The Energy Security Board’s (ESB) first annual update on the health of the National Electricity Market (NEM) found Australia’s main grid requires “massive physical investment and wide-ranging policy reforms” to ensure a smooth transition from fossil fuels to renewable power.

ESB chair Anna Collyer said the 2022 Health of the NEM report, released on Thursday, identifies key risks to Australia’s energy transition, including consumer affordability, and reiterates the need for large-scale investment in new transmission, renewable generation and flexible capacity.

“The energy transition is a complex coordination exercise on a national scale that will affect all parts of the supply chain,” she said.

“Events earlier this year highlighted the types of challenges we face and the bumps that can emerge due to a combination of factors including the pace and scale of change, our exposure to the volatility of global commodities markets and the accelerating retirement of thermal generation.

“We urgently need market reform and regulatory settings that encourage efficient investment for our energy future. And the ability to manage the pace of change including the exit of thermal generation.”

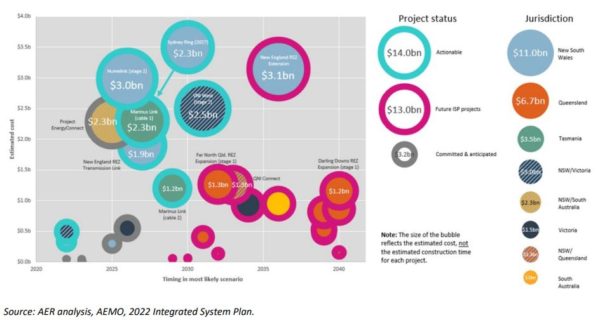

The ESB, which consists of key energy regulators including the Australian Energy Market Operator (AEMO), the Australian Energy Regulator (AER) and the Australian Energy Market Commission (AEMC) said it would look to accelerate the delivery of projects outlined in the 2022 Integrated System Plan (ISP) released by AEMO earlier this year.

Source: AER analysis, AEMO, 2022 ISP

The market operator estimates at least 10,000 kilometres of new transmission is required to connect a nine-fold expansion of wind and solar farm capacity and a near five-fold increase in distributed solar by 2050 and to treble the firming capacity from alternative sources to coal, including utility-scale batteries, hydro storage, gas-fired generation, and smart behind-the-meter virtual power plants (VPPs).

“The NEM requires significant investment in renewable energy, flexible capacity and the transmission network to support them,” the ESB says. “Our best strategy to manage the risk of the transition is to build replacement assets quickly, while still maintaining discipline over costs, in advance of thermal generation retirements.

“This will reduce our exposure to the shocks of international gas and coal price movements, reduce our reliance on ageing assets and allow consumers to benefit from strongly connected, geographically diverse renewable energy resources.”

The ESB report was released alongside the Australian Energy Regulator’s (AER) State of the Energy Market 2022 report which also identifies energy affordability as a major challenge in Australia’s transitioning energy market, while highlighting the increasing role rooftop and utility scale solar PV are playing in the NEM.

AER chair Clare Savage said wholesale prices were relatively low at the start of 2021, but a perfect storm of supply constraints, high international coal and gas prices, and increased demand caused costs to surge, resulting in record and persistent high prices and an unprecedented suspension of the entire wholesale electricity spot market in June 2022.

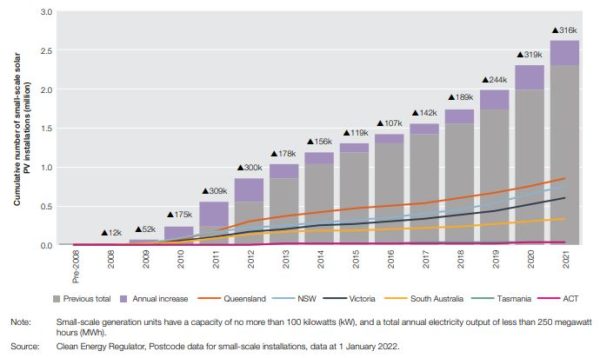

Source: CER

“We’ve seen record wholesale energy prices in July, but network costs are also likely to increase as inflation and rising cost of capital impact the cost of network investments that will be needed to support an orderly decarbonisation of the energy system,” she said.

“In these tough economic conditions, we are focused on using our regulatory levers to get the best possible outcomes for consumers to ensure the energy transition is delivered at least cost.”

The 225-page State of the Market report reveals the scope of the transformation that Australia’s energy markets are undergoing.

“The NEM is moving from a centralised system of large fossil fuel generation towards an array of smaller scale, widely dispersed wind and solar generators, hydroelectric generation, grid-scale batteries and demand response,” the AER says. “We have observed over the last 12 months that the transition continues to accelerate.”

As of 1 January 2022, rooftop systems in the NEM totalled more than 14 GW of capacity, making it second largest fuel type by capacity after black coal (~17GW). By mid-2022 this total had increased to more than 15 GW. About 30% of Australian houses have rooftop solar, a larger share than in any other country.

Output from rooftop solar across the NEM in the first six months of 2022 was 19% higher than the same period in 2021. Output in 2021 had already increased by 24% compared with the year prior.

Large-scale solar output also reached record levels with 18 solar farms, or almost 1.6 GW entering the market in 2021. In the last quarter of 2021, large-scale solar generation had the highest quarterly output on record – up a massive 41% from a year previous.

Image: Neoen

Battery energy storage has also ramped up, with four grid-scale batteries totalling over 500 MW entering the NEM in 2021. This took the total number of big batteries in the NEM to nine with a combined capacity of more than 800 MW. The AER said an additional 1,700 MW of battery capacity is committed to enter the NEM by 2025. Small-scale battery installations also increased in 2021, rising by 33% compared with 2020.

The AER said the rapid influx of grid and rooftop solar has changed the shape of wholesale electricity prices and demand for baseload generation during the day. These changing conditions, backed by the global investor and local push to decarbonise, are compromising the economic viability of the NEM’s 16 remaining coal-fired power stations with many of these power plants now slated to close earlier than previously announced.

While five coal-fired power plants, totalling approximately 8 GW of the current 23 GW of coal-fired capacity, has already been announced to withdraw by 2030, the Australian Energy Market Operator suggests this number will be closer to 14 GW. That is, it expects 60% of current coal-fired capacity will withdraw by 2030.

The reports came the same day as the country’s largest power producer AGL Energy announced it was bringing forward the closure of its coal-fired generation by 10 years to 2035 and would invest $20 billion in renewable energy to help replace that capacity.

Earlier this week, the Queensland government said it would shut all its coal-fired plants by 2035 and invest $62 billion with the private sector on renewable energy.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.