Solar leads way for new-build power source as all technology prices surge

A new report released by Australia’s national science agency shows that renewables, led by large-scale and rooftop solar, remain the cheapest form of new-build power generation in Australia despite a 20% average rise in technology costs.

Energy transition is off-track, says IRENA

The global transition to carbon-free energy has fallen behind pace to limit global warming to 1.5 degrees Celsius, a key threshold set forth by the Paris Agreement.

Freight costs edge toward 4% of solar module costs, near pre-pandemic levels

Freight costs fell for the 39th straight week to account for roughly 4% of solar module costs – close to pre-pandemic levels. PV consultant Asier Ukar tells pv magazine that this trend will likely continue over the short term.

Forced labour concerns prompt U.S. ports to block over 1,000 shipments of solar components

Panel shipments collectively worth hundreds of millions of dollars are blocked from entering the United States market as they have failed scrutiny under the Uyghur Forced Labor Prevention Act, said Reuters.

Elevated shipping costs to remain challenge for solar sector

Australia’s solar industry can expect to contend with elevated shipping costs and ongoing supply disruptions for at least another year before a ‘normalisation’ of the global ocean freight system.

EPC giant warns of workforce shortage challenge for large-scale solar

Global renewables contracting giant Sterling and Wilson Solar has warned Australia’s large-scale solar PV industry faces a significant workforce shortage as the nation shifts away from fossil fuels towards renewable power.

Rooftop solar price to keep rising this year

British analyst GlobalData has predicted residential and commercial rooftop panels will not return to a declining price trend until next year, with post-Covid logistics headaches the cause, rather than a polysilicon shortage.

90 MW Sebastopol Solar Farm near Wagga Wagga reaches commissioning phase

Fotowatio Renewable Ventures Australia’s 90 MW (AC) solar farm outside Wagga Wagga, New South Wales, has reached the commissioning phase after less than a year of construction. Barring no obstacles, the project should start exporting solar energy to the grid in a matter of months.

Module and shipping cost inflation could cost the world 50 GW of solar next year

The input costs of the two biggest contributors to solar plant development expense have gone through the roof since the world began to come out of Covid-19 lockdowns, to leave project developers with some difficult choices.

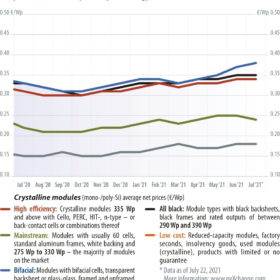

Sunday read: A decisive movement in module prices

The sky is the limit. Fortunately, this expression does not apply to current prices for PV panels, which have recently declined, following a continuous rise since the beginning of the year. Whether this situation holds, or whether prices drop further in the coming months is hard to say at the moment, writes Martin Schachinger of pvXchange. Polysilicon prices and thus wafer and cell prices could be in for a slight decline. However, a decisive movement in module prices in general is unlikely before the fourth quarter.