Big battery market gets a leg up as rule maker proposes rewards for fast grid responses

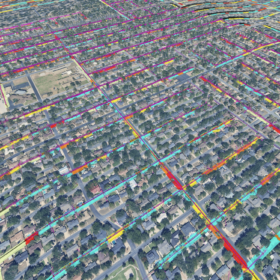

The Australian Energy Market Commission, the country’s rule maker for electricity and gas markets, has this morning released proposals to reward fast frequency services in the National Electricity Market for the first time.

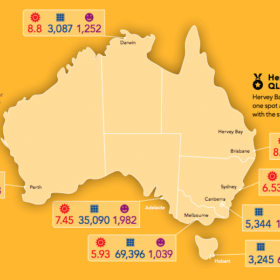

Spotlight on Australian solar – what’s working, why, and where there’s room to grow

Company Solahart, which originated in Perth, has delivered a heartening snapshot of solar Australia. It found the country deploys renewable energy 10 times faster per capita than the global average, four times faster per capita than in Europe, China, Japan or the U.S.A. Solahart examined what motivates different demographics of Australians to install solar and which parts of the country are most suited to solar.

Morrison continues to deflect net zero 2050 commitments despite growing international pressure

At an inner-city dinner party for the Australian Business Council, Prime Minister Scott Morrison said “we will not achieve net zero in the cafes, dinner parties and wine bars of our inner cities”; and he was right, because at this particular inner-city dinner party he continued to shy away from net zero 2050 commitments.

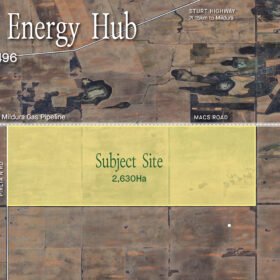

The manufacturing multiplier of BZE’s Renewable Energy Industrial Precincts

Business synergies, employment opportunities, leadership in decarbonising world markets. BZE has the ear of the Prime Minister, and research to inspire a statement of intent for renewable-energy-powered, competitive Australian manufacturing.

Saturday read: China’s push for decarbonisation

The carbon market is finally a reality in China. After 10 years of delays, regional pilot schemes and general uncertainty, China’s national carbon market became a reality on Feb. 1, 2021. Over time, the scheme is expected to support China’s gradual shift away from coal toward more solar and wind in power generation.

Facebook achieves net-zero emissions, looks to global value chain to follow suit

The social media giant met its 2018 goal at the end of 2020 and now aims to achieve net zero emissions for its entire value chain by 2030.

Battery storage systems 30% cheaper than rival gas peaker plants for firming renewables

The contest is over. Faster, cheaper, more flexible than gas turbines … battery energy storage must be the future peaking energy service provider of choice says the hard evidence exposed in a new paper by the Clean Energy Council.

Sunday read: Australia’s next wave of large-scale solar development

Call it “latent energy” – Australia’s renewable resources are expected to help some of the world’s greatest polluters to reach their net-zero emissions targets, writes Natalie Filatoff, senior editor at pv magazine Australia.

Tasmanian Labor installs solar at the top of its campaign promises

Tasmanian Labor believes Premier Peter Gutwein and his Liberal Party have dropped the ball on solar in a big way. Tasmanian Labor Leader Rebecca White is therefore promising $20 million to fund loans for residential and commercial solar and battery storage installations, as well as solar for state schools and social housing.

Facebook to buy power from offshore PV plant in Singapore

Facebook has revealed plans to buy electricity from a 5 MW floating solar array in the Straits of Johor. The project will sell power through a virtual power purchase agreement.