The main message of BloombergNEF’s Hydrogen Economy Outlook, released tonight, is: Mind the policy gap.

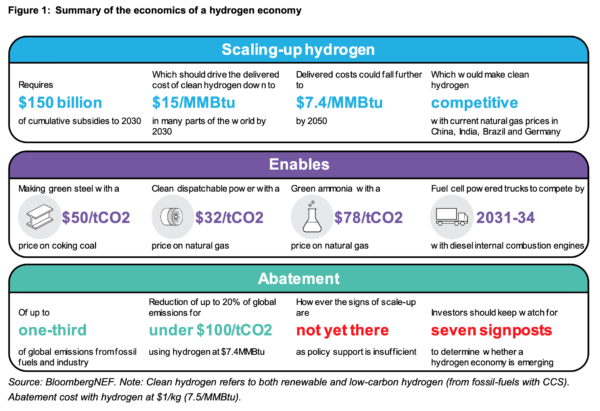

Hydrogen could absolutely become the clean-burning, zero-carbon molecule to replace fossil fuels in hard-to-abate sectors of the economy, and has the potential to erase one-third of today’s global emissions from fossil fuels and industry if it is deployed for steel making, providing dispatchable energy, producing ammonia, and powering trucks and shipping.

And meeting the related 24% of energy demand with green hydrogen by 2050 would require massive amounts of additional renewable generation; to power the electrolysers, some 31,320 TWh of electricity will be needed — “more than is currently produced worldwide from all sources”, boggles BNEF.

And because this has to be added to the projected needs of the power sector — for which renewable generation will also need to expand — “total renewable energy generation excluding hydro need to top 60,000 TWh, compared to under 3,000 TWh today”, estimates the report.

Opportunity knocks for solar generation, you might say, but consider that transporting and storing hydrogen at scale will require enormous investment in infrastructure: an estimated US$637 billion globally, to 2050. And driving demand for green hydrogen will require US$150 billion of cumulative subsidies by 2030.

Image: BloombergNEF

Hydrogen writ large

BNEF is talking big because demand for green hydrogen needs to become great enough to drive down production and storage costs. Therefore, says Kobad Bhavnagri, Global Head of Industrial Decarbonisation at BNEF and lead author of the report, there are no viable small-scale stepping-stone applications for hydrogen — which is perhaps why it has failed to take hold in the past, and why the hydrogen bubble may again fizzle.

“The conclusion of our work in a nutshell is that hydrogen has a high potential if policymakers get serious about reducing emissions,” Bhavnagri told pv magazine on Friday, in anticipation of the Outlook’s release.

It comes down to whether or not countries and the collective global economy wants to get to net zero. “Once you set a net-zero target and are serious about putting policies and measures in place to achieve that,” says Bhavnagri, “then hydrogen becomes a necessary option and has to play a very substantial role.”

But without that clarity of purpose, he tells pv magazine, “There’s no need to do hydrogen,” and BNEF’s work shows that “it won’t stand up, because hydrogen is a higher-cost, less convenient fuel than fossil fuels. Its real advantage is that it can be zero emissions.”

Save on the shipping spree

Hydrogen as an export to replace Australian coal exports? A misplaced narrative says Bhavnagri, cutting through the hype which he says is simply an idea that “resonates” with Australians: “Nothing gets Australians excited like the prospect of putting some raw commodity on a ship.”

In fact the economics of shipping hydrogen are fantastically bad. For a start it’s less dense than natural gas, and its liquefaction point is lower, requiring more effort, energy and churning shipping lanes to serve distant destinations. Bhavnagri says countries with high energy-generation costs, like Japan and Korea, would be better off producing hydrogen onshore from expensive renewable energy than they would be importing green hydrogen by sea.

But Australia can indeed be a hydrogen superpower by using homemade green hydrogen onshore and exporting value-added products — green steel, green ammonia, green glass, green cement and green aluminium for example.

A potential powerhouse of low-cost hydrogen generation

With Australia’s outstanding renewable energy resource and a small population — modest local demand for land and energy — it has the ability to come near the bottom of the cost curve for hydrogen production.

To minimise the costs of storage and transportation, “Clusters of industrial customers could be supplied by dedicated pipeline networks” hooked up to “a portfolio of wind- and solar-powered electrolysers, and a large-scale geological storage facility”, say, a salt cavern, “to smooth and buffer supply”, hypothesises the Hydrogen Economy Outlook. Surely that’s a Renewable Energy Zone on steroids.

BNEF analysis suggests that a delivered cost (including production, storage and transport) of green hydrogen of around US$2 per kilogram (US$15 per one million British Thermal Units) could be achievable in countries like China, India and Western Europe by around 2030. By 2050 most parts of the world should be able to achieve a delivered cost of hydrogen of US$1/kg (US$7.4/MMBtu).

However, “Costs could be 20-25% lower in countries with the best renewable and hydrogen storage resources, such as the US, Brazil, Australia, Scandinavia and the Middle East,” says the Outlook.

That’s the Australian advantage and the value in going early and going hard to capitalise on potentially low costs, to drive manufacturing of green products.

The fallout of playing follow the leaders

But said Bhavnagri, in comments tailored for Australia, “If hydrogen becomes widely used globally and Australia does not restructure its exports to use it, it presents a significant risk. A transition to hydrogen-based green steel internationally would decimate demand for metallurgical coal, one of Australia’s most valuable exports.”

Reality knocks for slow movers, and leaders are reminded to mind the policy gap.

The BNEF study also found that a carbon price of US$50 per tonne of CO2 would be needed for green hydrogen to bump coal from steel manufacture by 2050; make that US$78/tCO2 to make it the molecule of choice for manufacturing chemicals such as ammonia; and US$145/tCO2 and a delivered cost of green hydrogen of US$1/kg would see it powering shipping.

Bhavnagri estimates heavy vehicles could be cheaper to run on hydrogen than diesel by 2031, but says hydrogen-powered passenger vehicles are another pipedream, because batteries will be a cheaper solution for cars, buses and light trucks for the foreseeable future.

The leccie band

Competing technologies for green hydrogen are renewably produced electricity and biofuels; but biofuels are not yet commercially viable; but “Hydrogen is,” says Bhavnagri, and given the right policy settings “it can be scaled up fast and to massive quantities with few concerns about sustainability”.

And direct electrification could cover a lot of bases, potentially providing a lower-cost pathway than hydrogen, even in steelmaking where early-stage technology is being used to directly refine iron ore. But electricity doesn’t provide a molecule-based feed-stock for chemical production.

Hydrogen also has the benefit of being able to stabilise grids that run primarily on renewables, using clean fuel, when used in gas peaker plants. Turbine manufacturers, led by such as General Electric, Siemens and Mitsubishi Hitachi Power Systems are adapting their technology to run on various dual-fuel cocktails, and shooting for the stars — turbines that can run on 100% hydrogen.

A climate not quite ripe enough

Infrastructure investment, a universal carbon price, pumped-up renewable energy zones with integrated manufacturing — it all takes vision and the will to act.

Australia can’t do it alone, says Bhavnagri, even if its leaders were to show an appetite for carbon pricing and investment towards net-zero emissions: “This needs to be a global effort,” and the money and policy to match the broad-based enthusiasm for hydrogen are not yet on the table.

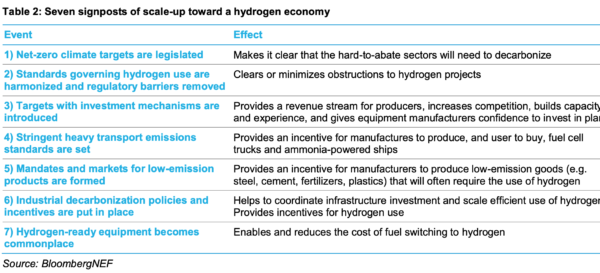

For clients of BloombergNEF, who have been knocking down its doors for guidance on the potential for investing in hydrogen, the Outlook author and his team have compiled a list of Seven signposts of scale-up toward a hydrogen economy:

Pushing natural gas to the edges of the pipeline

The costs of hydrogen may currently be high but there are encouraging signs that they will fall, with the price of Western-made alkaline electrolysers having reduced 40% between 2014 and 2019, and Chinese made systems up to 80% cheaper than those produced in the West.

If production of electrolysers can scale up and the cost of splitting water into its atomic parts continues to decline, BNEF calculates that renewable hydrogen could be produced for $0.8 to $1.6/kg in most parts of the world before 2050 — making it competitive with today’s natural gas prices in major markets such as China, India, Brazil and Germany on an energy-equivalent basis, and cheaper than hydrogen produced from natural gas or coal with carbon capture and storage costs included.

The subsidies required to kickstart large-scale production sound enormous; in fact US$150 billion, says Bhavnagri, is less than half of what governments around the world currently spend on fossil-fuel subsidies. That is not a punchline.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I do not see any reference to the relationship between KWh and grams of H2. How much does electricity cost? How do you get H2 out of ammonia?

Electricity is not free even if it is generated from solar or wind. How much does electricity cost in this example? What is the energy component cost/KG H2?