturers (ALMM) whereby all module suppliers and makes for sale in India need to be pre-approved by the government. Although the ALMM policy does not formally discriminate against any suppliers, senior government officials have openly stated that Chinese suppliers are unlikely to get approvals under the policy. Indeed, there are several other secondary support measures for domestic manufacturers ranging from demand creation to tax rebates and incentives in the form of cheaper land and power supply.

It could be argued that with formidable BCD protection, all other incentives are unnecessary. But the PLI scheme is facing significant implementation challenges. For example, the government approved an enhanced PLI budget of US$3 billion (AU$4.6b) in February 2022 but has so far allocated only US$550 million (AU$847m) to three manufacturers. There is still no clarity on process and timetable for allocation of the remaining funds. Similarly, since there is no sufficient domestic capacity for either cells or modules, the government has been extending timelines for implementation of ALMM for private projects.

Nonetheless, the domestic manufacturing landscape is gaining momentum. Most existing manufacturers including Adani, Tata Power, Premier, Waaree and Vikram have announced expansion plans focusing mainly on downstream module assembly and limited cell capacity. Reliance and First Solar are in advanced stages of setting up integrated capacities of 5 GW and 3.3 GW, respectively. Given the criticality of assuring supplies at a predictable price, some developers are also getting into the manufacturing business directly or indirectly.

ReNew, one of the largest renewable power producers, is setting up 2 GW of cell and 6 GW of module capacity. Azure Power has made an equity investment in Premier Energies (planned cell and module capacity of 2 GW and 2.5 GW respectively by the first quarter of 2023). The company has secured 600 MW of module supply annually from Premier, while many other developers are entering into tolling agreements with module manufacturers.

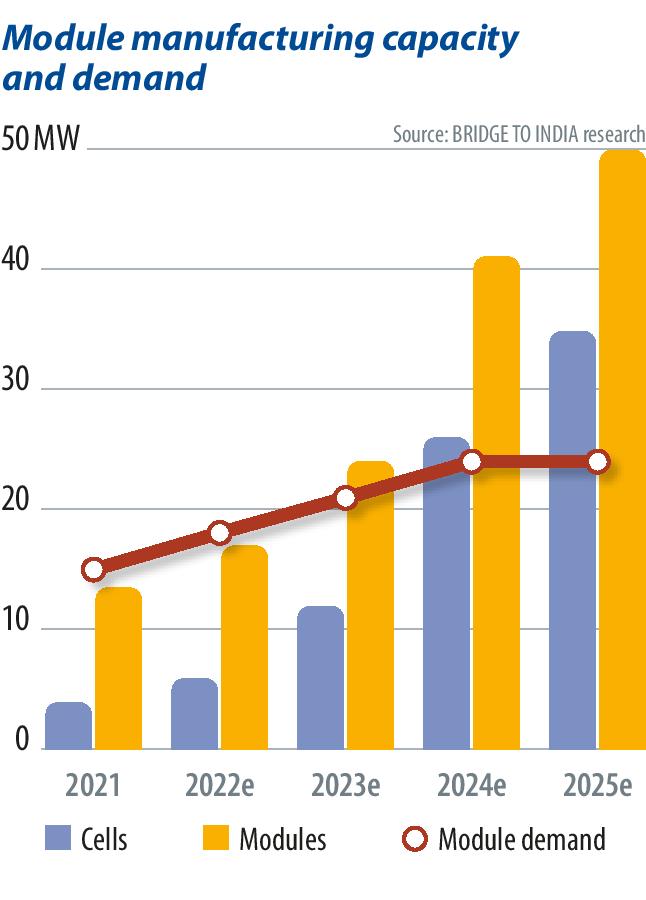

We expect total cell and module manufacturing capacity to touch 35 GW and 55 GW respectively by 2025 from current levels of about 4 GW and 18 GW, respectively. Assuming that the next tranche of PLI scheme is geared towards support for upstream manufacturing, we also expect about 30 GW equivalent of polysilicon-ingot-wafer capacity to come up by 2026. Total manufacturing investment over next three years could therefore reach between US$8 billion to US$10 billion (AU$12b – $15b).

Improving domestic supply should be a blessing for project developers and consumers, who have had to deal with recurring price renegotiations and order cancellations by Chinese suppliers in recent times. It should mitigate supply concerns, reduce lead times and provide better overall control of the procurement process. But there is an inevitable downside in the form of restricted module availability and higher procurement costs at least for the next two years. Utility scale project capital cost and LCOE are estimated to have gone up by about 10% to 15% since introduction of BCD. The impact on corporate renewable and residential rooftop solar markets is even more damaging. There is high risk of cancellation and postponement of some projects because of higher cost and/ or unavailability of modules in the interim period. Consequently, we believe that total solar capacity addition over 2022 and 2023 would be suppressed by about 6 GW to 8 GW.

The challenge for the government is now twofold. Focus should be on developing domestic technology and complete eco-system capabilities to reap full benefits of energy security and independence. The other critical need would be to wean domestic manufacturers away from trade barriers and subsidies to ensure that they are competitive with international manufacturers on technology and cost. In the ideal scenario, Indian manufacturers should be able to capitalise on surging global demand by matching their Chinese counterparts on scale and technology.

About the author

Vinay Rustagi is the managing director of Bridge to India, a renewable energy focused consulting and research company. He advises project developers, investors, equipment suppliers and policy makers on wide-ranging business strategy, policy, finance and business development related issues. He has also spent more than 15 years as a project financier in Asia and Europe financing projects across the renewable energy, transport and infrastructure sectors. His previous job stints include a role at Standard Charted Bank as senior director of project finance, besides working at National Australia Bank, Sumitomo Mitsui Bank and ICICI Securities.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.