Proof of C&I energy savings is in the PPA

New-generation energy retailer Flow Power will today release figures that show its high-use energy customers have collectively saved $14 million with power purchase agreements since the start of 2018. Such powerful testimony signals a new maturity in Australia’s renewable-energy PPA market.

Half of Australia’s solar and wind farms to trial providing their own short-term generation forecasts

Around $9.4 million has been allocated for 11 projects to trial short-term forecasting for large wind and solar farms under a funding initiative by the Australian Renewable Energy Agency (ARENA) in partnership with the Australian Energy Market Operator (AEMO). The trial aims to improve the accuracy of market outcomes.

Batteries stacking up in anticipation of Australia’s May election

Analysis released today by independent energy and consulting firm, Rystad Energy shows an incredible reserve of energy storage has been added to Australia’s ongoing boom in solar and wind projects during the first two months of 2019 — confidence, perhaps, that an energy-transition policy will finally triumph at the Federal polls!

Australia makes major contribution to global big PV uptake

The latest statistics highlights Australia’s contribution to the global utility-scale solar PV installation figures.

Hanwha Q-Cells sues Jinko, Longi for patent infringement in Australia

The Korean solar manufacturer has lodged a lawsuit with the Federal Court of Australia against Chinese panel makers Jinko and Longi following similar allegations in the U.S. and Germany.

Northern Territory councils in line for solar, battery grants under sustainability funding scheme

The Northern Territory has announced a one-off $2 million program energy efficiency and sustainability funding pool with grants now open to local government councils for a range of projects, including energy storage and renewable energy systems.

WA government launches energy transformation strategy, but denies support to stricter carbon emissions guidelines

In response to the energy sector’s transition from coal to renewables and distributed energy resources, Western Australia’s Labor government says it has started drafting a strategy to deliver a cleaner and more resilient energy supply for decades to come. Coming off the back of the strategy launch, WA’s environment watchdog has announced new and expanding mining and oil and gas projects would face much tougher scrutiny around their emissions. The WA government has moved to distance itself from the proposed emissions rules.

DC coupling for batteries on SMA inverters will let utility-scale solar farms play at night

In 2021, the settlement period for the supply of energy into the NEM will decrease from 30 minutes to five minutes, creating market conditions for batteries to start being deployed in the solar utility market. One of the world’s most respected inverter manufacturers is currently shipping central inverters that enable anytime integration of battery storage. Retrofits for already installed systems are on the next boat.

Australia’s political polar opposites on coal, solar, wind and climate

Australia’s two upcoming elections — in NSW this month and Federally in May — have brought to light the extreme contrasts that exist in Australian politics around the value of renewable energy, the indispensibility of coal to Australia’s economy and how the country might alleviate the high energy prices consumers are dealing with. Here are two recently presented views from each end of the political spectrum.

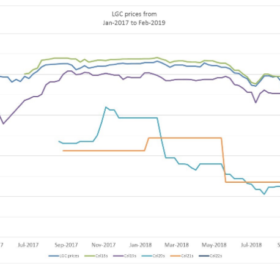

LGCs: To surrender or not to surrender, that is the question

17 liable entities have failed to meet more or equal to 10% of their renewable energy target obligations, including major electricity retailers – Alinta, Lumo Energy, Simply Energy and EnergyAustralia. This has pushed the surrender rate to a record shortfall of 13.9% of total liability. Tristan Edis, Director Analysis and Advisory at Green Energy Markets, explains why retailers decide to carry obligations forward, and how the precipitous fall in the LGC value reflects on customer electricity bills and merchant projects.