From the September edition of pv magazine

A new cavern of wonders is rising from the sands of Saudi Arabia. A century after transforming the global energy sector with cheap, abundant oil, the Kingdom is now building the first gigawatt-scale factory for redox flow batteries, a technology that proponents argue will slash the price of storing solar energy.

Since the basic patent protecting redox flow batteries expired just over a decade ago, dozens of tech firms have raced to develop the technology and drive down its cost. In many respects, they have succeeded. Matt Harper, president of Avalon Battery, says that prices offered by leading manufacturers have come down 80% in less than five years. Lazard, an asset manager, calculates that the levelized cost of storing electricity in some redox flow projects now overlaps with that of lithium-ion batteries, the main competition. This year, sales of vanadium-flow batteries, the most established redox flow technology on the market, have grown from double digits to just over 200 MWh of installed storage capacity.

In spite of these achievements, Alex Eller, an analyst at Navigant, points out that redox flow batteries have yet to dent the energy market. He says that most of the 7,000 MWh of grid scale storage coming online this year will be met by lithium-ion batteries, followed by pumped hydro and other established storage technologies, with flow batteries trailing behind.

“Flow battery projects have so far been relatively small scale,” said Eller. “We are only just starting to see large-scale commercial projects in the works.” While he sees many hurdles still facing the emerging redox flow industry, Eller is also convinced of the technology’s potential to reduce the cost of storing renewable energy.

Zero degradation

Undercutting the record-low prices set by lithium-ion batteries will be no small challenge. In recent years, global electronics brands including Samsung, LG and Panasonic have streamlined assembly lines capable of producing gigawatt-hours of lithium-ion batteries each year. Prices have come down faster than expected and sluggish demand for electric vehicles has led to a glut of cells now being sold at cutthroat prices to store power on the grid.

Fierce as this competition may be, flow batteries have an ace up their sleeve. Unlike the lithium-ion batteries they compete with, their electrolytes do not degrade. According to Richard Wills at the University of Southampton, what sets the technology apart is its architecture. Rather than distribute electrolytes within each cell, a flow battery separates electrolytes into external tanks and pumps the liquid through active elements that store and deliver energy. At first glance, the device looks more like a chemical treatment plant than an AA battery.

Redox flow technology raises new challenges. To function, these batteries require pumps and aqueous electrolytes that suffer from comparatively low energy densities. They also reduce the efficiency of the energy conversion process, they are unwieldy for most forms of transport, and they increase the floor space needed to house components.

But Wills says that redox flow technology can also charge and discharge batteries without degrading their performance. “The reactions undergone in redox flow batteries are surface electron transfers which are less susceptible to degrade electrodes and current collectors,” said Wills, adding that the large volume of aqueous electrolyte pumped through the cell stack also helps dissipate heat, a key burden on materials and notorious fire hazard in lithium-ion batteries. Cooler operation leads to higher safety margins, longer equipment lifetime and lower maintenance costs. On paper, this makes flow batteries safer than Li-ion technology and cheaper over the duration of a storage project.

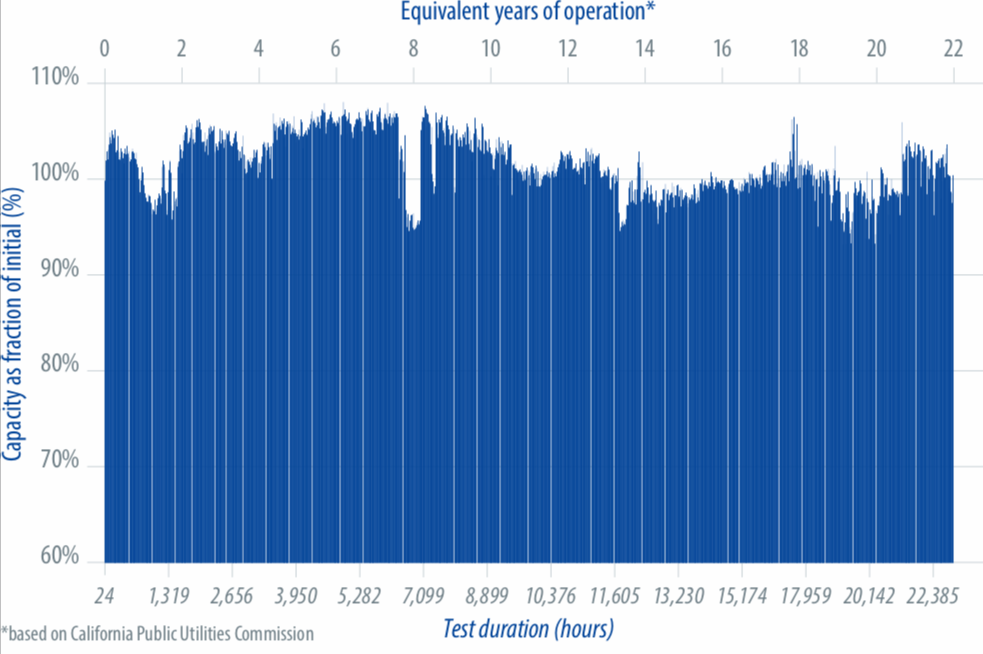

“We have run a vanadium flow battery through 24,000 hours of very aggressive cycles and still cannot measure any degradation on the battery’s performance,” said Alex Au, CTO of Nextracker. Three years ago, the U.S. tracker supplier added energy storage solutions to its catalogue Au tested more than 40 technologies in-house to select products compatible with lifelike fluctuations in demand on electricity grids. The vanadium flow batteries made by Avalon Battery made the cut. “They even boast less degradation and a better warranty than any solar module on the market today,” said Au.

Vanadium rental shop

Back at Navigant, Alex Eller says that the extended lifetime and dependability of flow batteries should in principle recommend the technology for secluded electricity generation assets, in particular solar arrays, keen on storing vast volumes of electricity for several hours until its value peaks on the wholesale market. But the limited track record of large-scale flow battery projects has so far limited their deployment.

“Flow batteries face a severe trust issue,” said Eller. He explains that the main companies buying batteries today are risk-averse project developers. These procurement teams want to make sure that the manufacturer of the battery they select still exists in ten years’ time in case they need to replace faulty purchases. As a result, they favor working with reputable lithium-ion behemoths, rather than upstart redox flow pioneers, regardless of the long-term cost projections of the project.

In a similar display of conservatism, no established lithium-ion manufacturer has so far ventured into the redox flow battery business. Eller ventures that their reluctance is caused by market uncertainty. It remains unclear which variant of redox flow technology will come out on top. “Flow batteries using vanadium electrolytes are very good, but vanadium is expensive,” he says. The cost of the raw material already inflates capital expenditure for vanadium flow projects by over 30% and investors fear that fluctuations in commodity prices could strangle supply chains.

Matt Harper at Avalon Battery claims that creative financing and vanadium leasing schemes are making vanadium flow projects more bankable. To reassure jittery buyers, manufacturers have started securing warranties from third parties. Insurers like New Energy Risk in the United States will cover falls in battery performance over the 20-year lifespan of a redox flow project, even if the battery manufacturer goes out of business. These contracts effectively guarantee returns from an energy storage project so that its developer can trust the insurer, even if they are still growing familiar with the manufacturer.

Likewise, business solutions are dampening the risk of vanadium supply chains by allowing clients and battery manufacturers to lease their electrolyte. Vanadium producers including Glencore and Bushveld Energy are prepared to rent out the metal and recycle it, shouldering part of the capital expense of the project. “The vanadium electrolyte does not degrade and can be fully recovered at the end of the battery’s life,” said Mikhail Nikoramov, CEO of Bushveld Energy.

Harper claims that these advances have brought the vanadium flow industry to the same inflection point that geared up lithium-ion manufacturers in the 1990s when consumer electronics entered mass production. So far, redox flow batteries have filled niche applications, typically where fire safety is of particular importance. But as its price verges on that of lithium-ion batteries, Harper expects redox flow technology to storm the stationary storage market. He calculates that this growth could reduce Avalon Battery’s prices below $40/MWh, turning solar into “a truly dispatchable asset, capable of displacing all other sources of electricity on the grid.” In his view, the key to cutting costs is a mature supply chain and standardization.

Saudi Qualität

This is good news for the 70,000-square meter factory taking shape in Saudi Arabia. Its opening in 2020 will deliver over 1 GWh of redox flow storage capacity to the market each year, bringing unprecedented economies of scale to an industry that has so far had to make do with tailor-made solutions as it contends with mass-produced competition.

The Saudi plant will churn out vanadium flow batteries developed by Schmid, a German PV equipment supplier with 150 years of experience in industrial engineering. The family business branched out into redox flow batteries in 2011, commercialized its first vanadium flow battery in 2014, and set out in search of partners to scale up production.

Schmid struck a deal this year with RIWAQ, a Saudi construction firm, and Nusaned Investment, a subsidiary of Saudi petrochemicals giant Sabic, which finances technologies supporting policies set out by Saudi authorities. In 2016, the Kingdom announced its Vision 2030 plan to reduce national dependence on oil revenues, notably through massive investment in renewables. The venture brings together some of the most venerable veterans in the flow battery industry with exceptionally deep pocketed investors.

“The new Schmid deal in Saudi Arabia is very exciting,” said Maria Skyllas-Kazacos, who invented redox flow technology in the 1980s. She adds that the plant “will definitely help to provide the production scale needed to further reduce costs.”

Author: Benedict O’Donnell

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

“Redox flow technology raises new challenges. To function, these batteries require pumps and aqueous electrolytes that suffer from comparatively low energy densities. They also reduce the efficiency of the energy conversion process, they are unwieldy for most forms of transport, and they increase the floor space needed to house components.”

One large energy storage source that has been around for hundreds of years is hydro, either entrained or pumped hydro storage. Typically these are large scale projects taking up acres of land, maybe hundreds or thousands of acres. Getting gigawatt redox flow batteries inside a large solar PV or wind generation project should be easy. Vertically integrate the storage and cell generation structure into elevated storage that requires less pumps to fill the ion tanks and use gravity and solenoid valves to regulate ion flow through the cell field. One might even treat the redox like an elevated storage system by placing large ion tanks on a hill and allowing the solutions to run downhill to create the “pumping” into the cell stack.

Right now with the complaints of overgeneration during the solar day, are creating “curtailment” of non-fueled generation, it would seem more sane to use this time to use overgeneration to regenerate the ion solutions, before pumping them back up the hill.