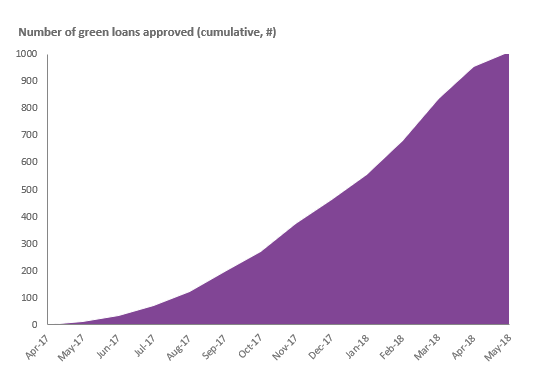

With 1000 green energy installation projects having been approved to date, an 18-month extension period has been announced by RateSetter and the CEFC for their green loan marketplace. The platform was launched in 2017, and brings together clean energy borrowers and investors together on the pioneering peer-to-peer lending platform.

It was brought to life with $20 million seed funding provided by the CEFC. As a service, it offers affordable finance to home owners in Australia and business that wish to invest in solar PV products. In its first year, it was reported that over 1000 households and small business decided to fund their renewables through RateSetter.

The main solar products installations financed through the RateSetter service have been solar modules, battery systems, energy efficient lighting, and energy efficient heating and cooling systems.

The green loan marketplace has seen its popularity rise since its launch, with reports of retail and other institutional investor showing a strong interest in the platform. 200 retail investors having financed green loans alongside the CEFC, delivering returns of up to 6.5% per year.

Daniel Foggo, CEO of RateSetter, said: “Continued reductions in the cost of solar systems coupled with low cost finance makes these products a smart choice for many more Australians. As power costs continue to rise the benefits of moving to solar power have become very clear.”

The peer-to-peer nature of the platform allows investors to choose the amount they wish to invest alongside an interest rate they deem suitable, with the offer then agreed or not upon by the borrower.

In order to initiate the expansion of the platform, partnerships with component manufacturers, installers and suppliers have been made. A low cost financing option is making the products affordable, which boosts sales, and allows customers to immediately spend less on power while allowing the whole system to pay for itself over a period of five to six years. With systems lasting around 20 years, the projects are profitable for buyers and lenders alike.

Furthermore, RateSetter has achieved a few milestones in the previous year. It passed the $250 million mark in terms of funds obtained through the 10,000 investors registered that are lending via the platform. Moreover, a $10.5 million fundraising initiative led by private equity investor FiveV Captial was achieved.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.