The Australian Renewable Energy Agency (ARENA) supported “Renewable Hydrogen Market Report” (Report) produced by ANT Energy Solutions has published some key findings in the race for an Australian renewable hydrogen economy, the main finding being that on-site solar is the only way to go.

The Report’s authors ran two models for renewable hydrogen produced by electrolysis, The first, a high OPEX, low CAPEX model (grid-connected, high capacity-factor). And secondly, a high CAPEX, low OPEX model (behind-the-meter, low capacity-factor). The analysis indicated “that despite the much lower utilisation rate, behind-the-meter solar renewable hydrogen generation can produce hydrogen at approximately half cost per kilogram to a grid connected system with electricity cost of 11 cents per kilowatt hour.”

What this means is that the most cost-effective way of producing renewable hydrogen is by powering an electrolyser with on-site solar. Indeed, the Report suggests hydrogen can be produced via on-site solar at a cost of $3.19 per kg of hydrogen versus $6.08 if produced from the grid.

Of course, considering the costs of solar continue to decrease simultaneously to rising efficiency, the cost of behind-the-meter solar hydrogen will only continue to drop, possibly below the $2 mark, the ‘H2 under $2’ ambition of which ARENA opened a $70 million Renewable Hydrogen Deployment Funding Round for earlier this month.

“Based on this alone,” says the Report, “Australia has great potential to drive forward an increase in renewable energy and renewable hydrogen production. The impetus from ARENA is continuing to drive the cost of solar down with a continued reduction in the cost of large scale solar expected over the next 5 to 10 years.” The call then, is to State and Commonwealth governments to bet behind large-scale solar electrolysis as the cleanest and most obvious way of driving down the capital cost of a hydrogen economy.

A Solar System

The Report not only finds on-site solar to be the most cost-effective way of building a domestic and export hydrogen industry, but in fact solar might be the only way. “Commercialisation of hydrogen as an end product requires the development of an entire economic ecosystem,” the Report says. “As with all ecosystems, they cannot function until there is critical mass in the system, so the faster scale can be developed, the more chance there is for the ecosystem to form and advantage to be generated.”

The point being that if Australia doesn’t act on its competitive advantage sooner rather than later, the capacity for other countries to develop their hydrogen economies and reach a cost-effectiveness required for export before we do is high. The Report points to Australia’s solar panel industry as an example of “where Australia failed to develop this ecosystem and competitive advantage has been lost to China and USA where scale of development has occurred in technology research, equipment design and fabrication.”

Businesses have already noticed the obvious competitive advantage. Toyota is installing a solar-electrolyser at their site in Altona, Melbourne. Indeed, Toyota celebrated Earth Day recently by unveiling the first completed stage of its green hydrogen hub with the help of ARENA funding.

Image: ARENA

H to Go – Australia’s Hydrogen Export Potential

The CSIRO National Hydrogen Roadmap expects the demand for hydrogen imports by Asian nations to reach 3.8 million tonnes by 2030. At the same time, ACIL Allen Opportunities for Hydrogen Exports model suggests that 10-20% of Japanese and Korean hydrogen demand could be met by Australian exports. In other words, hydrogen means big business.

However, before we can talk about how much hydrogen countries such as Japan and Korea might want from us, let alone how we’ll manage to get the hydrogen up there, we must first decide how we’re going to produce said hydrogen.

In November last year, the COAG Energy Council adopted the National Hydrogen Strategy, our pathway to a domestic and export hydrogen economy. The Strategy, however, remains “technology-neutral,” which is to say the Strategy is not solely to produce Green Hydrogen, but to keep our options open to fossil-fuels as well—playing the field, as it were. Although, as the ANT Report shows, fossil-fuel produced hydrogen is rather senseless compared to renewably produced hydrogen. Energy Minister Angus Taylor may think he is playing the field, but these are Flanders Fields, not Elysian ones, which is to say Taylor is pursuing a senseless policy for the comforting sake of outdated norms.

How Far To Go?

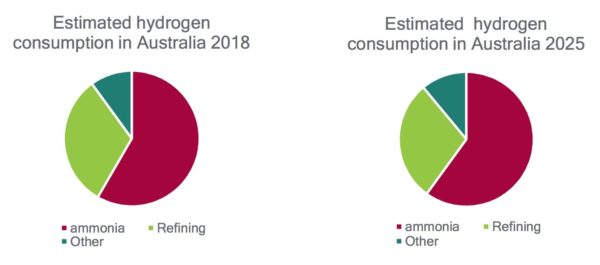

The ACIL Allen Opportunities for Hydrogen Exports model projected a mid-case forecast of 500,000 tonnes of hydrogen per annum by 2030. To put that in perspective, if we continue only with what we have already and what we have under construction, by 2025 we will have less than 3,000 tonnes per annum by 2025.

This is to say, in much the same understated way Richie Benaud described a Glenn McGrath innings in which he was dismissed for two, as “just 98 runs short of his century” – if we don’t scale up renewable hydrogen production capacity 160x by 2025, we’ll be just 497,000 tonnes short of the ACIL Allen mid-case.

Image: ANT Energy Solutions

For an increase of that scale Australia requires multiple industry-scale (100 MW plus) renewable hydrogen projects in place in the next few years or the cost of production will remain too high and our hydrogen opportunity will be tentative if not lost.

The renewable hydrogen opportunity cannot afford to be lost, the scope of its promethean potential is unfathomable, but there is much that can be fathomed already. Take for instance if renewable hydrogen breaks the $2 per kilogram barrier it could immediately replace the domestic market for natural gas feedstock and provide a low-cast pathway to a green ammonia export industry, let alone Australia’s grander export ambitions. But, of course, “industry-scale renewable hydrogen development will require government and industry support to enable the adoption and the continued reduction in the cost per kilogram of renewable hydrogen…At levels below AUD$1.95 between 2025 and 2030, Australia will be able to transition a domestic market and be competitive in the forecast export markets.”

Currently, it is estimated that only 2-4% of the world’s hydrogen is produced via electrolysis.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

The trouble with hydrogen is energy losses during manufacture and storage. Only 20% of the original electrical energy can be recovered as electricity after electrolysis, liquification and regeneration in a fuel cell.

Why not make aluminum? Common technology, easy to store and transport then electricity can be recovered in a fuel cell similar to a hydrogen fuel cell.

After reading through the report referred to in this article it is clear that the $3.19kg is not a commercial number as there is no consideration to the cost of capital and the cost of risk in the report. I re did there number with a low 5% cost of capital (I would love you to tell me if you can get lower) and no cost for new technology risk and the cost comes out at $4.99kg

The grid certainly could not cope with a large amount of hydrogen production, it is very inefficient so you need your own power. Still the best use of solar is to charge EV batteries using smart grid or an installation local to a charge station.

Once that is done and we have filled up all the batteries we can, and pumped up all the hydro then it might be worthwile to product hydrogen with spare renewables.