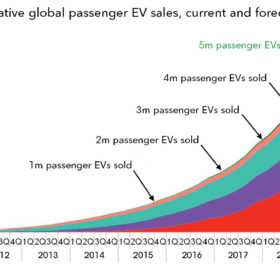

Global EV sales hit 4 million, soaring market sees next million in May 2019

While it took 60 months to reach the first million electric vehicle (EV) sales, in late 2015, it took the fourth million just six months. China is driving this development. Meanwhile, as first generation EVs batteries are reaching their end-of-life, interest in second-life use cases is growing. The volume of retired EV battery packs is set to be 108 GWh by 2029 – representing a third of the expected storage capacity market at that time.

Is China about to add 10 GW of unsubsidized solar?

Rumor has it industry lobbying has persuaded the government to agree to 300-500 MW of distributed PV in each of the populous nation’s 34 local government areas, with a reduction in “non-technical costs” making up for a lack of guaranteed payment.

PV Info Link: Mono-cSi cell price drops below multi

According to PV Info Link, the price for monocrystalline cells in China fell below that of the usually cheaper multicrystalline products. However analysts expect it to be a blip, with multi prices expected to fall and mono to be supported by the Top Runner Program, now China’s main source of demand for the rest of 2018.

Beijing about-turn influenced collapse of polysilicon deal

Shanghai Electric says the Chinese government’s abrupt decision to rein in solar was a significant factor in the collapse of its planned US$3.64 billion acquisition of a controlling stake in the world’s biggest poly maker.

Prices begin to stabilize, though falling revenues and job losses expected among Chinese manufacturers

According to reports from Energy Trend, a 30% decline in PV demand from China this year will likely spell trouble for some of the country’s major module manufacturers, with job losses and factory closures expected, despite China’s determination to open new international markets for its PV industry.

The figures for China’s booming PV industry will be seen with a tinge of regret

In what analysts worldwide are sure to look back on as the last golden period for global solar – at least for the immediate future – China saw more impressive figures for PV manufacturing in the first half of the year. Then the government stepped in.

The China effect: Decreasing PV utilization rates, serious oversupply and future strategies

Independent PV analyst, Corinne Lin discusses the fallout of China’s recent solar PV policy decision, including decreasing utilization rates and serious oversupply; and a focus on equipment upgrades, particularly for PERC, SE, half cut and bifiacial technologies. The industry will bounce back in 2019, she concludes.

Ambitious PV expansion plans for China’s Tongwei, Longi and Sunport still on track

Many expansion plans are still firmly afoot in the Chinese solar PV manufacturing industry, if the information pv magazine gathered from some of the country’s leading manufacturers at last week’s Smarter E event, are anything to go by. Indeed, Tongwei , Longi, Sunport and BYD are all progressing at full speed with their capacity ramp ups.

Suntech announces panel supply deal for Australia projects

Former manufacturing giant establishes a foothold in the promising Australian market, and says it is in talks with developer Biosar about supplying further modules for projects in the nation.

Global PV module prices collapse

The predicted fall in global PV module prices appears to have already begun, with PVInsights and EnergyTrend reporting average prices in the $0.27-$0.37/W range.