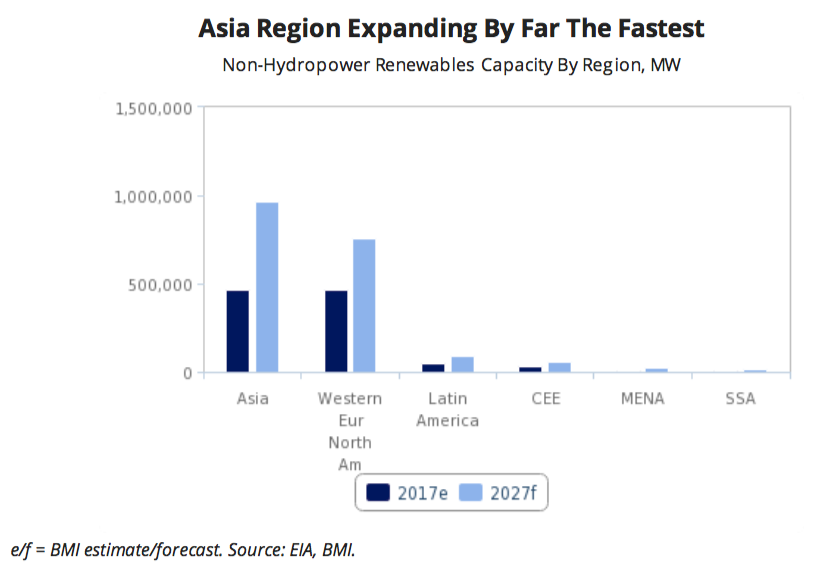

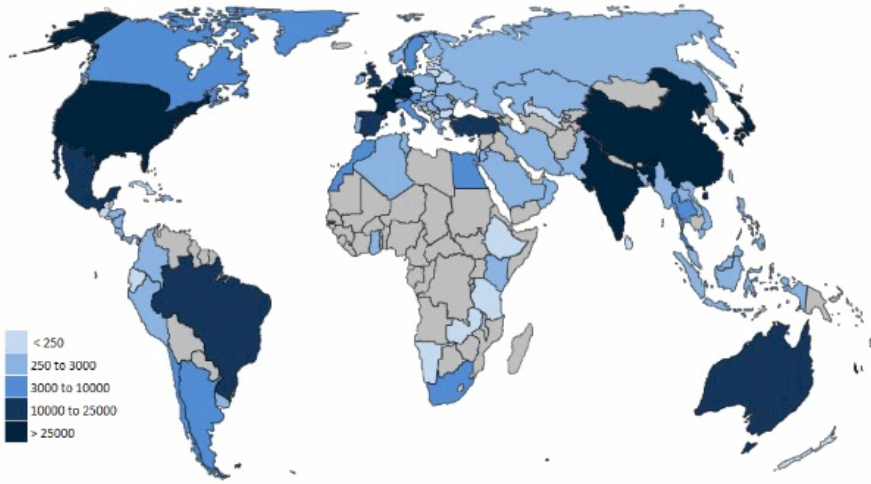

Global non-hydro renewable generating capacity is set to increase from 1,000 GW today to over 1,900 GW by 2027, according to the latest forecast from BMI Research. Solar will slip past wind over that period, with PV accounting for 46% of new capacity, compared to 45% for wind.

The Asia-Pacific region is set to become firmly entrenched as the leading renewables region in the coming next decade, installing some 500 GW of non-hydro renewables. This more than doubles both North America and Europe, which are expected to install a combined 290 GW.

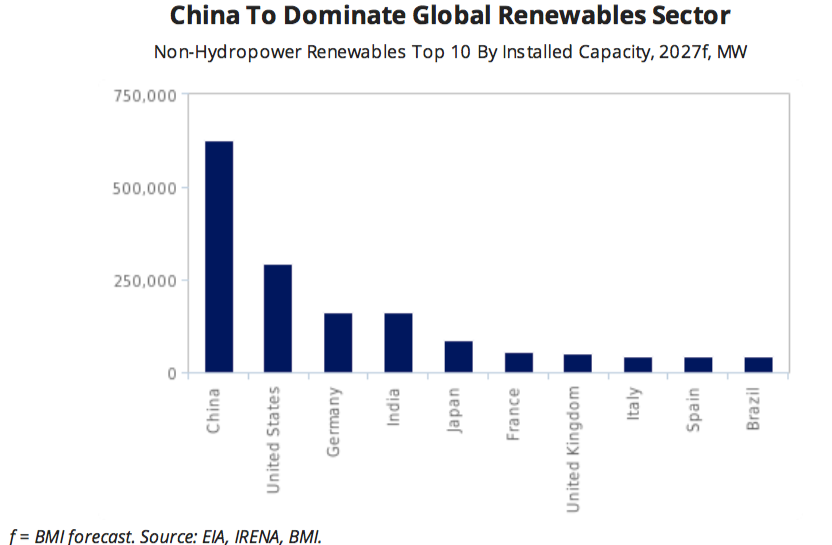

Within APAC, China and India are set to continue being the demand drivers adding 430 MW of, primarily, new wind and solar through 2027. BMI notes that renewables in China will, “maintain its role of elevated importance in Chinese power mix diversification efforts” – as the country continues to expand and enhance its electricity grid.

Within APAC, China and India are set to continue being the demand drivers adding 430 MW of, primarily, new wind and solar through 2027. BMI notes that renewables in China will, “maintain its role of elevated importance in Chinese power mix diversification efforts” – as the country continues to expand and enhance its electricity grid.

India is forecast by BMI to add some 164 GW of non-hydro capacity over the decade, an increase of 165% on current installed capacity of 62 GW. BMI notes that a range of policy support structures have been implemented by India to enable renewable deployment as the country attempts to “reverse deteriorating air quality”, the result of a reliance coal-fired generation. India’s renewable support structures are anticipated to remain in place over the forecast period.

By contrast, growth of European and North American renewable deployment is expected to slow – also as a result of policy measures. Capacity-based renewable procurement and trade tariffs are cited by BMI as the driver of the slowing growth in both regions, respectively.

The shift of renewable energy subsidy programs from feed-in tariffs to competitive auctions is the primary factor behind slowing renewable deployment in Europe. The BMI analysis sees the shift to auctions as being a mechanism by which deployment can be controlled by governments, after generous FITs resulted in an increase of the “subsidy cost burden” on consumers in countries including Spain, Italy, Germany, Denmark and the UK.

Solar is expected to be the driver of renewable deployment in the U.S. over the next decade, accounting for some 90 GW of the 140 GW of capacity added. As such, renewable deployment in the U.S. has been revised down by BMI through 2027 as a result of solar tariffs introduced by the Trump Administration.

Solar is expected to be the driver of renewable deployment in the U.S. over the next decade, accounting for some 90 GW of the 140 GW of capacity added. As such, renewable deployment in the U.S. has been revised down by BMI through 2027 as a result of solar tariffs introduced by the Trump Administration.

“The introduction of tariffs on solar components heightens the risk that the cost of project development will increase, threatening the economic feasibility of several projects in the pipeline,” write the BMI authors.

Despite the almost doubling of non-hydro capacity between 2017 and 2027, the Global Renewables Forecast sees electricity generation from renewables growing only from 9% today, to 12%.

“The near doubling of renewables capacity will have a limited impact on global power generation, as hydropower, natural gas and coal-fired power continue to expand their power output,” the report finds.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

5 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.