With a run rate of over 200 MW per month, the Australian small scale rooftop market segment was soaring to record heights in the first three months of 2020. However, like many industries, it looks set to be heading for steep decline with uncertainty and economic disruption caused by Covid-19 depressing new orders.

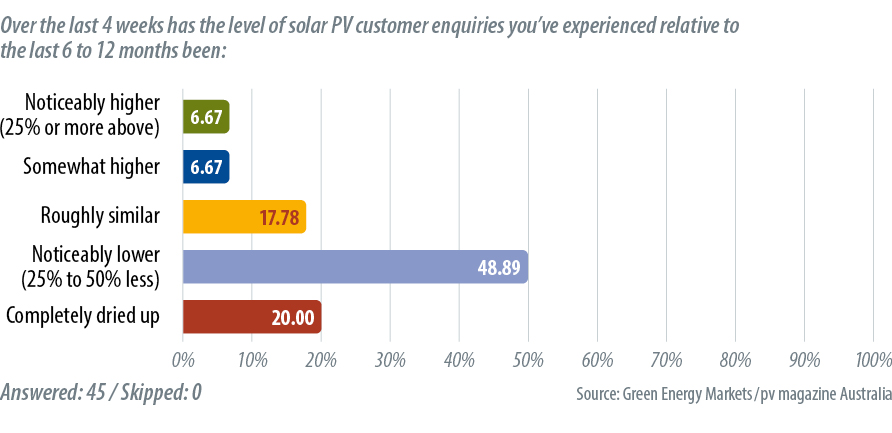

A survey carried out jointly by Green Energy Markets and pv magazine Australia has revealed that installers and suppliers to the rooftop PV market are seeing a steep decline in new leads and enquiries. Almost half of respondents reported that they are experiencing a decline in customer enquiries of between 25-50%. What’s worse 20% of respondents report that new leads have “completely dried up”.

Tristan Edis, Green Energy Markets’ director of analysis and advisory says that Covid-19 has “changed everything” – after a record-setting first three months of the year. ”The survey results look very grim, suggesting that not even a booming solar sector can escape the impacts of the Covid-19 downturn that has put so many people out of work and a range of major industries like tourism, hospitality and education into a coma.“

Edis notes that January, February and March saw some 203 MW, 215 MW and 254 MW respectively of sub-100 kWp solar added to Australian rooftops – according to small-scale technology certificate (STC) data. He notes that some installers and retailers are reporting to have built up a considerable backlog of orders in that period, which may provide a buffer of between six-weeks to three-months. “But then the drop in customer interest will bite.”

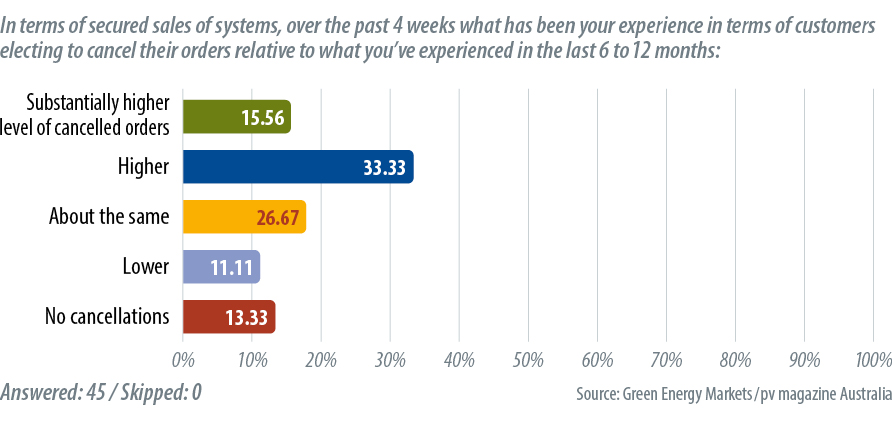

A positive in the survey data is that installers are not reporting a rash of order cancellations, further strengthening the buffer created by order backlogs. “This would seem to suggest that April could record installs above the 200 MW mark as well,” notes Edis.

As to what a 50% decline in installations could mean, Edis observes that it would result in a monthly installation run rate of around 100 MW per month and 1.6 GW for the full year. This level of activity will represent a contraction back to 2018 levels, “which at the time was considered a massive year for the industry.”

However, this will be cold comfort for many. “This will be extremely tough for many solar businesses around Australia, many of which would have geared up on the expectation of something closer to 200MW per month.”

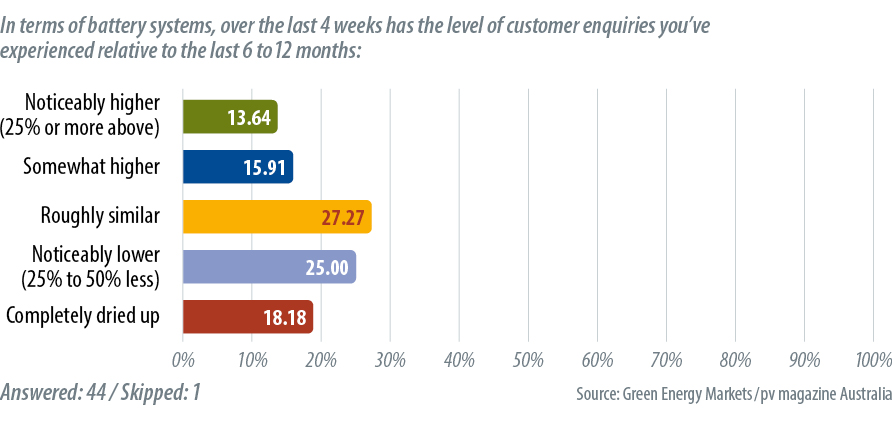

The survey data do not indicate that there has been a surge towards battery storage – expected by some as households and businesses try to build resiliency in the face of wider economic uncertainty. While results were mixed, negative sentiment outweighed responses of increased demand for battery storage systems.

The survey was conducted over seven days, commencing April 2. There were 45 survey respondents.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.