This scenario highlights the potential for repurposing EV batteries for second-life stationary applications, which could maximise their value before recycling. However, to fully realise this opportunity, several economic, technical, and regulatory challenges must be addressed and resolved.

The large majority of lithium-ion (Li-ion) battery production is dedicated to powering electric vehicles, and these batteries will become available for stationary applications typically 5-8 years later. In 2023, electric vehicles accounted for 80% of Li-ion battery demand. Lithium-ion battery costs and prices have been declining rapidly, mirroring the price reductions seen in solar photovoltaics.

Li-ion batteries have become dominant in both electric vehicle and energy storage applications, and the significant cost decreases they have experienced recently are due to advancements in technology, economies of scale in manufacturing, and shifts in battery chemistries.

As the fast uptake of rooftop PV continues, solar has already overtaken nuclear, large-hydro, coal and natural gas, and will become the largest contributor to the world’s energy mix by the turn of the decade. Increased penetration of PV systems in both transmission and distribution networks can greatly benefit from the balancing capabilities that batteries can provide.

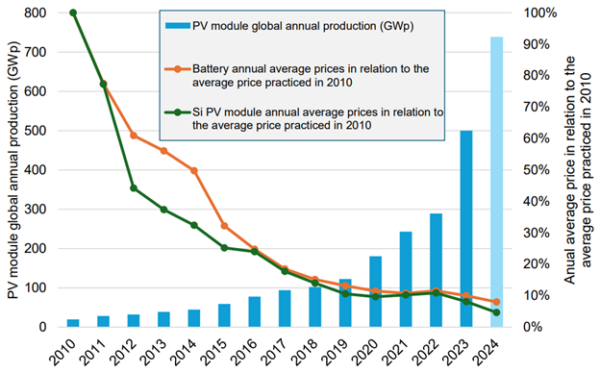

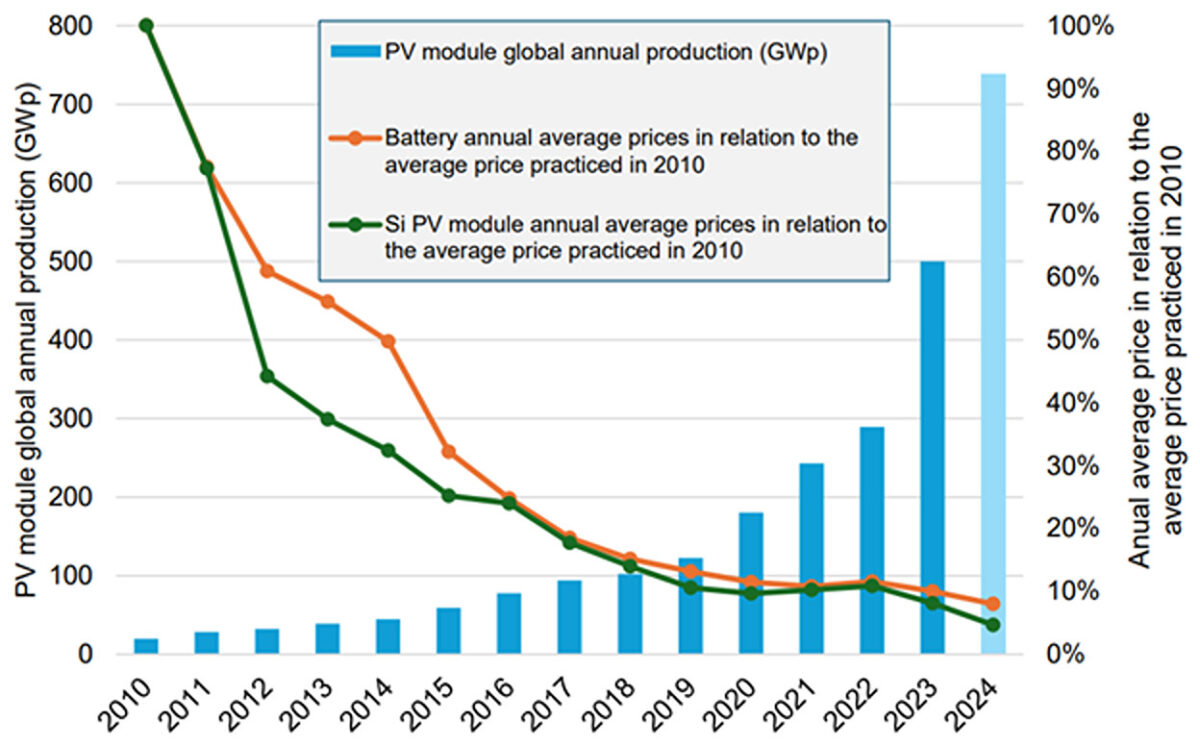

Due to the intermittent nature of the solar resource, short-term electricity storage using Li-ion batteries will become essential. As the figure below shows, the cost-reduction curves of both silicon PV modules and Li-ion batteries are similar. In large-scale PV and wind generation, curtailment has become common, and together with overbuilding PV and pumped hydro energy storage, large-scale battery energy storage systems (BESS) are being widely deployed everywhere.

Second-life Li-ion batteries and the EU Battery Passport

A battery that has been retired from its original application, such as in EVs, but still retains enough capacity and functionality, can be repurposed for stationary energy storage applications. Key drivers of second-life battery markets include policies promoting sustainable energy storage and circular economies; collaboration between automakers, battery manufacturers and energy companies; and advancements in battery diagnostics and refurbishing technologies.

Advanced battery grading technologies are being developed by several start-ups. These technologies could be in-vehicle end-of-life battery testing to determine battery state-of-health (SOH) in the order of minutes rather than hours as per typical cycling techniques, reducing testing time and therefore cost.

The EU Battery Passport is a digital record that tracks the entire lifecycle of a battery, from raw materials to disposal and recycling. It is a key component of the EU’s Battery Regulation, aiming to increase transparency and sustainability in the battery value chain. This digital passport will be accessible and mandatory for specific battery types starting 2027. Industrial batteries (over 2 kWh), electric vehicle batteries, and light means of transport (LMT) batteries (like e-bikes) will require a Battery Passport starting February 2027. Consumers and other stakeholders will be able to access the Battery Passport information through a QR code printed on the battery or its packaging.

The EU hopes that the Battery Passport will help to promote the use of sustainable materials in battery production, encourage responsible recycling and end-of-life management, increase consumer awareness and trust in battery products, and facilitate the development of a circular economy for batteries. The EU Battery Regulation entered into force on August 8, 2023.

To facilitate the dismantling of batteries and to support repairers, remanufacturers, second-life operators and recyclers in their operations, the battery passports will also contain more detailed data on battery composition, dismantling (such as the tools required for disassembly) and safety measures. This includes values for performance and durability parameters, SOH, battery status (e.g. ‘original’, ‘reused’, ‘waste’), and information related to the battery use (e.g. number of charging and discharging cycles, accidents that the battery may have been subject to).

Many players in the battery industry see benefits in focusing on repurposing battery packs, rather than performing disassembly and repurposing battery modules, because labor and cost for disassembly are substantial. A California startup has announced the commissioning of the world’s largest second-life, grid-connected battery energy storage installation. The 53 MWh storage project, made up of retooled EV batteries, has been operating commercially, storing and dispatching power to the grid, since May 2024. The project enabled the reuse of 900 EV batteries to make up the BESS.

Asian and European companies have developed the infrastructure, financing, and expertise to handle large volumes of retired batteries across various chemistries and form factors. Despite the example above, the US market remains fragmented and immature. A significant challenge is the disconnect between first-life battery owners and second-life buyers. First-life owners often expect to recoup 50% or more of the original value of their batteries. However, second-life companies typically aim to pay only 10 to 20% of the original price to remain viable. This disparity, coupled with the rapid obsolescence of older battery technologies, creates a mismatch of expectations. Many surplus and lightly used EV batteries are sent straight to recycling — despite being viable for second-life use. This is due to warranty gaps, testing costs, and the falling price of new batteries.

Second-life batteries provide a bridge between recycling and disposal, enabling a circular economy in energy storage, but they might only be viable if assisted by appropriate policies that penalise direct disposal or recycling of batteries that are still too good to be disposed of. A greater emphasis should be made on incentivising players to repurpose instead of prematurely recycling these batteries. Regulations and policies for second-life batteries, covering topics such as the EU Battery Passport, provision of end-of-life (EOL) battery data across stakeholders, extended producer responsibility (EPR), and other policies can make the difference.

Authors: Prof. Ricardo Rüther (UFSC), rruther@gmail.com; Prof. Andrew Blakers (ANU), Andrew.blakers@anu.edu.au

ISES, the International Solar Energy Society is a UN-accredited membership NGO founded in 1954 working towards a world with 100% renewable energy for all, used efficiently and wisely.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.