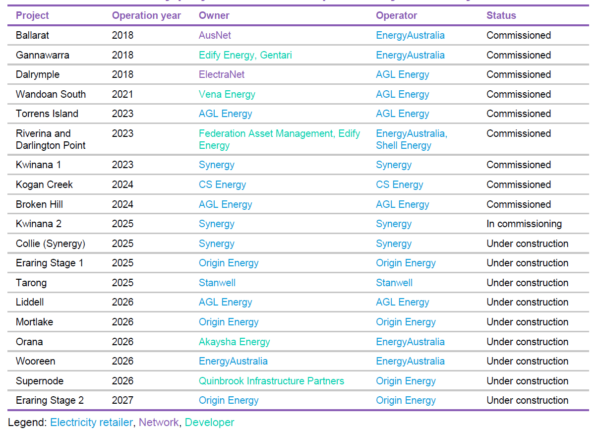

A new trend toward ownership of big battery developments by utilities and owners of coal plants is gaining momentum as return on investment and market revenue potential improves, according to a new report published by research provider Bloomberg New Energy Finance (BNEF).

The report says the appetite for big batteries coincides with the drive to replace coal and gas assets in portfolios in the wake of large-scale, long duration battery competitative advantages.

Image: BloombergNEF

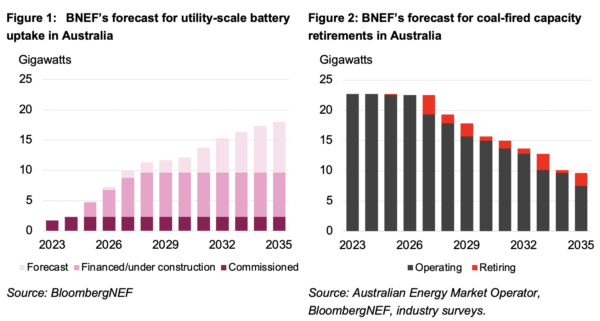

Further boosted by the Capacity Investment Scheme (CIS) and state and territory tenders, the BNEF’s 2025 Australia Energy Storage Update report forecasts the adoption of utility-scale batteries in Australia will expand fourfold in the next three years and could expand eightfold to 18 GW in 2035, up from 2.3 GW in 2024.

According to sources at the time of the research, the estimated capacity of utility-scale batteries under construction at the end of 2024 was 7.3 GW, and the report concludes big batteries will be crucial in facilitating an orderly transition from coal toward cleaner alternatives.

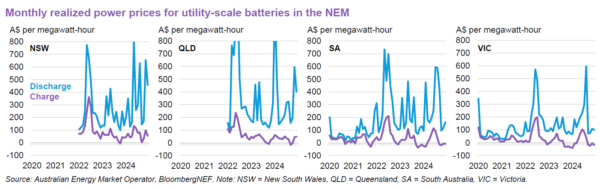

Solar and wind assets exacerbating intraday volatility is a lucrative opportunity for batteries to arbitrage wholesale spot prices – charging when prices are low and discharging when prices rise – and put pressure on the aging coal fleet, which can’t compete with lower-cost renewables, the report says.

Figures from the Australian Energy Market Operator (AEMO) show the year-on-year (Y0Y) increase in net arbitrage renvue earned by utility-scale batteries in the national electricity market (NEM) is 225%, and the YoY increase in average intraday arbitrage in the NEM in 2024 was 41%.

Utility-scale batteries in the NEM earned $165.4 million (USD 104 million) in revenue from arbitrage in 2024 – a record high, and more than triple the revenue earned in 2023.

The report also says across 2024, average intraday arbitrage ranged from $88.04 / MWh in Tasmania to $538.88 / MWh in Queensland, up from 2023 figures which ranged from $41.80 / MWh in Tasmania to $373.28 / MWh in Queensland.

The uptake of rooftop solar is also having the greatest impact on negative power prices in the NEM – when prices can fall below $0 / MWh – with a record high occurring in South Australia during the fourth quarter of 2024, when 37% of all power prices were in the negative.

Image: BloombergNEF

BNEF Australia Senior Associate and Report Author Sahaj Sood said the pending federal election is unlikely to slow the major role of large-scale batteries in Australia’s power markets.

“The election is set to be a referendum on Australia’s pathway to a low-carbon power sector. A win for the incumbent Labor Party would see continued support for renewables, and the batteries to integrate them,” Sood said.

“A win for the Coalition would see the emphasis shift toward nuclear, a potential lifeline for some of the country’s aging coal fleet. Either way, batteries will be required to balance Australia’s volatile power markets by shifting power from times of low demand and high supply to times of high demand and low supply.”

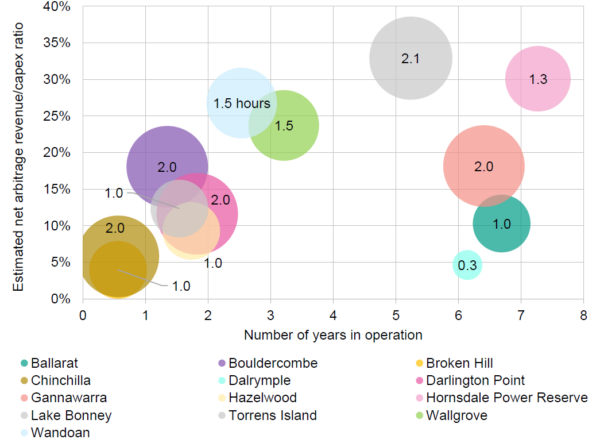

Newer, longer-duration batteries

Newer, longer duration batteries compared to frequency control ancilliary services (FCAS) in the past few years have demonstrated arbitrage has been more financially significant, where batteries with longer durations are earning more arbitrage revenue as a percentage of their capex than older shorter duration batteries.

It gives the example of the two-hour Lake Bonney battery, which has already earned 33% of its capex in arbitrage revenue, a higher ratio than the 16-minute Dalrymple, one-hour Ballarat, and 1.3 hour Hornsdale power reserve batteries.

Newer batteries like the 1.5 hour Wondoan and Wallgrove projects have both earned 20% of their initial capex in net arbitrage revenue, surpassing the ratios earned by Ballarat and Dalrymple, which have operated longer.

Image: Australian Energy Market Operator

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.