From pv magazine ISSUE 11 – 2022

A helpful crisis sounds like an oxymoron but, for the solar industry in the energy transition, such situations are both deeply regrettable and a time to get to work. With a global pandemic ongoing, the climate crisis, plus Russia’s invasion of Ukraine and the associated energy crisis, humanity faces tragedy on all sides. Most economies are in a downturn as widespread inflation causes central banks in multiple countries to tighten monetary policy by raising interest rates, thereby reducing low-cost opportunities.

Yet the renewables industry couldn’t be busier. Solar is the cheapest and cleanest form of energy, serving dual goals in decarbonising the grid and delivering cheap energy. Even hard-nosed investors sense opportunity and funds for climate tech and impact investing are growing in a sector that appears recession-proof. You can add the Inflation Reduction Act in the United States, which among its USD 369 billion ($547 billion) investment package includes USD 2 billion for national laboratories for energy research. Risk capital for new ideas is guaranteed but opportunities require scale and connections.

More, but slower

Jan Michael Hess, founder and CEO of Ecosummit, a leading green innovation and impact conference for startups and investors, told pv magazine that investor activity from venture capital (VC) has greatly increased since the first Ecosummit was held in Berlin in 2010.

“New investors are getting active,” said Hess. “We have more investors joining our events than in the past … and even in the recent past it was very different, with more startups than investors.” Hess pointed to multiple companies which have pitched at Ecosummit over the years, finding both initial and follow-on investments as well as successful exits, including GreenCom, which pitched to the conference in 2016 and was acquired by Enphase Energy in 2022.

Multiple VCs confirm that while funds are flush with cash, venture funding has had to become more cautious.

Julia Padberg, partner at SET Ventures, a capital firm investing in ideas for a “carbon-free energy system,” noted that backers have become more focused.“Climate tech VCs have been acquiring larger stakes in more selective opportunities, in effect doubling down on the winners.,” she said.

Padberg observes the climate tech exception in the third quarter, citing data from Pitchbook. “Even though the number of deals and average deal valuations were also down approximately 30%, the total amount of capital invested in climate tech companies actually increased 16% from USD 32 billion in Q2 to USD 37 billion in Q3,” she reported. “This means that climate tech VCs have been acquiring larger stakes in more selective opportunities this quarter, in effect doubling down on the winners.”

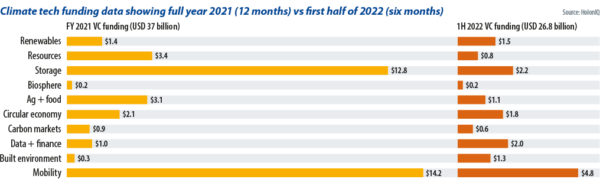

Market research agency HolonIQ offers a similar view, tracking 968 climate tech venture funding rounds globally in the first half of 2022. A total of USD 1.5 billion of funding has flowed into new ideas in the renewables industry in just six months, up from USD 1.4 billion for the full calendar year of 2021; in one of the few sectors showing strong investment growth.

Further confirmation comes from Dragos Novac, who operates Nordic 9, a data platform focused on Europe which tracks investors, startups, and transactions in the region. Novac noted that there is more money than projects in Europe for startups but a higher bar for consideration must now be crossed.

“In general, the deal pace has slowed down and the venture money still deployed is generally seeking verticals not affected by the downturn of the economy,” he told pv magazine. “Climate-focused startups, and energy in general, are in this category.”

And whereas, in the past, investors were making strategic – and, at times, even benevolent – investments, the game has completely changed. “Make no mistake, VC is not a philanthropic business,” said Novac. “Investors deploy money to become rich ASAP, it’s their number one reason for being in this line of work.”

Heavyweight activity

With opportunities so seemingly obvious, those piling into climate tech now include private equity (PE) bodies such as pension and sovereign wealth funds.

Matthias Dill, CEO and managing partner at Energy Impact Partners Europe, said the velocity of money heading towards solar and the energy transition has not been unexpected. “No, I’m not surprised,” he said. “I started energy investing in 2015 and back then it was an odd thing to do. But I think the fundamentals were already there. The fundamentals of the energy transition have been solved. For example, solar panels work at scale, they are the cheapest form of energy.”

“I think a lot of the heavy lifting has been done over the last decades and now it’s ready to scale,” continued Dill. “And it enables all kinds of new business models because it’s not a science problem any more. It’s a commercialisation problem.”

Ulrich Seitz, managing director of BayWa r.e. Energy Ventures, a corporate VC investor, confirms the newly expanding world of VC funding for climate tech. “More non-traditional actors are coming into the VC space, like PE,” said Seitz. “Many new, sizeable funds are being raised to invest purely into climate tech and there is no shortage in capital.”

Dill points to more than 50 large industrial energy companies, including global names such as AGL, EDF, Duke Energy, Fortis, and tech giants Microsoft and Amazon, now participating in his firm’s funds. The business amassed more than USD 1 billion in a climate solution fund last year and added a USD 390 million fund for Europe this year. And money is coming from some of the largest sectors.

“We now see pension funds and sovereign wealth funds invest in energy transition as well,” adds Dill. “It’s a very positive sign because they’re very hard-nosed, financially driven people … the fact that they can see they can make money is a very good thing. The sector has gained the confidence of these players for purely financial reasons. The floodgates have opened for the sector, which will drive change.”

Climate tech

Seitz provides some other reasons that corporate VCs such as BayWa r.e Energy Ventures meet and work with early-stage startups, with two clear focuses.

“On one hand, we act as a VC and invest into climate tech startups,” said Seitz, “On the other, our team introduces innovative businesses to the business units of BayWa r.e., creating cooperation possibilities even if we do not invest.”

Software or hardware?

Hardware investments carry more risk for investors, due to capital demands. Yet boosting overall performance and efficiencies, and decarbonising manufacturing, requires speculative investment. “Hardware is a complicated business in general and that simply means the risks for a good return are higher,” said Nordic 9’s Novac. “The more complicated a business is, the more difficult it will be for investors to understand, and consequently consider, to fund it.”

Seitz points out, accordingly, that VC money has traditionally been dedicated to higher-margin software plays, though that is changing.

“Software is still prevailing but there are more talks about hardware – something not traditional for the VC space,” he said. “From the software side, there’s a lot of focus on flexibility, smart EV charging and platforms for planning and financing assets for renewable electricity or heating.” He even hands out a tip for entrepreneurs, adding: “In my view, there is an oversupply of companies dealing with carbon credits and carbon-footprint-calculating software.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.