UQ takes ownership of 64 MW Warwick Solar Farm

The University of Queensland has completed the purchase of the $125 Warwick Solar Farm in the Southern Downs region, making it the largest solar asset in ownership of an Australian university. Lendlease will act as developer on the project.

SA virtual power plant moves forward with new retailer on board

The second phase of the proposed 250 MW virtual power plant will see Tesla Powerwall batteries and solar panels installed on 1,000 South Australian households.

Greenpeace Energy wants to buy Germany’s RWE coal business, and to replace it with 8.2 GW of renewables

Greenpeace operates a renewables-powered electricity retailer in Germany, in a Hamburg-based operation. It has proposed purchasing giant utility RWE’s coal power plants and replace them with 8.2 GW of wind and solar power plants. Approximately €7 billion will be invested in the new facilities, which could be built without subsidies – Greenpeace Energy claims.

Epuron refinances NT solar portfolio with Infradebt

Infradebt has provided a $22.2 million senior debt facility for Epuron’s portfolio of operating solar assets in the Northern Territory with the accumulated capacity of close to 7 MW.

Mali gold mine to slash power bill with 40 MW solar hybrid plant

Australian mining company Resolute Mining has inked a JDA and PPA with Ignite Energy, to construct what it says is the world’s largest off-grid solar hybrid plant, at one of its gold mines in Mali.

JinkoSolar posts significant shipment growth in Q3

The Chinese manufacturer saw its shipments increase 24.4% year-on-year, to around 3 GW of modules in the latest quarter, with overseas shipped products accounting for approximately 80% of sales. The outlook for full fiscal 2018 was maintained almost unchanged, while new positive changes from policy side in China are confirmed.

South Australia sets up $50 million Grid Scale Storage Fund

The South Australian state government has launched a $50 million fund to support construction of new energy storage projects, seeking to address intermittency in the state electricity system and make electricity more affordable and reliable. There will be one round of applications, with a closing date of Thursday, 7 February 2019.

CSIRO, Fortescue enter into hydrogen partnership

Iron ore giant Fortescue Metals Group will invest $20 million into hydrogen research at Australian national science agency CSIRO’s Brisbane laboratories. The partnership aims to develop new technologies, create jobs, and capitalise on the economic opportunities associated with hydrogen.

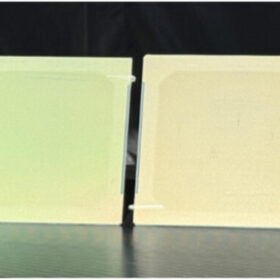

RCR Tomlinson enters administration

After it entered the second trading halt in a matter of months a week ago, Perth-based engineering company RCR Tomlinson has failed to secure additional funding and went into administration. Earlier this year, the company managed to raise $100 million in capital from its shareholders, after which it took huge write-downs on two Queensland solar farm.

Queensland kick-starts battery grant and loan scheme

Under the scheme, the state government will offer a combination of grants and interest-free loans for solar and battery storage systems to help 1500 Queensland households and small businesses save money off their energy bills.