Major developments in Australia’s planned pipeline of green hydrogen projects coupled with some of the world’s most commercially viable energy storage facilities has caused Fitch Solutions to revise its expectations for Australia’s renewable energy transition. The market analysts now expect renewables to account for a considerably bigger share of the country’s energy generation, to the detriment of the thermal power sector.

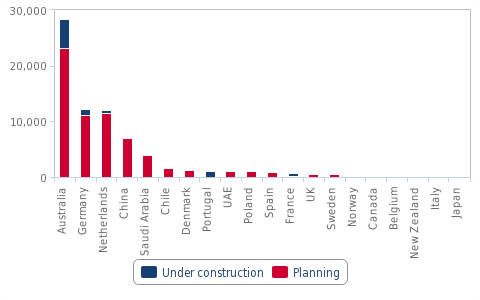

Hydrogen pipeline triple the size of closest competitor

Fitch Solutions

Australia’s green hydrogen project pipeline is nearing 30 GW, according to Fitch’s analysis. That is triple the size of the next biggest pipelines, which belong to Germany and the Netherlands at 10 GW.

“Australia currently leads the world with its robust green hydrogen pipeline, given strong policy support for the industry and significant investor interest. We believe that Australia has a high potential to scale up the development of green hydrogen and reach cost parity,” Fitch’s report reads.

“Significant growth in its renewables sector, whose prices have already fallen below that of fossil fuels, has made it a highly competitive and viable generation source in the market. This will have a mutually re-enhancing effect as it can also act as a form of energy storage for excess renewables generation, and become a capacity growth enabler.”

Fitch analysts share the renewable industry’s optimism about the prospect of Australia becoming a leading hydrogen exporter, noting this would unlock even more capacity for renewable sector growth.

Australian state governments, most notably the West Australian and Queensland governments, have both earmarked millions of dollars in funding to kick-start the green hydrogen industry. Industry has proven receptive, with a slate of project plans unveiled already this year.

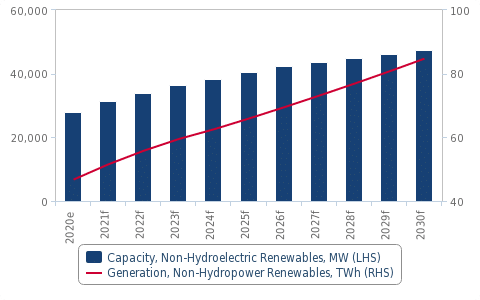

Fitch Solutions

Energy storage offsetting grid woes

Labelling Australia “one of the few in the world where large-scale battery storage facilities have already grown commercially viable,” Fitch says the country’s energy storage solutions have offered respite from bottle-necked grids.

“The [large-scale energy storage] sector has continued to develop rapidly with record-breaking capacity values,” it said.

Pointing to CEP Energy’s plan to build an 1200 MW grid-scale battery storage project in the Hunter Economic Zone by 2023, Fitch says the completion of such world leading facilities will “support its renewables growth momentum and replace retiring thermal power stations.”

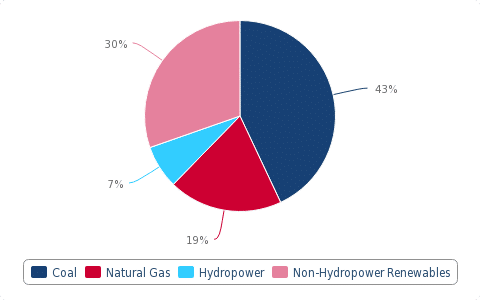

Fitch’s energy generation mix revised

Taking into account the “stronger-than-expected” growth in Australia’s pipeline of energy storage and hydrogen projects, market analyst said it had made “several revisions” to its forecasts.

“We now forecast non-hydro renewables capacity to increase by an annual average rate of 5.5% between 2021 and 2030, totalling 47.4 GW by the end of the decade. This will see its share in the overall power mix increase notably from an estimated 18.6% in 2020 to 30.1% by 2030, with significant further upside risks.”

Fitch Solutions

The forecast growth for renewables led Fitch to downgrade its expectations for the thermal power industry, noting the acceleration of green energy integration poses a “structural risk” to the incumbent system.

“In addition to the planned retirement of older coal plants, thermal plants, especially coal, are becoming increasingly uncompetitive with cheaper renewables. The integration of renewable energy into the grid has lowered wholesale electricity prices significantly in recent quarters, making it increasingly difficult for baseload coal-fired power plants to remain economically feasible.

“This will be exacerbated by increased difficulty to source the required quality of coal due to a decline in coal mining production, which could lead to higher prices over the longer term. We believe that there is a high risk of early plant closures that could reduce capacity further than our original expectations.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.