Electricity prices are set to rise for Australian households and businesses in the National Electricity Market (NEM) after two of Australia’s major energy regulators forecast increases of up to 31% from July 1.

The news came with the release of the Australian Energy Regulator’s (AER) draft determination of the Default Market Offer (DMO) for 2023-24, which acts as an electricity price “safety net” for customers in New South Wales (NSW), southeast Queensland and South Australia.

The volatility of Australia’s energy markets in 2022 is being treated as a major factor in AER’s draft offer. The global demand for coal and gas driven by the geopolitical impact of Russia’s invasion of Ukraine saw a number Australian coal-fired power stations fail.

Utilities have struggled to adapt to the price rises and the growth in renewable energy generation, especially rooftop solar. Regulators have previously called for “massive invesments” in renewable capacity and transmission infrastructure.

Default offer

The AER’s default market offers will translate into estimated price rises of up to 23.7% in NSW, 21.8% in South Australia and 19.8% in southeast Queensland.

For small businesses, increases could range between 14.7% in NSW to as much as 25.4% in South Australia.

In Victoria the state’s own regulator, the Essential Services Commission (ESC), proposed increases of 30% for residential customers and 31% for small businesses.

“Energy prices are not immune from the significant challenges in the global economy right now; that’s why it’s more important than ever that we strike a balance in setting the DMO to protect consumers as well as allowing retailers to continue to recover their costs and innovate,” said AER Chair Claire Savage.

“It’s important to understand that the DMO is not the best offer, it is a safety-net,” added Savage, referencing the active price competition and offers between retailers.

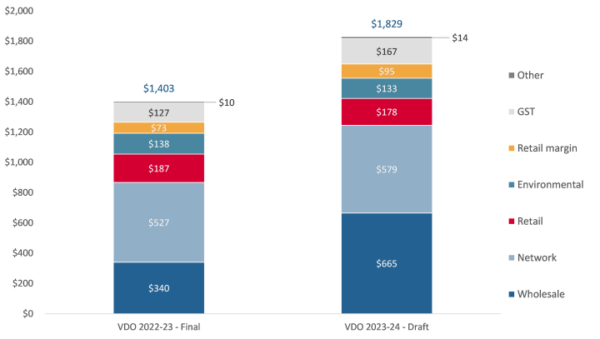

For Victorians, the change in Victorian Default Offer annual bills for domestic customers was illustrated in the following chart, reflecting the wholesale component affecting prices.

Causes

In December 2022, the federal government introduced a 12-month emergency price cap on gas of $12 per gigajoule (USD 8 per gigajoule) and coal prices ($125 per tonne) in a bid to provide bill relief for households and businesses.

At the time, AER forecasted DMO increases of more than 50%.

Minister for Climate Change and Energy Chris Bowen hailed the impact of last year’s price caps, while acknowledging the effects for Australian consumers already struggling with the rising cost of living.

“The Government, faced with large increases in the DMO, urgently acted to curb spiralling prices of gas and coal and shield Australian families and businesses from the worst of these energy price spikes,” he said.

“Despite our distance, Australia has not been immune to the impacts of Russia’s invasion of Ukraine and the biggest global energy crisis since the 1970s.”

Bowen pointed to the government’s Rewiring the Nation and Capacity Investment Scheme, which aim to help Australia reach more than 80% of renewable energy generation by 2030, as long-term solutions to the energy crisis.

Both the AER and ESC’s draft offers will be open for stakeholder consultation until early April, with final decisions expected to be confirmed in May and changes to take effect from July 1.

This could include retailers arguing for higher price increases to reflect their own costs of sourcing wholesale electricity.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.