A tale of two causes: curtailment as renewable records break

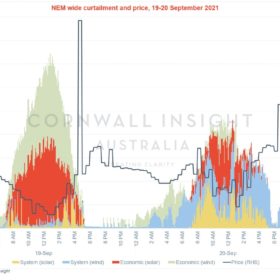

The past week saw more records broken in the National Electricity Market (NEM), with instantaneous renewable generation hitting a record 59.8% in the afternoon of Sunday 19 September 2021, before breaking 60% for the first time on Monday 20 September 2021. Sunny weather across both days meant rooftop solar made up around half of renewable generation at this peak output, reducing operational demand and suppressing prices during the day.

There’s no decarbonisation without data

WePower’s Kaspar Kaarlep offers a closer look at how we must use data to avert the worst of climate change.

Are solar and wind the cheapest forms of energy? And other FAQs about renewables

Everything you ever wanted to know about the way we will ultimately derive all our power from renewable sources, and how quickly it will be achieved.

A closer look at Australia’s ‘solar stopper’ market reforms

Australia is currently staring down a suite of reforms which could stifle our rapid and sensible transition to clean energy.

Hydrogen must take centre stage at COP26

Hydrogen is likely to play a crucial role in the pursuit of energy transition over the coming years. However, the UN Climate Change Conference of the Parties (COP26) in Glasgow in November will be the acid test that determines whether involved players are now prepared to put their words into action.

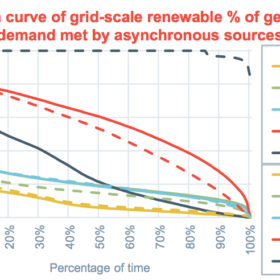

AEMO’s 2025 goal means that SA becomes the proving grounds

The latest news in the NEM is AEMO’s goal to be capable of handling periods of 100% instantaneous renewables penetration by 2025. This is a significant challenge and fitting given the pace the NEM is moving to

supporting increasingly higher levels of instantaneous (and increasingly asynchronous) renewables on a regular basis.

Chasing the sun — tax-free!

The Australian Energy Market Commission (AEMC) has made final a rule that will allow for solar export tariffs to be gradually introduced in the NEM jurisdictions (that is, everywhere except WA and the NT) under limited circumstances in four years’ time.

Half of my new sales are either replacements or additional systems

I had quite the epiphany in the winter of 2020. I began to realise that selling cheap solar systems isn’t actually a smart thing to do in the long run. I’d heard all the rumours from old heads of the industry, but went in a bit wet behind the ears with the old ‘it couldn’t happen to me’ mentality. But replacing solar panels that were only four years old made me wise-up very quickly.

Why insurers are adjusting underwriting criteria for renewable assets

It’s no secret that extreme weather events are increasing, both in terms of severity and frequency. Australia is no exception. Despite historically seeing a relatively low occurrence of natural catastrophes, over the past 24 months the country has experienced cyclones, bushfires, large hail storms and numerous flooding events. This includes the recent floods in March of this year, in which New South Wales and parts of Queensland saw the worst flooding the region has experienced for six decades. Recent estimates predict the flooding to have caused between AU$919 million and AU$1.055 billion* in insured losses.

Solar export charging: a solution or just added confusion?

My partner and I just bought our first home, and after years of renting, we’re excited to get the keys and finally have the chance to install solar. But the process of choosing a solar installer and appropriate system size, ensuring that our appliances are set up to utilise energy during the middle of the day, and picking the best deal from a retailer is daunting – even for someone like me who works in energy.