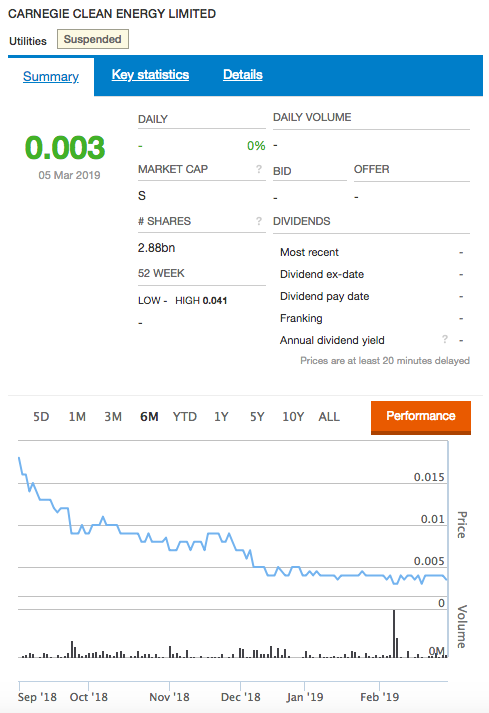

Carnegie Clean Energy has been suspended from the Australian stock exchange for failing to post its half-yearly results by due date. In an ASX statement on Friday, Carnegie said it regretted not meeting the deadline for the half year report and it was working with its auditors to lodge the accounts as soon as possible.

As reported by The West Australian, the suspension came after the principle shareholder had sold half its stake. John Davidson, who resigned as a director of Carnegie in June last year and was former managing director of Carnegie’s microgrid subsidiary Energy Made Clean (EMC), is reported to have offloaded almost 150 million shares in 30 transactions between early December and February 8, reducing his stake from 13% to 6.47% and signaling troubles ahead.

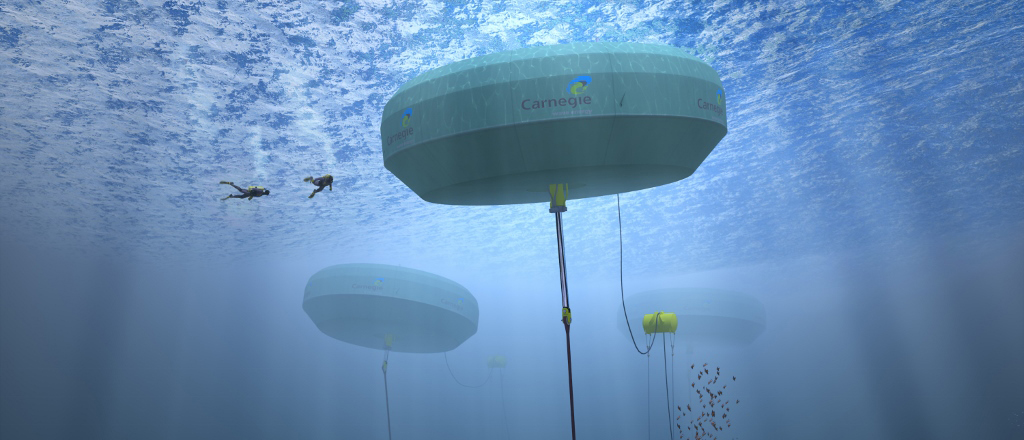

Albany wave energy project

Despite serious questions over its ability to fund what it billed as Australia’s first commercial-scale wave farm, Carnegie got a $2.6 million government pay check last October. The company was in for a total of $15.75 million contribution from taxpayers, provided it could foot its share of the development costs.

To unlock the rest of the funding, Carnegie was given a nine-week deadline to submit a detailed plan showing it could fund its $26 million share of the $53 million Albany wave energy plant. After missing the original deadline citing uncertainty around changes to federal R&D tax incentives, the developer was granted an extension to February.

It managed to come up with a funding plan at the eleventh hour mid last month, hoping to secure the next installment of the state government grant.

In an emailed statement to pv magazine Australia in February, Minister for Regional Development Alannah MacTiernan confirmed the assessment and a decision on next steps for the project were expected to take up to six weeks, noting that the state government will provide further comment once the assessment is complete.

Addressing reporters following the ASX suspension, Premier Mark McGowan described the situation as “concerning”, noting cabinet would decide soon whether to continue support.

Troubled times

Last year, Carnegie had a rough ride, posting a $64 million loss in its interim results, including a $35 million write-down of its CETO wave power technology. On top of that, it has seen the departure of its long-serving managing director Michael Ottaviano.

Another big hit for the company came in December, when the deal to merge Carnegie’s troubled subsidiary EMC with TAG Pacific’s M-Power fell through. At the time, non-executive Chairman Terry Stinson noted that EMC had performed “far below expectations” despite having established “a positive reputation in the market for technical capability, customer support, quality, and project delivery.”

Solar projects

The company has, however, managed to advance its pipeline of solar PV projects. Last year, its largest PV plant and WA’s first operational merchant utility solar project, the 10 MW Northam Solar Farm commenced exporting power to the grid and received approval to operate from Western Power.

In addition, the solar and battery microgrid at the Delamere Air Weapons Range in the Northern Territory achieved practical completion. EMC’s CSIRO Pathfinder and RAAF Delamere microgrid projects have been operational since August of last year. A couple of weeks ago, Carnegie Clean Energy completed commissioning of a microgrid project, featuring 2 MW solar PV and 2 MW/0.5 MWh battery, at a naval base on Garden Island, WA.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

It is apparent that the “little people” who put money in Carnegie because it felt that they were helping a new technology in WA, have done their dough.! No doubt this means nothing to the people who by whatever means acquired a large amount of shares, that at least they got some of their money back before they departed.. To think that not so long ago at the last share issue, I was approached to purchase more shares, which I declined to do so, as it appeared it would be foolish to do so and to cap it off, I was phoned up to convince me to purchase more, but I politely declined.