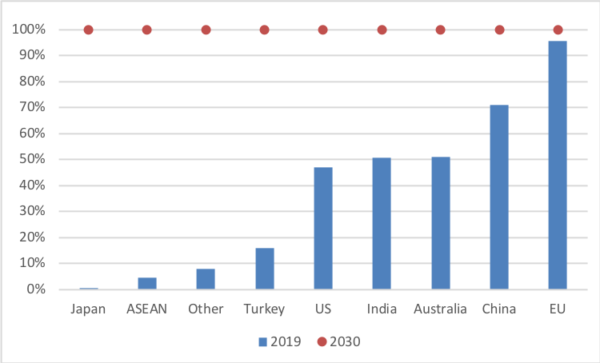

The report, entitled: “How to waste over half a trillion dollars: The economic implications of deflationary renewable energy for coal power investments,” asserts that if we are going to limit global warming to 1.5°C as per the Paris Agreement, coal use will need to fall by 80% by 2030. To hit that mark, one coal plant will need to retire every day between now and 2040. Thankfully, as the report shows, green energy isn’t just green because it’s clean, but because it’s a money-maker. By 2030 it will be cheaper to build new wind or solar capacity than to continue operating with coal in all markets across the globe.

Moreover, Carbon Tracker’s report warns governments and investors that the financial insecurity of coal power is only going to deteriorate further. 499 GW of new coal power is in the pipeline worldwide at a cost of £638 billion, but considering coal plants typically take 15-20 years to cover their costs, that figure is likely conservative, especially in comparison to the expected continuance of falling renewables prices.

Matt Gray, Carbon Tracker co-head of power and utilities and co-author of the report, said: “Renewables are outcompeting coal around the world and proposed coal investments risk becoming stranded assets which could lock in high-cost coal power for decades. The market is driving the low-carbon energy transition but governments aren’t listening. It makes economic sense for governments to cancel new coal projects immediately and progressively phase out existing plants.”

Image: Carbon Tracker

Asia-Pacific:

The renewables boom in Australia and South-East Asia is becoming more and more interlocked. Due to energy deficiency, particularly in countries like Indonesia, the region is hungry for Australia’s renewable resources. We need only look at the Sun Cable project by which Singapore is hoping to meet 25% of its energy needs from solar energy generated in the Northern Territory.

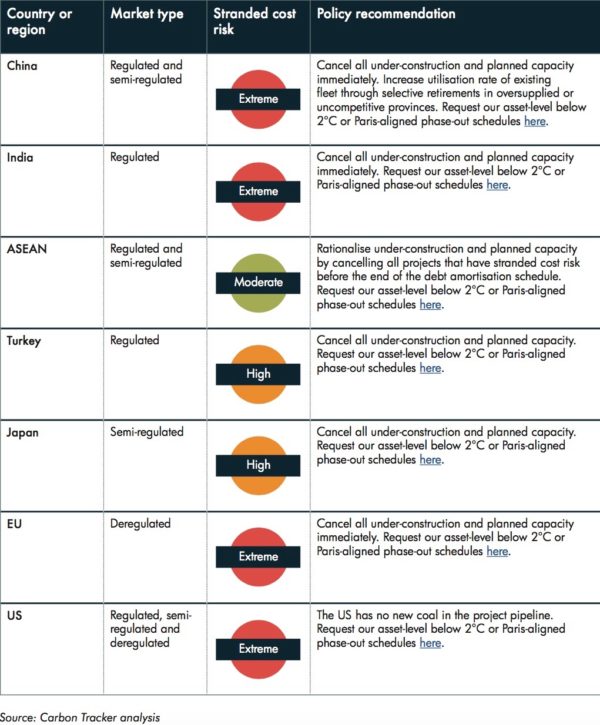

Fellow co-author of the report, Sriya Sundaresan, told pv magazine Australia that for the ASEAN region, with a stranded cost risk labeled as “moderate”, governments and investors should act rationally by canceling all projects planned and under construction.

Image: Carbon Tracker

Sundaresan believes the share of renewables should increase dramatically in ASEAN markets over the next decade but government support is needed. “Government policies would need to change to aggressively support deployment of renewables through cancellation of new coal projects that have stranded cost risk beofre the end of their debt amortisation schedule,” said Sundaresan, “and creation of tariffs or financing schemes along with other incentives.”

Australia:

The Australian Government is not the sharpest tool in the shed, especially when it comes to Australian Kryptonite – coal. Let alone the Adani fiasco, in February Federal Minister for Energy and Emissions Reduction, Angus Taylor, announced $6 million in funding to study the feasibility of two new proposed projects in Queensland – a 1 GW high-efficiency, low-emissions (HELE) coal plant, and 1.5 GW of pumped hydro storage.

The funding is solely to identify whether a HELE coal plant in Collinsville, QLD, is competitive with solar generation firmed by storage, which, as Carbon Tracker’s report and common sense show, it is not.

“Deciding to continue with planned coal capacity is very risky,” continued Sundaresan. More risky still is the feeble attempt to fool one’s addiction through poorly disguised dilution. “The Australian government should introduce regulations that maximise the systems value of variable renewable energy and retire the existing coal fleet through phase-out schedules,” advises Sundaresan. “They will otherwise face stranded asset risk and overcapacity.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.