The COAG Energy Council (Council) is set to meet this Friday, 22 November 2019, for the first time in nearly a year. The Clean Energy Council (CEC) is concerned the Council will fail to address the nation’s highest priority, the downturn in new renewable large-scale energy investment.

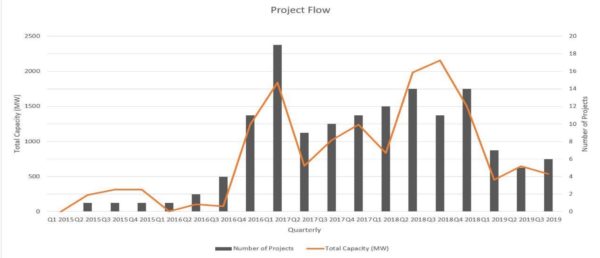

According to the CEC new clean energy investment has slowed significantly in 2019, with average quarterly investment in new generation capacity this year just over 500 MW per quarter compared to over 1600 MW per quarter in 2018. This reflects a reduction of over 60% from 2018 levels.

Concern with the investment downturn has been growing in the CEC and the greater renewable industry. In September the CEC published a report showing investment in renewable energies had slowed to levels not seen since the prime ministership of Tony Abbott as a result of policy uncertainty and mounting regulatory challenges.

The downtown has been similarly singled out by public policy think-tank Grattan Institute and BIS Oxford Economics. Grattan’s Power Play report blasts the current and previous Australian governments for chaotic approaches to energy policy, for baulking at cohesive and consistent market management and opting instead to intervene in the market with knee-jerk reactions. The BIS Oxford Economics report predicted a plunge in construction work on renewable energy projects of between 40-50% in the early 2020s.

The CEC argues that a prolonged slowdown in new investment at this pivotal time of the energy transition is a major risk to Australia. A sustained slowdown, says the CEC, will have a dramatic impact on Australia’s energy prices and reliability at a time when existing coal-fired generation is becoming less reliable and making its way out of the system.

Though the CEC lauded the federal government’s 2020 Large-Scale Renewable Energy Target (LRET) which saw 15,700 MW of new capacity committed to over the past two years, the absence of policy beyond 2020 means investors are hesitant.

Of course, government apathy is not the only cause; indeed the causes of the slowdown are multifarious, from increased risks and barriers relating to challenging grid connection issues, to a lack of transmission investment, the federal government’s energy policy vacuum and an outdated market.

These causes are substantiated by the CEC’s biannual survey of the CEOs of Australia’s leading renewable energy companies which set out the industry’s concerns:

The CEC argues further that attempts to address these issues are already veering off course. For instance, the Australian Energy Market Commission’s (AEMC) development of a new access model as part of the COGATI review. The CEC suggests the AEMC’s review has lost track of its key impetus, the pressing need for new transmission. Instead, the CEC charges the AEMC with an overly complex and yet still underdeveloped model that ignores transmission and focus on “a rage of second-order objectives, such as delivering more efficient dispatch and addressing race to the floor bidding.”

Furthermore, the CEC also contends the COGATI access proposal misses the most pressing issues inside the renewable energy sector, notably grid connections and MLFs. The current process of connecting new large-scale generators to the grid is becoming more expensive and simultaneously encountering more delays. If the COAG Council does not treat these issues with the highest priority, says the CEC, the overdue meeting may as well stay overdue.

The CEC has written to every energy minister ahead of the COAG Energy Council meeting with recommendations:

- The COAG Energy Council should not endorse the AEMC’s approach to progressing its proposed access model (COGATI). Instead, it should task the AEMC to undertake quantitative analysis and further detailed design development to demonstrate the proposal delivers a net market benefit and ensure its practical implications are well understood and tested.

- task the AEMC and AEMO with pursuing reforms of the grid connection process and the MLF regime as a priority.

- The COAG Energy Council should reaffirm its commitment to effectively actioning AEMO’s Integrated System Plan

- task AEMO and the AEMC to develop clear ancillary services markets that recognise and monetise the value of services such as inertia, fast frequency response and voltage support.

- support long term energy policy certainty, through a combination of harmonisation of state targets and schemes, refinement to existing policy measures (such as the Emissions Reduction Fund) to support new clean energy investment or progress new coordinated policy measures such as the National Energy Guarantee.

- The COAG Energy Council should endorse the National Hydrogen Strategy.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.