Hard hats and high-vis vests were rolled out on Feb. 8, 2024, as government, utility, and developer luminaries observed the progress of the Collie Big Battery in Western Australia (WA). New state Energy Minister, Reece Whitby, was visiting one of his first major clean technology projects in the role.

With development approval for an eventual 1 GW/4 GWh scale, the battery will be very big. Phase one of the project, encompassing 219 MW/877 MWh, was approved for construction by the Australian Energy Market Operator (AEMO) on June 19, 2023, after securing a contract to provide 197 MW of capacity for four hours. France’s Neoen is developing the project, with Tesla supplying 224 of its Megapack 2XL batteries.

Stage one is set to be complete in the fourth quarter of 2024, “on track to support WA’s network ahead of the 2024-25 summer,” said Neoen, announcing the energy minister’s visit. February 2024 saw the state swelter through a heatwave, pushing the grid to its limits.

Heat is on

February 2024 was the hottest month on record in WA. On Feb. 19, the state was home to 15 of the hottest places on earth, with the mercury hitting 49.9 C in the coastal town of Carnarvon. The state capital, Perth, saw temperatures above 40 C for seven days in February 2024, at the time of going to press.

On Feb. 18, WA’s main grid achieved record electricity demand of 4,322 MW, at 5:55 pm on a Sunday. AEMO declared a grid “emergency operating state,” enabling the regulator to activate – in an “off market” move – up to 26 costly, polluting diesel generators.

The Collie Big Battery will likely plug some of that heatwave-driven shortfall during evenings as rooftop solar production wanes.

State-owned utility Synergy completed the 100 MW/200 MWh Kwinana Big Battery 1 in Perth in October 2023 and a 200 MW/800 MWh facility at the same site is due in 2025. China’s CATL supplied the batteries for both projects.

Good spots

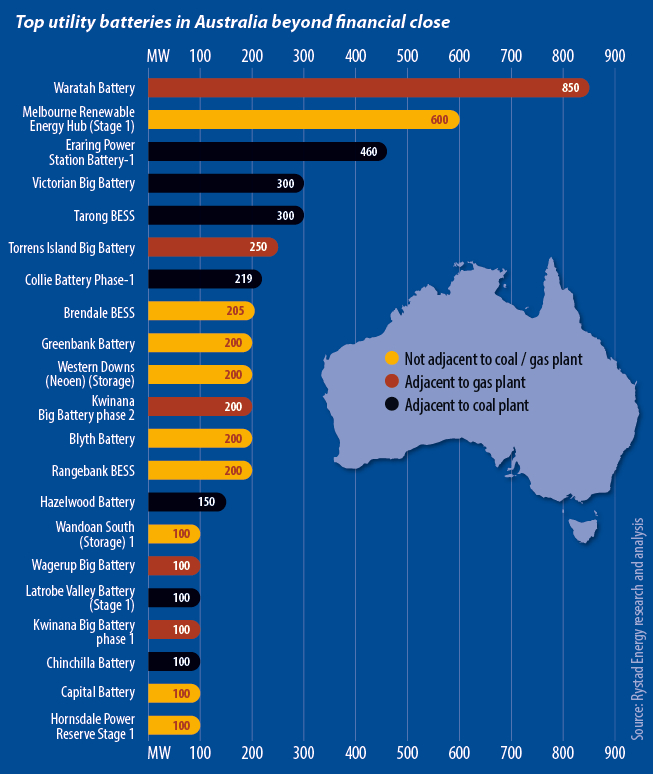

Kwinana and Collie both host coal-fired power plants so the batteries “already have good spots in the grid, which is a huge advantage in Australia,” said David Dixon, senior analyst at Rystad Energy.

Australia’s electricity generating and retailing “gentailer” utilities will seek to retire aging power plants, said Dixon, and could benefit from cheaper-than-gas-peaker batteries in the interim period. “It makes sense for these companies to be building [batteries] next to coal plants,” said Dixon. For gas, “the synergies are there to save on cost and it provides the dispatchable capacity that you are going to need.”

Batteries also generate revenue, via grid frequency regulation, state and federal capacity contracts and capital grants, and through arbitrage – storing renewable energy at surplus periods for sale during peak demand. AEMO has contracted with battery owners, including Neoen, under its System Integrity Protection scheme.

“They will set aside capacity at certain times of the year and this capacity will be made available to the system operator and will decongest the grid at certain occasions,” said Dixon.

Jobs for coal

On Feb. 19, Queensland (QLD) Premier Steven Miles attended a ground-breaking ceremony at a 250 MW/500 MWh battery on the site of the former Swanbank B coal-fired power plant in the city of Ipswich. Swanbank closed in 2012. “Now we’re transforming it into a massive, publicly owned clean energy hub,” said Miles. The battery will be owned and operated by CleanCo, formed in December 2018 by the state government to develop and own renewables sites.

“Ipswich has a proud history generating electricity,” said Miles. “This huge, 250 MW battery … will create secure local jobs and put downward pressure on power prices.”

Collie has been a coal-mining town for more than 125 years. The roughly 1.2 GW of legacy coal-fired plants there will be shuttered by 2030. The state government says 150 jobs will be created during construction of phase one of the Collie Big Battery. Only a fraction will remain after construction, however, and Collie will be one of 2.5 GW of Australian renewables assets monitored remotely by Neoen’s Operational Control Centre in Canberra.

“Coal use has been in decline in WA since 2015,” said Ray Wills, managing director of consultancy Future Smart Strategies. “Renewables combined have passed coal generation in the past two years and if we extend what the growth looks like, we get to about 90% green energy in the state by 2030.”

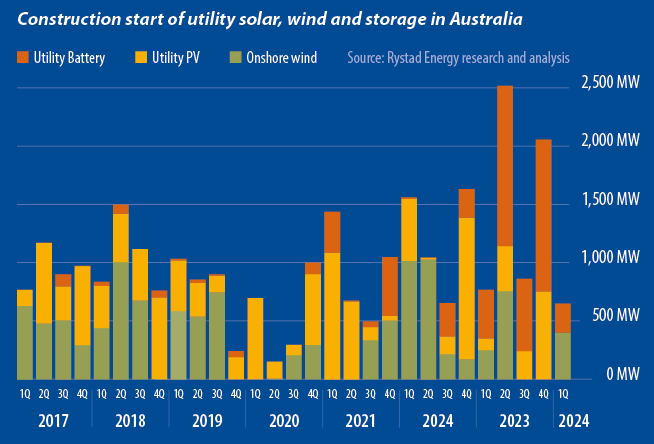

Rystad Energy data reveal that roughly 5 GW of large scale batteries will be added to Australia’s grids in the next 12-18 months. They will play an important role in meeting peak demand and bolstering the country’s electricity network. The opportunity to locate such batteries alongside retiring coal and existing gas generators is a good one but energy storage roles won’t replace the jobs lost from the coal mines and other legacy generators – despite the messaging of Labor state governments. “Any opportunity for a politician to be positive or negative to suit their agenda is going to happen,” said Dixon.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.