What really happened in the borderlands of western Victoria and New South Wales, where five solar farms have been curtailed and an estimated further 45 renewable generators are now lined up to connect to the Australian grid one at a time, in a process that could take years?

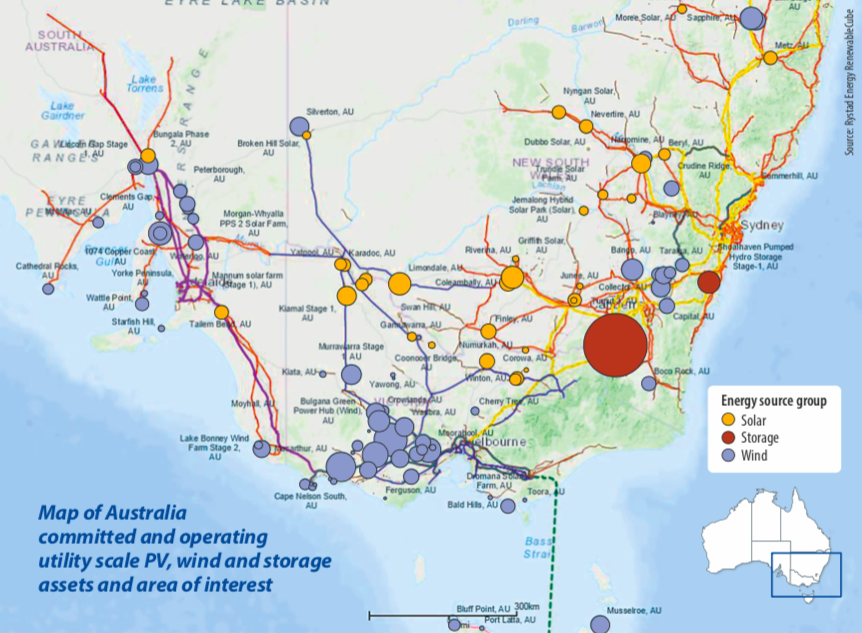

The genesis of the problem lies in the fact that there’s great renewable resource in this part of Australia, loosely described as the West Murray region, at the dangling ends of a transmission network designed to serve about 500 MW of load in the entire western region of Victoria from coal-fired power stations in the east. It’s not designed to carry some 4.6 GW of existing and committed renewables capacity in the region in the opposite direction.

“In ideal conditions, the maximum thermal network transfer limit for the West Murray region is only 1,700 MW,” said a spokesperson for the Australian Energy Market Operator (AEMO). This means generation output in the area “will increasingly have to be restricted to avoid breaching limits,” due to the limited capacity of transmission lines.

That’s the relatively straightforward capacity problem in a nutshell, but system strength – defined as the network‘s ability to maintain voltage profile within a specified technical envelope or range during disturbances to the grid – is harder to predict, and to correct. The technical crunch for the five already grid-connected, operational solar farms – Gannawarra, Broken Hill, Karadoc, Wemen and Bannerton – came when AEMO detected interactions involving them, which produced voltage oscillations. They were curtailed to just 50% of their output in September 2019, costing the group an estimated AUD 1 million ($601,890) a day in lost revenue.

That’s the relatively straightforward capacity problem in a nutshell, but system strength – defined as the network‘s ability to maintain voltage profile within a specified technical envelope or range during disturbances to the grid – is harder to predict, and to correct. The technical crunch for the five already grid-connected, operational solar farms – Gannawarra, Broken Hill, Karadoc, Wemen and Bannerton – came when AEMO detected interactions involving them, which produced voltage oscillations. They were curtailed to just 50% of their output in September 2019, costing the group an estimated AUD 1 million ($601,890) a day in lost revenue.

Swings and roundabouts

There have always been interactions between generators on the grid, “and that’s fine as long as it stays within the stable limit,” explained Andrew Kingsmill, manager of network planning at TransGrid, the NSW Transmission Network Services Provider (TNSP), at a recent solar conference. “But what we’re seeing now is that inverter-based generation is so fast acting that this phenomenon, instead of occurring on a seconds basis and being able to be controlled, is now occurring on a much faster basis.”

The result is that when a disturbance – such as lightning strike or bushfire – affects the system, voltage doesn’t recover from the resulting wobble, but rather enters an oscillation pattern. Behind the scenes, says Kingsmill, different inverter-based plants may fight with each other or transfer power from one to the other, controlling the voltage in a way that causes oscillation to continue.

In February 2020, the specter of heightened grid instability in the West Murray region, which was likely to be increased by imminent connection of several renewable generators (all of which had fulfilled connection criteria and followed due process), caused AEMO to restrain actual connection of five generators that were at the point of commissioning to a single-file process. Under this plan, each connection would be tested to verify continued stability of the grid before the next would be considered – and so on for a further 15 generators that are committed to connect, and 25 more that are applying for connection.

Diminishing returns

The shock waves – costs to developers of delayed generation and therefore their ability to pay down investor loans, disgruntled PPA offtakers whose contracts would not be honored for some time, and so on – were said to have seriously impacted investor confidence.

A Clean Energy Council (CEC) analysis in February showed a fall in investment from AUD 10.7 billion in 51 projects in 2018, down to AUD 4.5 billion across 28 projects in 2019. The CEC cited growing regulatory risks, underinvestment in transmission, and policy uncertainty as the main contributors to investment slowdown.

Electron jams

There are few dissenters to the view that there is need for significant investment in transmission and state-to-state interconnection, to expand the ability of the long, stringy Australian network to better transport large volumes of renewable electrons from areas of resource to load centers. Until the West Murray crisis brought industry frustration to a head, the states and system administrators had doggedly adhered to Australia’s arduous and lengthy Regulatory Investment Test for Transmission (RIT-T) cost-benefit analysis for interconnection projects.

“What we struggle with,” says Kingsmill, “Is that the economic test to invest in transmission needs to take into account a wide range of scenarios, and if the generation isn’t actually confirmed to be built then it’s hard to say we’re going to spend hundreds of millions or billions of dollars on transmission investment.” This leads to a chicken-and-egg situation, where the building of transmission is several times slower than the time taken to build solar farms.

The pace of renewables deployment has also played a role. Australia has some 14 GW of coal-fired generation that needs replacing by 2040, as thermal plants reach the end of their technical life. “It’s difficult,” says Ben Cerini, principal consultant at Cornwall Insight Australia. “We’re going through a period of transition which one of my colleagues described as flying a plane and trying to change the engines mid-flight, without the plane coming down.”

The West Murray situation represents a significant loss of altitude. Some market participants, including Jonathan Upson, director origination at Canadian Solar, a developer of projects and supplier of solar panels, declared Victoria “Closed for business,” as far as renewables were concerned.

State rebellion

In that sense, the situation worked as a catalyst. The Victorian state government took immediate action by introducing the National Electricity (Victoria) amendment Bill 2020 to parliament to “facilitate or expedite specified transmission system augmentations or services to improve the reliability of electricity supply in Victoria.” Its aim is to circumvent the RIT-T process, giving the Victorian Minister for Energy the ability to direct the construction of new transmission lines or upgrades.

The New South Wales state government has since also declared its intention to “derogate from rules” that threaten to derail the implementation of its demonstration Renewable Energy Zone, which will follow a “build it and they will come” approach to providing a network for integrated distribution (and some storage) of 3 GW of renewable generation, said Rohan Tayler, principal policy officer for energy infrastructure in the NSW Department of Planning and Environment, at a conference in February.

As soon as it became evident that the oscillations caused at five operating solar farms had also been observed in West Murray, AEMO hosted technical forums to not only explain the difficulties, but also to gather combined experience around exploring novel solutions.

It was already working with the curtailed group to retune their mostly SMA inverters to mitigate their effects on system strength, although extensive testing and modeling to verify the outcomes of such actions is still underway almost six months later.

Several Australian industry players – including AEMO, Kingsmill at TransGrid and Simon Taylor, group manager of network customers at Powerlink – are liaising with the technical departments of inverter suppliers, to appraise them of the particular challenges of the Australian grid, and to help advance the development of grid-forming inverters.

“Depending on how you configure your power electronics and the overlay capability of those power electronics, grid-forming inverters could actually provide more system strength,” says Kingsmill. Such solutions would be “preferable to having more rotating machines on the grid”, he adds, referring to the requirement imposed on several solar farms to invest millions of dollars in synchronous condensers, which have subsequently been deployed without coordination and potential to share the costs and benefits.

Modeling the playing field

In the meantime, modeling how connections of new generation will affect the grid is becoming more complex with every added asset. TransGrid last year quadrupled its computational capability, while Powerlink outsources half its modeling to Canadian facilities to be able to simultaneously process four full impact assessments, which take six weeks each. One additional challenge inherent to the current modeling system, is that only AEMO and transmission providers have access to the results of modelling, in order to protect the intellectual property of each proponent.

Under Australian rules, generators connecting to the grid are responsible for mitigation of interactions with other plant, and for remediation of voltage dips and oscillations.

“We’re working with AEMO to develop a ‘black box.’ You just plug your plan into the black box, you don’t know who all the other players are, but you can see the impacts. It sounds simple to do, but it’s a very complex process,” says Taylor.

Cutting edge

Developments in every aspect of the NEM are expected to render the second half of this decade a cake walk compared to the current out-of-synch situation. Learnings from the flashpoint in the West Murray grid are expected to light a path for other generators flocking to renewable-resource riches in north Queensland and other hot spots.

The Energy Security Board’s in-progress design of new electricity markets, to be implemented post 2025, is likely to value fast frequency response, and other firming and reliability services to the grid independently of generation, providing incentive for investment in large-scale batteries, which are currently challenging to monetize.

“There are a lot of upsides that will come into play in the mid to late 2020s,” says David Dixon, a renewables analyst at Rystad Energy. He tells pv magazine that in the meantime Rystad Energy is “extremely bullish” on the prospects for continued solar PV development in Australia, saying that as long as there is insufficient transmission capacity in regions such as West Murray, development will begin to follow network capacity and strength, rather than pure resource. And offgrid opportunities in mining and natural gas processing will start to shine.

“In the short term, we maintain that Australia will continue to be a 1-2 GWac a year utility-PV market,” Dixon says, citing figures from some 550 MW of on-grid projects either already breaking or set to break ground this year, and around 200 MWac of offgrid digging in. He also points to 3 GW per month that developers intent to build large-scale renewables entering Rystad’s market tracker, up from 1-2 GW a month in recent years.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I see mention of microgrids and VPP’s as DER components but I see no mention of microgrids/VPP’s at the city/town block scale. Why not?

A city block of homes, all with energy efficient building envelopes (Passive House), solar PV and storage (both of which use DC), with DC appliances, all connected via a DC microgrid is a game changer. Who is looking into this?