The last week has seen a narrative emerge, and take hold, that Australia’s installed solar PV capacity is set to double in 2018. The Guardian Australia appears to have the led the charge with the story last Sunday, and since it’s been picked up by Inhabit, Green Matters and Futurism, among others.

The Smart Energy Council was the latest to repeat the bold prediction, in its Friday Bulletin (February 16). “By year’s end the nation’s solar power capacity is set to almost double in size,” it enthuses.

Wonderful news indeed, or at least it would be, if it were true.

The Australian PV Institute (APVI), which has been tracking market development since April 2001, has the country’s installed capacity at roughly 7.04 GW by the end of 2017. For this to double in a single year would be pretty extraordinary.

The Smart Energy Council itself predicts that rooftop installations could total 1.4 GW in 2018, partly on the back of January installation figures 70% higher than the previous year. The figure aligns with market reports that demand from both the residential and C&I segments is approaching unprecedented levels.

Coupled with a booming utility scale segment, which the Smart Energy Council estimates will install some 2.5 GW in 2018, the result is around 60% expansion of PV installed capacity – close to 4 GW. A stellar result, but some 3 GW short of a doubling.

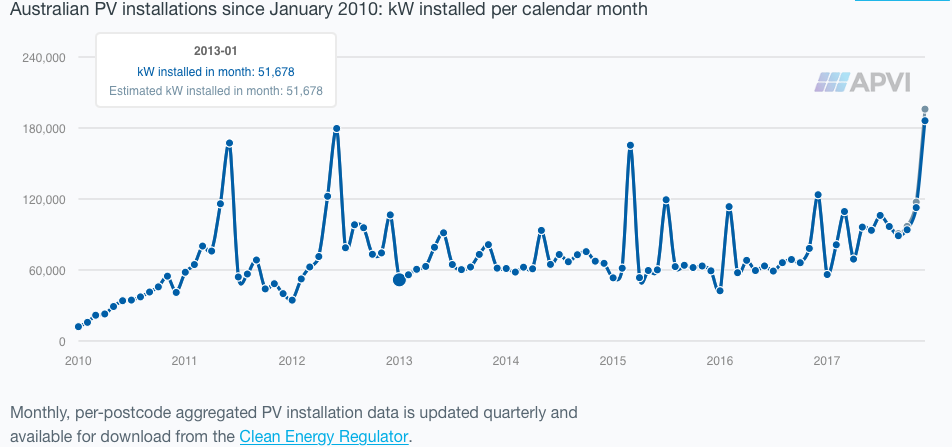

APVI figures have almost 200 MW being installed in December 2017. What is striking in APVI data is the upturn in installations. This could be a spike, as has clearly occurred in the past, or it could be an inflection point.

While spikes have plagued the Australian market in the past, the so-called ‘solar coaster’, the fundamentals appear better this time around – as noted by the Smart Energy Council. This is particularly true of the rooftop segment, where previous spikes were fuelled by changes in state-based feed-in tariffs, while in 2018 it is economics and consumer interest.

The build out of the utility scale segment is partly policy driven – at present underpinned by Renewable Energy Target obligations and LGC prices. With these obligations quickly being met by both large scale solar and wind development, the market could drop off. However, any decline will certainly not occur in 2018 and, even then, there are signs from developers that there is confidence that projects can be built beyond the RET, particularly if the large-scale pipeline taking shape in NSW is any indication.

In its report of doubling PV capacity, The Guardian Australia quotes the Smart Energy Council’s John Grimes as saying: “These solar farms can be built within a matter of weeks. They’re really quick and simple.”

In many ways this is true, and the history of the solar industry has been defined by markets that went through periods of very rapid installation growth – Spain, Italy, Germany, Japan and now China – the latter hitting 50 GW in annual installations from megawatts only a few years earlier.

What is potentially dangerous is overhyping and rushed expansion. Extremely fast project development and installation can cause substandard planning, procurement, design and installation practices.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.