From pv magazine global

JinkoSolar reported little slowdown in its business during the first quarter of 2020, shipping 3.4 GW of modules during the period and bringing in $1.2 billion in total revenue. Accordingly, the company is leaving its full-year 2020 shipments guidance untouched at 18-20 GW.

Net income for the first quarter came in at $39.9 million, and Jinko’s posted $103.5 million income from operations, excluding the impacts resulting from its disposal of two solar power plants in Mexico.

These figures represent a 24.8% decrease in shipments compared to the previous quarter, but still 12.3% ahead of Q1 2019. Further, the company says that while it predicts the overall market will shrink by around 25% in 2020 compared to last year, it does not expect its own business to be affected. “…we see a number of growth opportunities in the near-term as the market consolidates,” said JinkoSolar CEO Kangping Chen. “Smaller, less-competitive manufacturers will gradually exit the market, leaving more opportunities for a few key players to expand their market share worldwide.”

Chen’s comments are broadly in line with analyst’s expectations of consolidation across the PV manufacturing industry following the shock caused by the Covid-19 pandemic.

For the rest of this year, Jinko says it expects further challenges arising from the pandemic and is coordinating its manufacturing, logistics, and sales to meet these. For the second quarter of this year, Jinko forecast’s a higher level of shipments at 4.2-4.5 GW, and a similar revenue at $1.1-1.18 billion – reflecting an expected drop in prices for materials across the supply chain.

Strong future for solar

Further into the future, the company’s outlook is more positive, noting several positives that could result from the recent Covid-19 disruption. “The pandemic has actually accelerated the adoption of high-efficiency premium products by downstream partners which is allowing the industry to transition into the 500W ultra-high efficiency era earlier than expected,” continued Chen. “As solar energy continues to race towards grid parity, we expect more countries to implement policies that support solar energy in the post-pandemic era, and at the same time, remove outdated energy capacity, reduce the levelized cost of energy for solar, and accelerate the application of new technologies.”

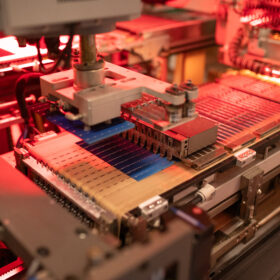

On the technology side, the company further noted that as of April it has completed the ramp-up of its new monocrystalline wafer capacity, bringing its total production capacities to 17.5 GW for mono wafer, 10.6 GW for cells (9.8 GW PERC cells and 800 MW devoted to n-type technology) and 16 GW for modules.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.