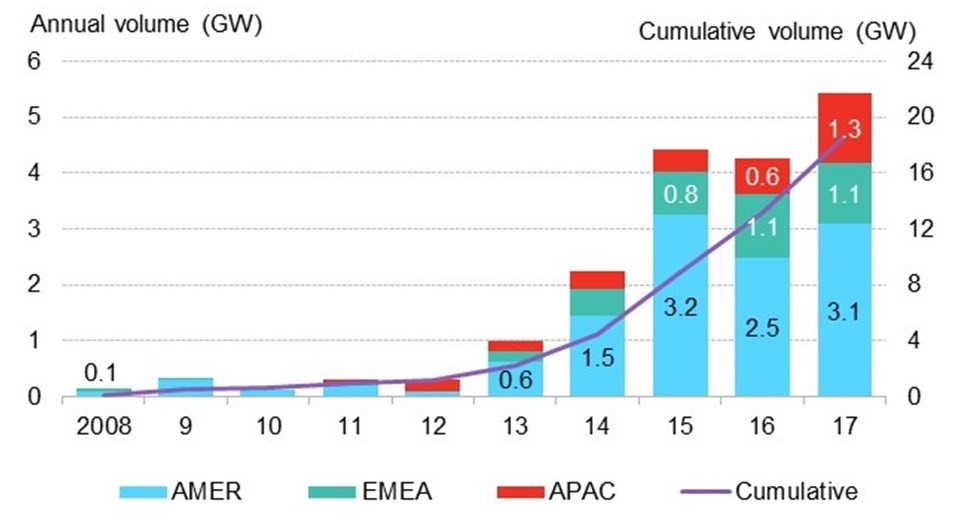

A total of 5.4 GW of PPAs between private companies and renewable energy power generation asset owners were signed last year, according to the report Corporate Energy Market Outlook from Bloomberg New Energy Finance (BNEF).

Last year’s result, BNEF stressed, surpassed that of record year 2015, in which private PPAs for renewables at global level reached 4.4 GW, and that of the previous year, in which a combined capacity of 4.3 GW was contracted.

Deals in 2017 relate to 43 corporations in 10 countries. Last year’s largest PPA market was the United States which grew by 19% year-on-year with around 2.8 GW of contracted capacity. In this market, however, the likely imposition of duties on Chinese solar imports is currently creating uncertainty, as developers “cannot accurately price PPAs with corporations and other offtakers in the meantime”.

While only in its early stages, there are signs that the Australian market is set to follow the lead in the U.S. High and rising power prices for large consumers, rising pressure for corporate consumers to take action on climate change, and falling renewable costs are all combining to make corporate PPAs attractive. In terms of solar PPAs, the growing pipeline of utility scale project right around the country is also likely to open up new opportunities for large offtakers to sign a PPA with solar project developers.

The second largest corporate PPA market in 2016 was Europe with over 1 GW signed, BNEF reports. Most of the contracted power in the Europe, however, came from wind power deals in in the Netherlands, Norway and Sweden. In those countries, policy mechanisms allow developers to secure subsidies, while also giving corporations the ability to receive certificates to meet sustainability targets.”

As for solar PPAs in Europe, which are not cited in BNEF report, pv magazine has reported private PPAs totalling around 60 MW of solar in central Italy, of three private PPAs in the UK, and of Spain’s and Portugal’s first private solar PPAs.

The signing of corporate solar PPAs in Australia is beginning to pick up, with the University of New South Wales’ deal to source 100% of its power from an offsite PV power plant, along with onsite rooftop solar, evidence of the trend. Schools, universities and government facilities are thought to represent the most promising solar PPA market in Australia at present, although large power consumers from other sectors are likely to follow suit.

“The growth in corporate procurement, despite political and economic barriers, demonstrates the importance of environmental, social and governance issues for companies,” said BNEF analyst Kyle Harrison.

Looking forward, BNEF expects the volume of contracted power in this segment to surpass 2017’s record level of activity. Especially Latin America and Asia are pointed out as markets that will be able to attract major activity in 2018 and the coming years, although these regions are currently known for their low level of development of the private PPA market. As for China and Japan, BNEF stressed that there are still too many regulatory barriers that are currently preventing this market to develop.

Edited and local content by Jonathan Gifford

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.