As manufacturing processes mature and costs decline, xBC is emerging as one of the most promising technologies for industrialisation, following tunnel oxide passivated contact (TOPCon) and heterojunction (HJT) technology.

xBC has demonstrated notable advantages over other silicon PV technologies. Its structure eliminates front-side gridline shading, increasing the active cell area and resulting in significantly higher conversion efficiency. The technology can also be combined with mainstream cell technologies such as TOPCon and HJT, giving rise to various high-efficiency back-contact architectures, such as TBC, HBC and HTBC. Mainstream TBC cells have already surpassed 26% efficiency, outperforming TOPCon and HJT.

With no gridlines on the front side, xBC modules are strongly favored by end-users that prioritise both appearance and performance. They are particularly well-suited to high-end distributed applications such as premium residential and commercial rooftop installations.

Development status

Longi and Aiko are the leading players in the xBC space. Longi’s TBC cell production capacity is expected to reach 50 GW this year. Aiko’s TBC cell capacity reached around 20 GW last year and is expected to increase to 25 GW this year. A 6 GW project jointly developed by Longi and Yingfa is also scheduled to begin production in the second half of this year. Overall, total xBC production capacity is projected to exceed 80 GW by the end of 2025.

Though xBC remains limited to a small number of manufacturers, the market has recognised its high-performance potential. Leading companies have established pilot or R&D lines and many have announced plans to expand xBC capacity.

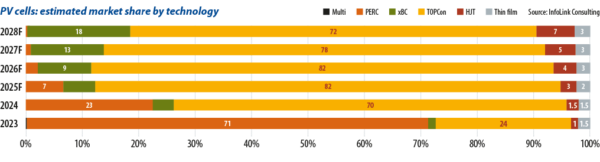

xBC module shipments grew from around 7 GW in 2023 to 23 GW in 2024, and are projected to rise further to

between 35 GW and 40 GW in 2025. Given the current industry-wide overcapacity and relatively high investment cost of xBC, along with the strong compatibility between TOPCon and xBC technologies, upgrading existing TOPCon capacity to xBC is expected to become a major driver of future xBC growth.

Competitively priced

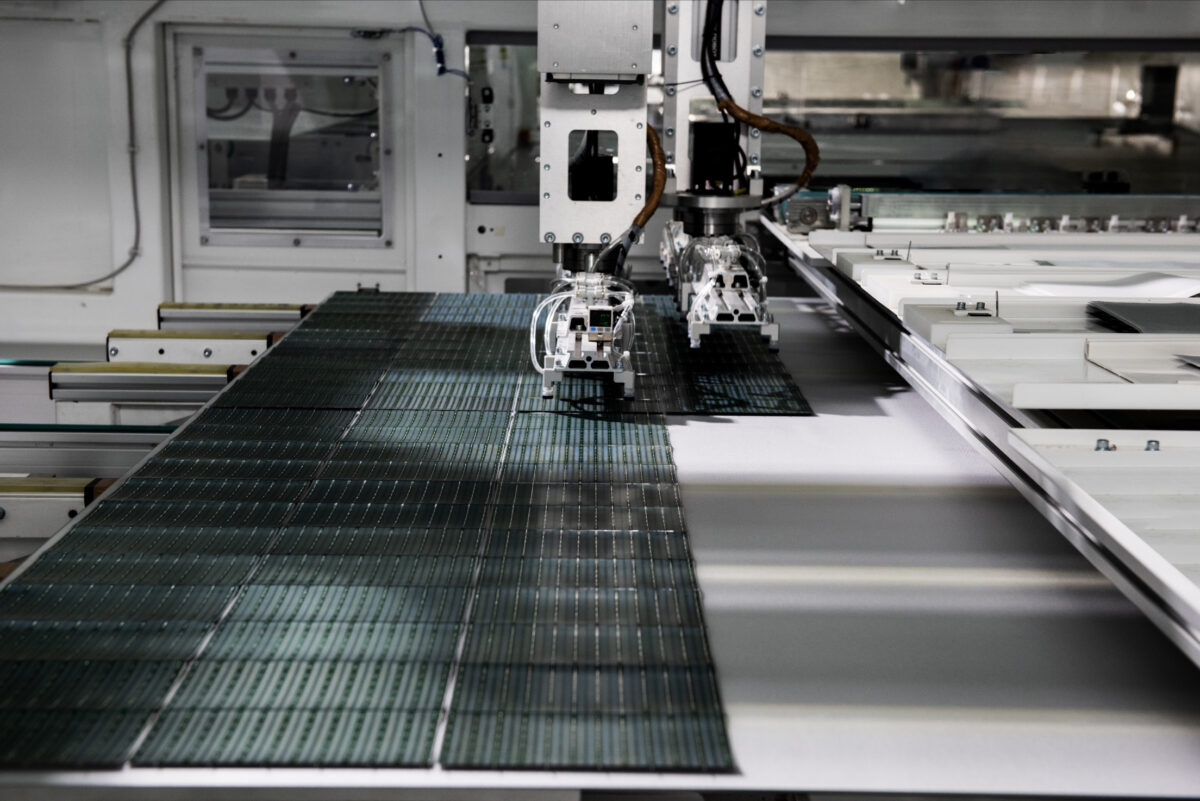

TBC has demonstrated a notable reduction in silver paste consumption as of the second quarter of 2025. This was achieved through the adoption of steel mesh screen printing. Enhancements in screen durability have further reduced metallisation costs, now on par with TOPCon. On the module side, the use of flat ribbons has enabled mass production of copper-aluminum composite ribbons.

Limited feasibility for these adaptations in TOPCon in the short term has significantly narrowed the cost gap between TBC and mainstream TOPCon. At the same time, many TBC production lines have not yet implemented these new processes, meaning that the cost of mainstream TBC solar cell production is still around CNY 0.07 ($0.01)/W higher than for TOPCon.

As xBC manufacturers adopt composite ribbons and steel mesh printing, along with more cost optimizations on the module side, the pre-tax cost (cell and module) for this lower-cost TBC will fall to just CNY 0.03/W higher than mainstream TOPCon. Given that TBC modules typically command a price premium of around CNY 0.05 to 0.07/W over TOPCon, the lower-cost TBC has shown stronger cost performance.

Market constraints

Technical complexity, high capital investment, and elevated production costs of xBC technology have resulted in slow capacity expansion. Despite recent cost reductions, the PV industry is still adapting to the transition from passivated emitter and rear cell (PERC) to TOPCon, in addition to overcapacity.

Whether through new installations or upgrades of existing TOPCon lines, xBC deployment requires substantial capital investment. An increasing number of companies plan to develop xBC capacity, but many are still taking a wait-and-see approach, suggesting that the primary obstacle to rapid xBC growth has shifted from high costs to the current PV market downturn. If the market recovers by 2027, xBC’s market share could exceed current projections. Nonetheless, even under the continued market slump xBC’s favorable cost effectiveness and high power output make its market share likely to reach about 20% by 2028.

Authors: Derek Zhao, head of solar PV research, InfoLink Consulting; Kyle Lin, research assistant, InfoLink Consulting

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.