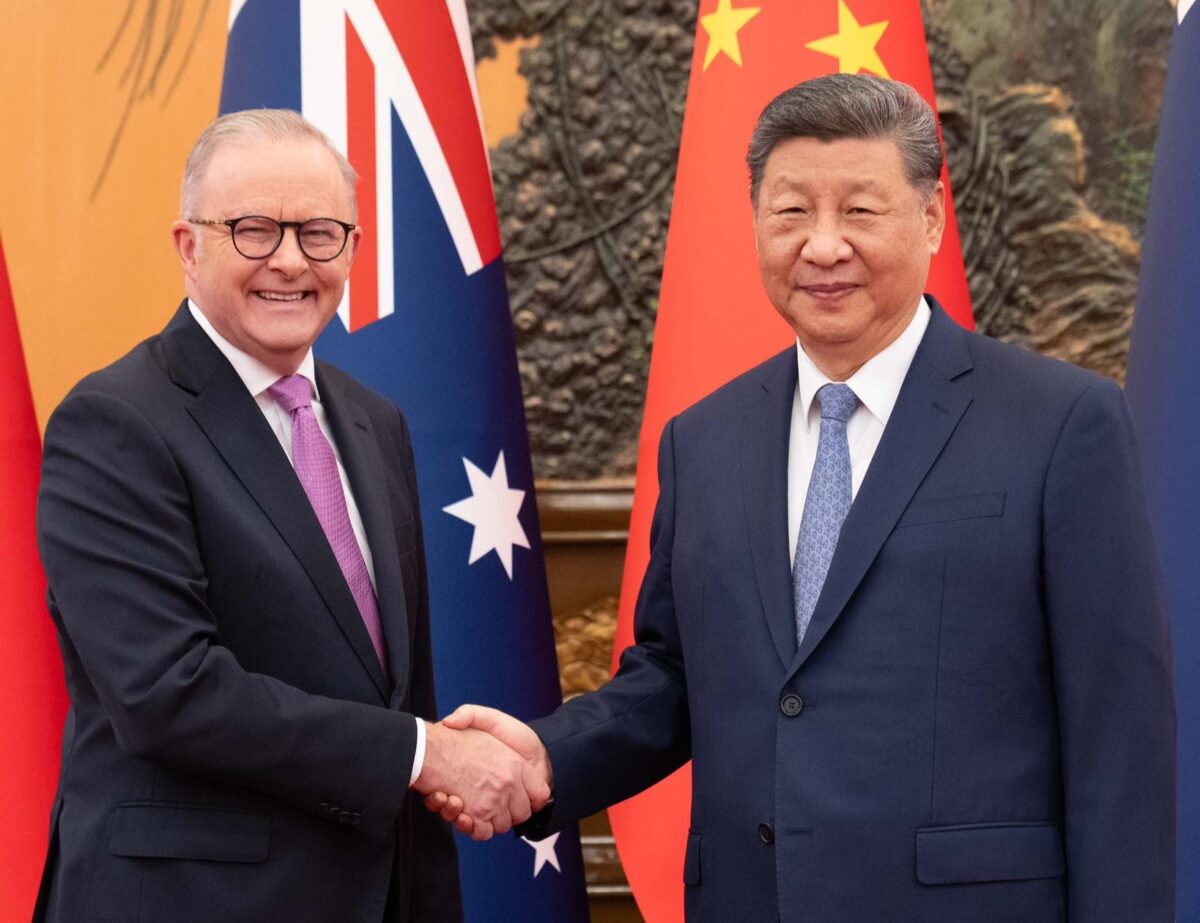

The PM’s Shanghai green steel roundtable with Chinese officials and Australian resources leaders including executives from BHP, Rio Tinto, Fortescue and Hancock was a potential watershed in China-Australia trade collaboration, and a welcome start to the monumental transformation of the steel industry that has real potential to position Australia as a leader in green iron. After the meeting the PM announced that a Policy Dialogue on Steel Decarbonisation had been established, which will “provide Australia with timely insights and input into the Chinese government’s planning on steel, including new opportunities for our domestic mining and steel industries.”

New opportunities are crucial. We can’t keep shipping rocks of unprocessed low-quality ore and hoping for the best. Value-adding our iron reserves onshore pre-export using renewable energy, and accelerating the renewables build out needed to do this, should be an urgent top-tier national priority – and partnership with China is key.

China leads globally in steel production, and the sector accounts for 15% of China’s emissions. Decarbonising the steel supply chain would permanently slash its emissions, supporting the climate goals of the world’s biggest emitter as it doubles down on its stunning acceleration towards transitioning its economy to clean energy.

Globally, steel production creates 7-9% of emissions. Outside of the electrification of transport and the decarbonisation of electricity, green iron and steel is the single largest opportunity to reduce global greenhouse gases as climate change escalates.

As number one in ore and steel respectively, Australia and China are uniquely placed to jointly play the pivotal role in this era-defining industrial transformation.

Economically, repositioning Australia as a global leader in green iron exports has the potential to double the value of our iron exports to greater than $250 billion per annum, and is key to securing our future prosperity. Failure to pivot to green iron, on the other hand, risks halving Australia’s export revenues, as China, which takes an 86% share of Australian iron ore exports, looks to other nations to decarbonise and restructure its iron and steel supply chains.

As detailed in Clean Energy Finance’s recent report, Green Metal Statecraft: Forging Australia’s Green Iron Industry, if Australia does not act now and grasp this opportunity at speed, China will pivot to partner economies such as Guinea, West Africa, which offer a pathway to accelerate the decarbonisation of steel with their higher quality, lower-impurity iron ore resources – resources that allow for more efficient and cleaner steelmaking – and to countries with supportive government policy frameworks.

China has already moved to reduce its dependence on Australian iron ore via a joint venture in Guinea to unlock a vast new high-grade deposit. In the context of these shifting trade dynamics, failure to position Australia now in the green steel supply chain with China is an opportunity cost that threatens to blow a +$50bn annual hole in Australian exports.

In the face of these enormous opportunities and risks, it was highly significant this week to hear the PM and Australian iron ore business leaders reaffirm their commitment to working in partnership with China to jointly drive steel sector decarbonisation.

Equally heartening was the PM’s confirmation of the government’s intention to invest in joint R&D and make equity and other investments via nation-building vehicles such as National Reconstruction Fund to strategically accelerate our green iron industry in the national interest, providing the state support and policy certainty that iron ore majors needs to further invest their private capital into the transition. The $1 billion Green Iron Investment Fund announced by the Albanese government in February to boost clean energy, green iron manufacturing and supply chains is exemplary of this, but we now need to double down.

While, for example, iron ore major Fortescue is making strides in the transition to clean energy needed to decarbonise the industry, it can’t do it alone. Australia needs to scale public-private collaboration and strategic public interest investment of the sort the PM flagged this week, in partnership with our key north Asian customers – preeminently China – to forge leadership in the green iron sector, helping our partners decarbonise and slashing emissions as the climate crisis escalates.

Capitalising on the momentum this week, next on the table should be a China-Australia bilateral agreement on green iron and steel, as Fortescue CEO Andrew Forrest proposed, to consolidate the progress made in these talks into actionable form.

This would be a game-changing step forward in bringing Australia’s top investment, employment and export opportunity to fruition, and not a moment too soon.

Authors: Tim Buckley, Director of think tank Climate Energy Finance (CEF), former MD of global investment bank Citigroup; Dr AM Jonson, Editorial Director, CEF; Matt Pollard, net zero transformation analyst, CEF.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.