In the latest edition of its Transmission Annual Planning Report (TAPR), Transgrid says the New South Wales (NSW) energy transition is entering an “intense phase” that will see a mass buildout of renewable generation and connecting transmission.

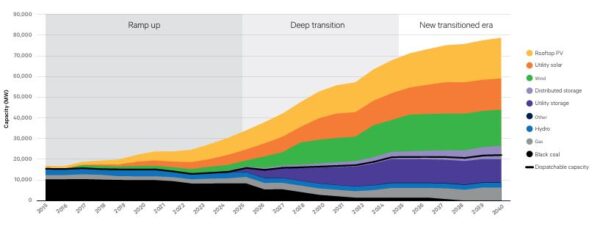

Transgrid Chief Executive Officer Brett Redman said after ramping up over the past two decades, the pace of the energy transition is set to accelerate over the next 10 years with almost all remaining coal-fired generation in NSW scheduled to close by 2025.

“We are now entering the new, highly dynamic phase of ‘deep transition’ in which the grid will undergo dramatic change, with the rapid closure of coal generators and accelerated buildout of renewable generation, storage and transmission,” he said.

“During this time, we forecast NSW transitioning from the current threshold of about 40% renewable energy, to around 90% in 2035.”

Transgrid, which operates and manages the high-voltage electricity transmission network in NSW and the Australian Capital Territory, says NSW now has 8 GW of operational utility-scale solar and wind generation, another 8 GW of rooftop solar, and 1 GW of utility-scale battery storage.

By 2035, it expects NSW will require more than 23 GW of additional large-scale solar and wind capacity, enabled by a stronger transmission backbone and 10 GW of utility-scale energy storage.

It also expects consumers to add another 8 GW of rooftop solar and 3 GW of household batteries.

Image: Transgrid

Redman said navigating this phase presents complex challenges to minimise cost and maximise system security and success will require collaboration with all participants in energy sectors.

“It will take the aligned efforts of our entire sector to accelerate progress and ensure renewable generation and security services are ready on time as coal retires so that energy consumers have ready access to more affordable energy,” he said.

The report predicts peak demand growing higher and minimum demand falling faster than previously projected, with the growth of data centres spiking industrial loads, while rooftop solar and electrification reshape how and when energy is used.

“By the early 2030s, the impressive rise of rooftop solar may see minimum demand from the grid hitting zero, a tipping point for how the grid is planned and operated,” Redman said.

At the same time, rapid growth of data centres, particularly in western Sydney, are causing “unprecedented” interest from plants wanting to connect into the network.

Transgrid said that at the end of June, more than 10 GW of data centre projects had lodged a connection enquiry and more than 4 GW were at the connection application phase. The company estimates electricity demand from data centres will increase to 6,723 GWh by 2035, up from 307 GWh forecast a year ago.

The uptake of electric vehicles (EVs) is also expected to have a marked effect on the network with Transgrid estimating 5,200 GWh of EV charging in NSW and ACT in 2035.

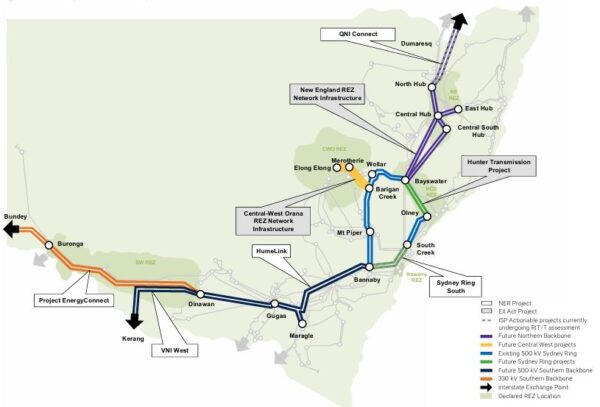

Image: Transgrid

The report details the new transmission projects that will make up the future grid and provides updates on Transgrid’s network augmentation projects and collaborative work on Renewable Energy Zone (REZ) connections with EnergyCo and local electricity networks. Critical transmission projects include EnergyConnect, HumeLink, VNI West, Hunter Transmission Project, Sydney Ring South and QNI Connect.

Transgrid said in addition to building new network infrastructure, investments are also needed to ensure sufficient security services as coal plants exit. These will include up to 10 large synchronous condensers and 5 GW of “grid-forming” batteries that provide voltage and frequency support.

The report also highlights record growth in generator connections over the past 12 months, with Transgrid saying it is now supporting more than 10 GW of new renewable energy and storage projects.

“We are processing more applications than ever before from new generators and energy storage facilities wanting to benefit from connecting directly to our transmission network,” Redman said.

“Since 2024, more than 6.6 GW has progressed through key project connection milestones. Connection interest from battery energy storage systems has surged, with more than 3 GW achieving or progressing towards commissioning.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.