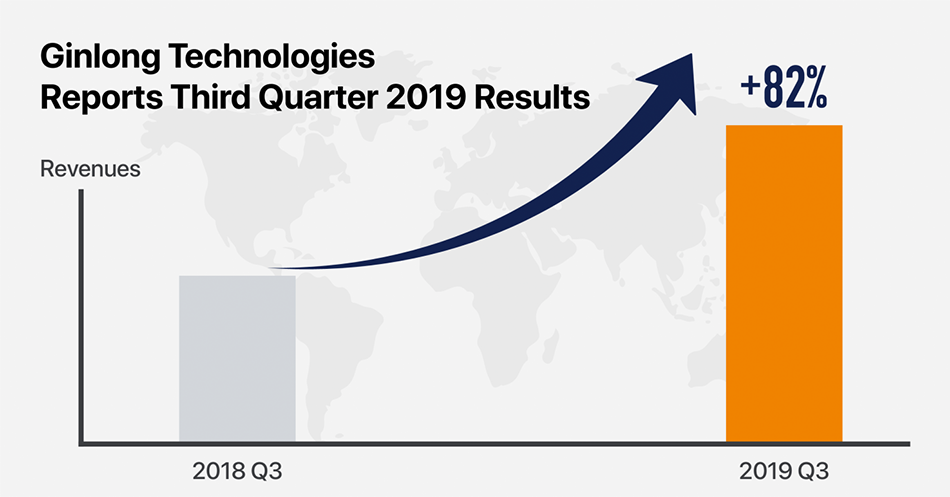

String inverter maker Ginlong has reported its best-ever quarter. The Chinese company, which has been trading in Australia since its early days, brought in $52 million during the third quarter alone, a figure in excess of the annual revenue recorded by the company in years as recent as 2014-2016.

The news of Chinese inverter makers recording record profits is perhaps not surprising considering their expansion into overseas markets in recent years. The expansion has been facilitated by the trend of large multinational high-tech companies exiting the solar inverter business. One such example is Swiss giant ABB who joined a host of inverter big-shots in seeing its role as redesigning infrastructure rather than supplying inverters at ever lower margins.

The research firm Wood Mackenzie released a report in August saying that the value of the global inverter market will continue to decline until 2024. “Total revenue for the top 5 global PV inverter vendors underwent a year-over-year decline of 10% last year,” the company said.

Beijing’s U-turn on solar subsidies in late May put price pressure on the industry by pushing Chinese inverter makers into overseas markets. The resulting drop in global sales prices, along with the increased share held by Chinese manufacturers (from 22% in 2017 to 28% in 2018) means that many multinational companies are preferring to focus on higher-growth areas such as energy storage and smart devices.

Of course, the impact on the global inverter market is not the only consequence of Beijing’s U-turn on solar subsidies. China’s Photovoltaic Industry Association (CPIA) released the country’s PV statistics for the first nine months this week, stats showing the once-booming industry has slowed to a crawl.

Nevertheless, Ginlong’s record revenues speak to the growing market share of the publicly-traded company, which focuses exclusively on its Solis PV string inverters. The revenue intake of $52 million represents an 82% increase year-over-year and a 53% increase in net income from 2018.

Ginlong’s intelligent hybrid PV inverter flexibly interlaces with a solar + storage system to maximise self-consumption while boosting efficiency and overall returns.

The company’s growth is now allowing it to push into other markets, notably utility-scale solar PV project development in China through its wholly-owned subsidiary, Ginlong Smart Energy Co., Ltd. The company’s competitive advantage in the inverter market and growing dominance means that as it heads upstream into utility-scale project development, it’s rowing with a big paddle.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.